30 September 2024

Please refer to the Important Notice at the end of this article1

Copper has shaped human history and civilisation for millennia. In the 20th century, the story of copper was inextricably linked to the rise of electricity demand. As we harnessed electrical power, copper became an indispensable material, crucial to our energy systems and modern technology.

Through the 21st century, we expect copper to remain an essential building block to modern life as the world seeks to improve living standards for billions of people, transitions towards a net zero greenhouse gas (GHG) emissions economy, and further digitalises its industries and societies.

In this article, we discuss:

- Why we believe global copper demand will grow by around 70% to over 50 million tonnes (Mt) a year by 2050 and our view on how copper’s role in multiple applications will provide demand resilience.

- The looming global copper supply challenge as existing copper mines age, with the pipeline of potential projects less healthy than in previous cycles. Both brownfield and greenfield projects are expected to face cost and stakeholder challenges.

- Why ‘long-run marginal cost’-based inducement is still our preferred approach to forecasting price in the long run.

Demand

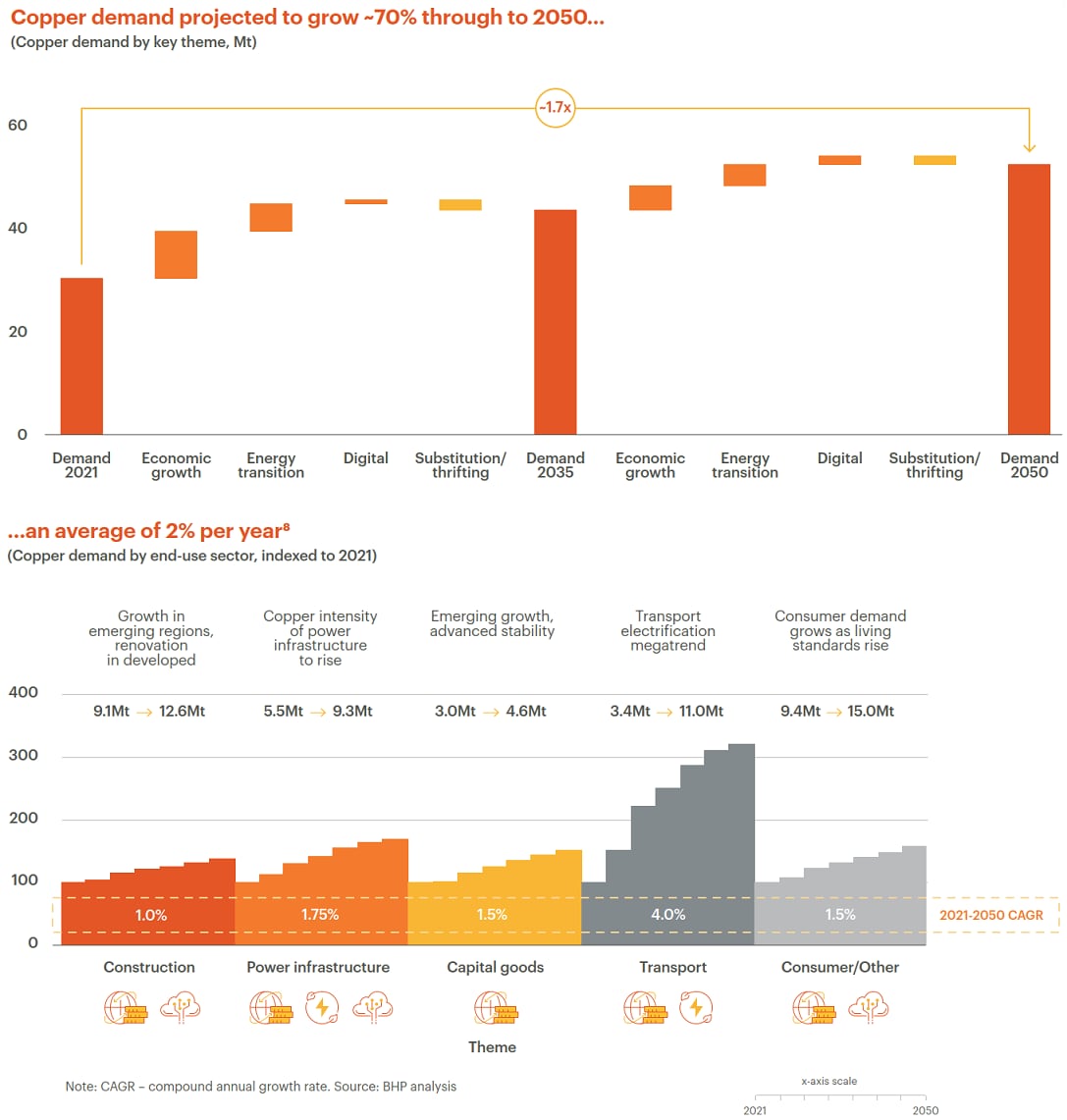

Total global copper demand has grown at a 3.1% compound annual growth rate (CAGR) over the last 75 years – but this growth rate has been slowing. It was only 1.9% over the 15 years to 2021. Looking to 2035, however, we expect this growth rate to jump back to 2.6% annually.

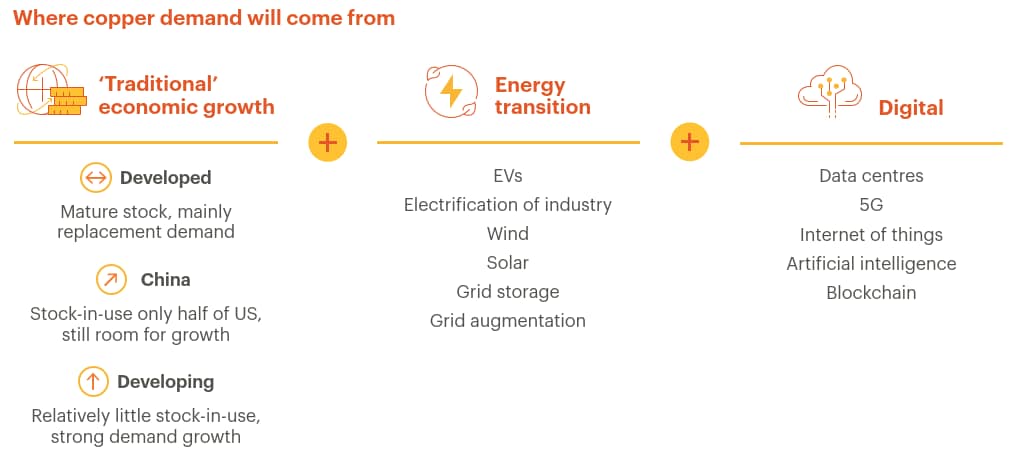

We believe this reversal will come from a combination of three key themes: ‘Traditional’ economic growth, and the newer themes of the ‘Energy Transition’ and ‘Digital’ (primarily data centres).

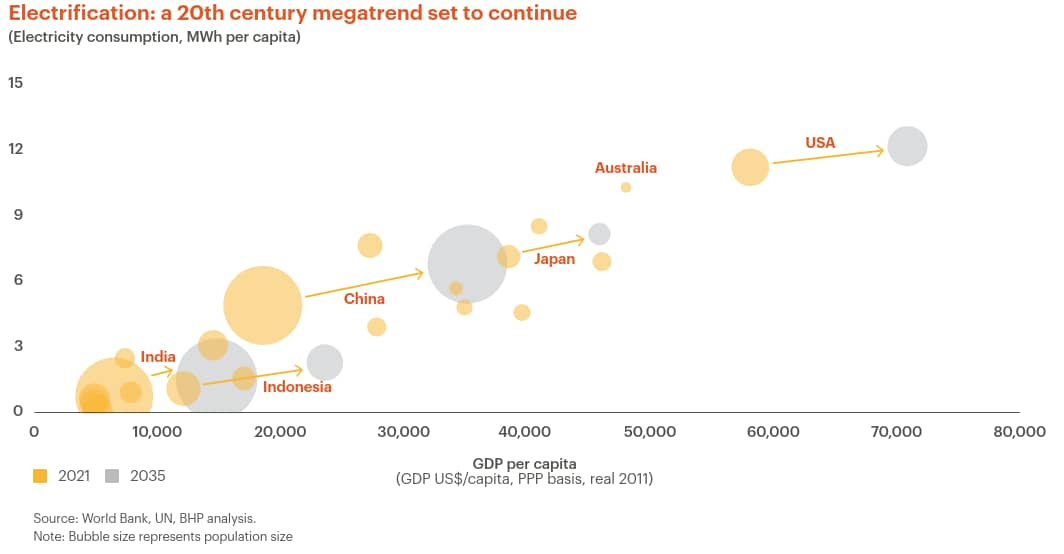

‘Traditional’ demand refers to the basic relationship between economic growth, electricity consumption and copper. Through the 20th century and into the 21st, as countries developed, electricity became accessible to industry and homes and led to the creation of products that lifted living standards: lighting, washing machines, refrigerators, air conditioners, radio and television, computers and smartphones. It is not only these products that need copper; so do the factories and supply chains that produce and deliver them, and the power infrastructure keeping them all running. Copper’s broad application across multiple end-uses has made it resilient and less-exposed to single point failures of demand.

Traditional demand in the developed world is expected to remain strong and as living standards rise globally, the demand for copper is expected to follow suit. Developing economies, which have nearly five times the population of high-income economies, will increasingly strive to achieve the same high standard of living. This transition will lead to a greater need for copper.

Take China for example, despite its enormous appetite for copper over the past two decades, it still only has half of the copper accumulated stock-in-use per capita (e.g. buildings, machinery, vehicles) compared to a developed economy, at around 100 kilograms per capita. India, the other major economy with over one billion people, also has a compelling copper story. India’s electricity consumption per capita currently stands at around one-seventh of Japan’s and one-fifth of China’s, and we expect its copper demand to grow five-fold over its pre-Covid volumes in the coming decades as electricity is made more accessible.

This traditional demand provides a solid foundation, but it does not account for the rapid acceleration of growth expected in the decades to come. That will be driven by the ‘Energy Transition’ and ‘Digital’ trends.

Since the Industrial Revolution, the use of fossil fuels has helped the world unlock greater levels of productivity. As the world seeks to rein in the use of these fuels (and their related carbon emissions), it will need more electricity (mainly from renewable sources) to keep everything running. Most energy modellers agree that electrification will be a major enabler of the decarbonisation of transport, buildings and large parts of industry. Under our base case, we see electricity demand roughly doubling from today to 2050, as electricity’s share of total energy consumption also doubles to around 40% by 2050.2

‘Energy Transition’ copper demand refers to the additional copper required to achieve that level of electrification. As the most conductive industrial metal, copper is a key enabler of low GHG emissions energy sources, such as wind, solar, and hydro, as well as electric vehicles (EV) and batteries. An EV, for example, uses around three times more copper than typical internal combustion engines (ICE). As the energy transition unfolds, we anticipate the roll-out of EVs to lift the transport sector’s share of total copper demand from around 11% in 2021, to over 20% by 2040.3 Copper is also needed for energy efficiency and conservation measures, such as smart grids, LED lighting, and heat pumps. On top of this, the generation and transmission of low GHG emissions electricity is expected to require more copper than conventional fossil fuel power generation.4

‘Digital’ demand refers to the growth from the expected ramp-up in demand for digital infrastructure, as the world creates and consumes massive amounts of data, enabled by copper-hungry data centres. Artificial Intelligence (AI)-enabled technology requires vast amounts of data and processing capability, which in turn needs larger and faster computers consuming more electricity. We expect global electricity consumption for data centres to rise from around 2% of global demand today, to 9% by 2050, with copper demand in data centres increasing six-fold by 2050.5

Today, we estimate that the Traditional vs Energy Transition vs Digital split of global copper demand is around 92%/7%/1%. By 2050, we predict the split to have evolved to 71%/23%/6%.6

Towards 2050

What is unique about the next 25 years is the way copper demand from electrification, decarbonisation and digitisation will cut across high, middle and lower-income economies alike. Unlike the 20th century, where the adoption of cars, electricity, consumer electronics and white goods occurred at different times across various regions, we expect to see more-or-less concurrent adoption of the copper-intensive technologies of EVs, renewables and data centres around the world.

There will be some balancing factors for this significant growth in copper demand, such as from substitution and thrifting, which have been a feature of the copper industry throughout its history.

- Substitution refers to the replacement of copper by other materials, such as aluminium, plastics, or fibre optics, which can be cheaper, lighter, or more efficient for certain applications. (Or in some cases, the adoption of a different technology with a lower copper content.)

- Thrifting refers to the reduction of copper content or usage in products or processes, while maintaining functionality, through design improvements and technological innovations.

When it comes to copper-to-aluminium substitution, many have long held to the ‘three to one’ rule of thumb: when the copper price is more than three times the price of aluminium, you will start to get increased levels of substitution. More recently, some estimates have adjusted this ratio higher, to around 3.5 times.

However, the copper-to-aluminium ratio7 has been in excess of 3.5 for much of the past five years, supporting our belief that the price ratio needs to be higher still, at around 3.5 to 4 times, before you see greater levels of substitution.

It is not just about cost either. Substitution and thrifting require design alteration, product line modification and investment in new equipment, and worker retraining. And uptake relies on customers believing the product works as well or better than what they can access today. None of these things happen quickly, especially in the well-established ‘traditional’ end-uses. The sectors that are most exposed to substitution and thrifting are those driving demand in the Energy Transition segment. These new technologies are still undergoing evolution and development, and each iteration presents a new opportunity to reduce copper use – up to a certain limit.

We also believe copper has some unique advantages that make it difficult to substitute or thrift in many end-uses, such as its conductivity, durability, recyclability and antimicrobial properties. This is why it remains widely used, despite potentially cheaper options being available. Copper also has a smaller GHG emissions intensity8 footprint than aluminium, which may be a relevant factor when choosing materials in the future.

While we expect substitution and thrifting will rise from current levels, this should be a gradual process, as has been observed over the past century.

Putting all these levers together, we project global copper demand to grow by around 70% to over 50 Mt per annum by 2050 – an average growth rate of 2% per year.

Due to the concurrent adoption of new copper-intensive technologies, as well as support from the broad-based ‘traditional’ development across end-uses in emerging economies, we anticipate a re-acceleration of copper demand to 2035 of 2.6% CAGR, versus a 1.9% CAGR over the past 15 years. In absolute terms, this is roughly 1 Mt copper demand growth per year, every year, until 2035 ‒ double the 0.5 Mt annual growth volume of the past 15 years.

Supply

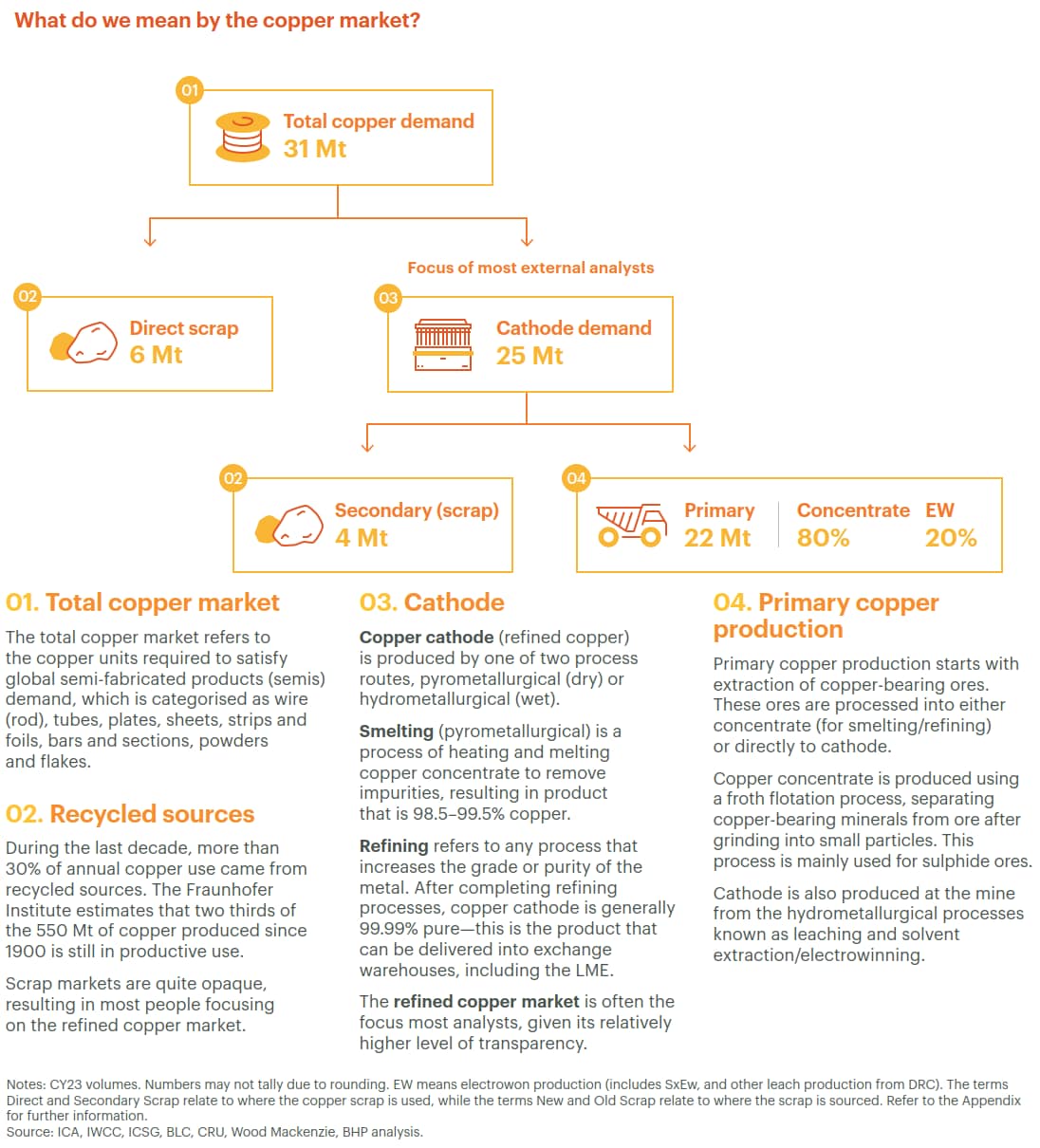

As with demand, there are different drivers of copper supply. First and foremost, primary supply comes from mines and processing facilities such as those that BHP operates.

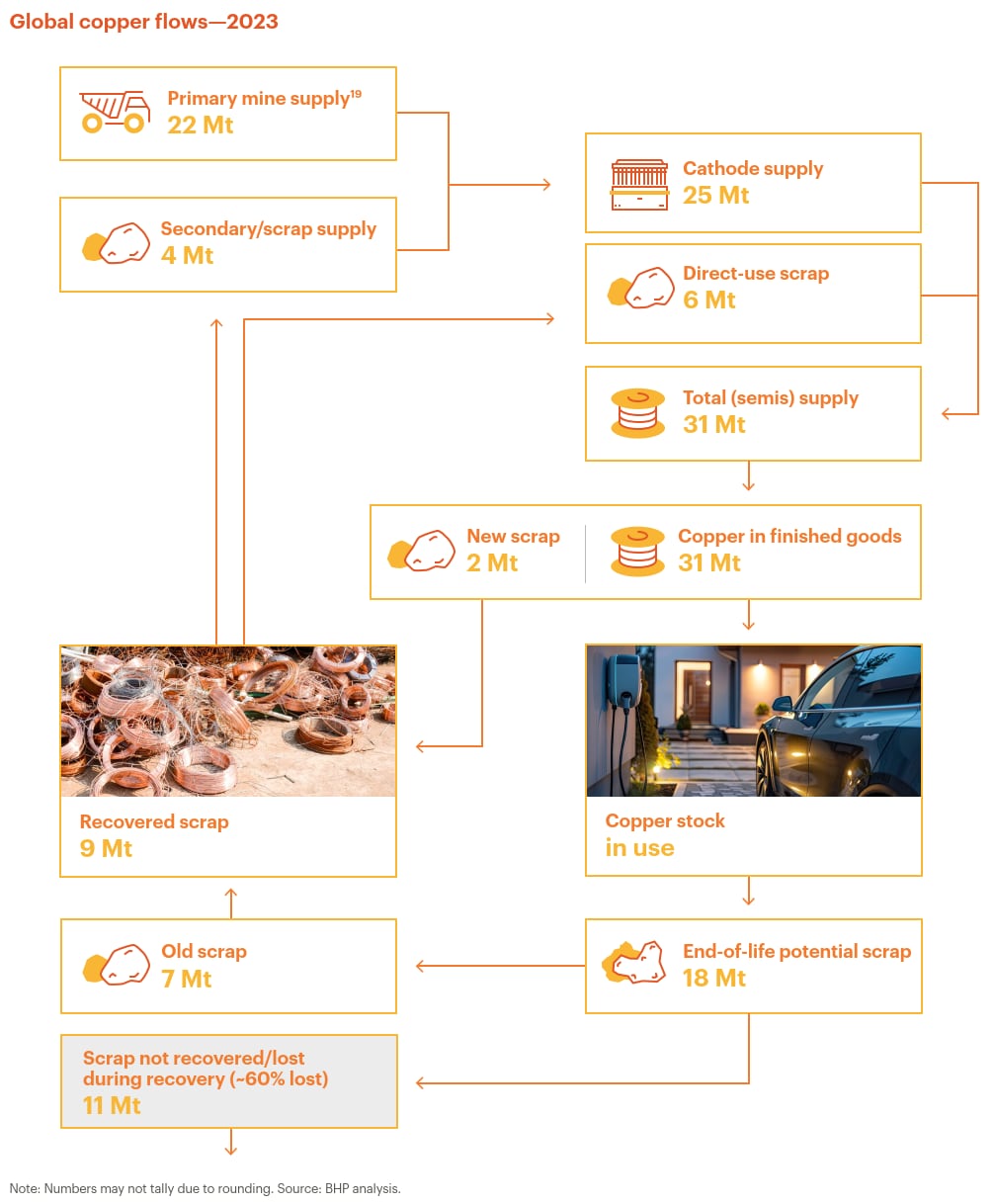

But secondary, or scrap, copper is also an important source of supply. Copper can be recycled from end-of-life products (‘old scrap’) or from waste generated in the manufacturing process (‘new scrap’), reducing the need for primary copper from mining.9

Scrap and recycling

Recycled copper is expected to be an important source of supply to meet the large copper demand growth over the next 30 years. The main barrier to recycled copper supply is the availability of scrap.

The pool of ‘old scrap’10 is principally determined by the average lifetime of an end-use product. These lifetimes can range from weeks or months for some consumer products (e.g. from batteries, headphones, charging cables) up to several decades (e.g. from construction and infrastructure). We assess the average life of copper in-use to be around 20 years.

Much of this ‘old scrap’ is also not recovered. We estimate that in 2021 only 43% of available ‘old scrap’ was collected and recovered for re-use, falling to 40% in 2023 as lower prices, slowing economic activity and regulatory changes acted as headwinds. Rising ‘scrap nationalism’ to preserve the local use of secondary material and restrictions in cross-regional waste trade have also acted as a drag on growth for global scrap collection and recovery11 (and may affect the availability of scrap in developing countries who have not yet built up their own substantial pool of copper in-use).

Nevertheless, we expect the increased focus on copper as a critical or strategic raw material will lift copper scrap collection and recovery rates from their current levels to 56% by 2035 and even higher longer term.12

With the growing scrap pool, we estimate that scrap supply will increase from around one third of global copper today to around 40% by 2035, and reach around a half of total copper consumption by 2050.

But even with this increasing use of copper scrap, we still expect more primary, or mined, copper will still be required when you add grade decline and mine depletions on top of this.

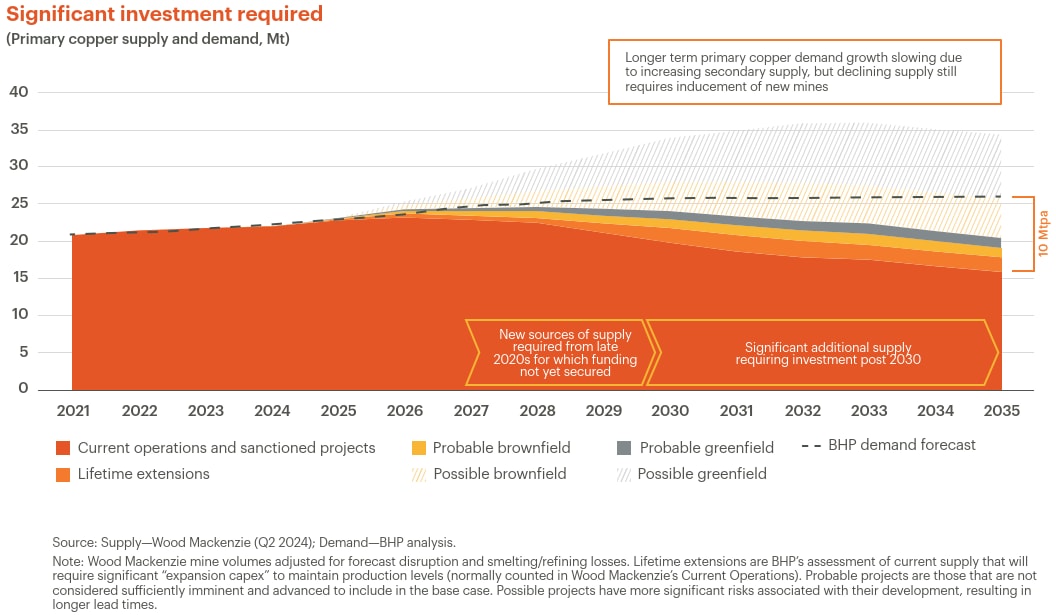

We estimate that the world will need about 10 Mtpa new mined copper supply13 in the next 10 years.

Where will it come from?

Mine supply

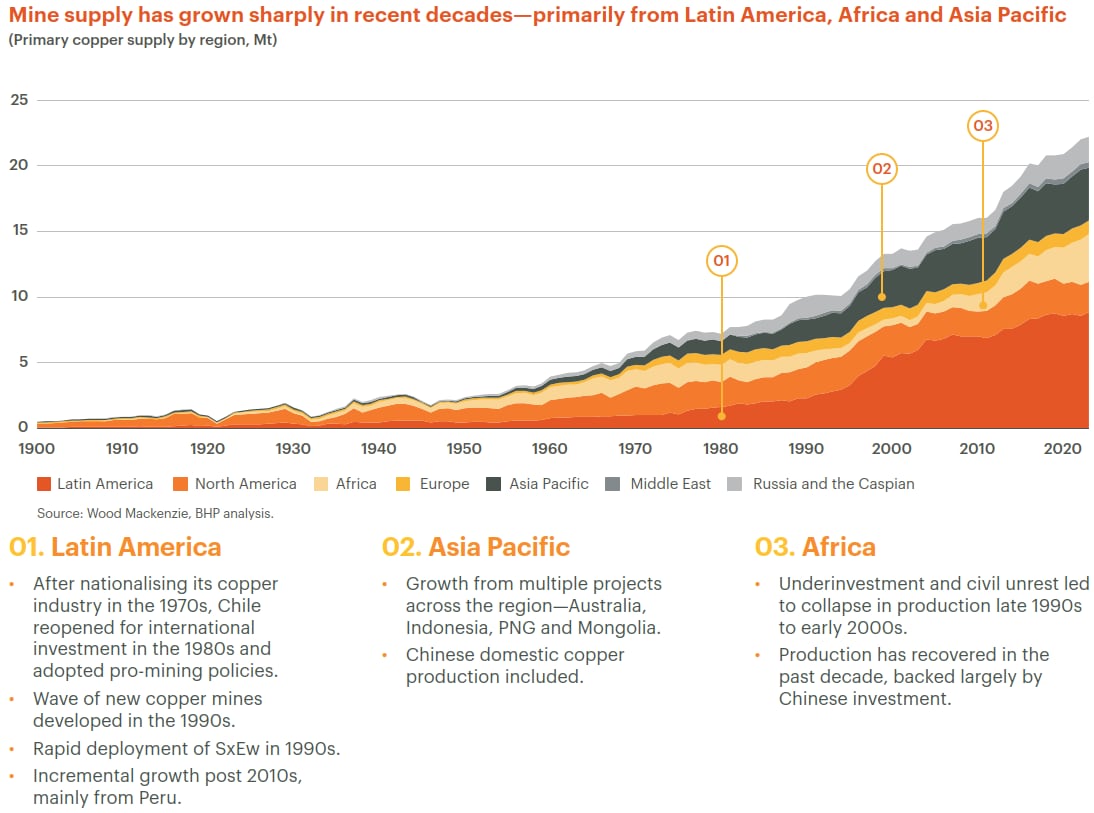

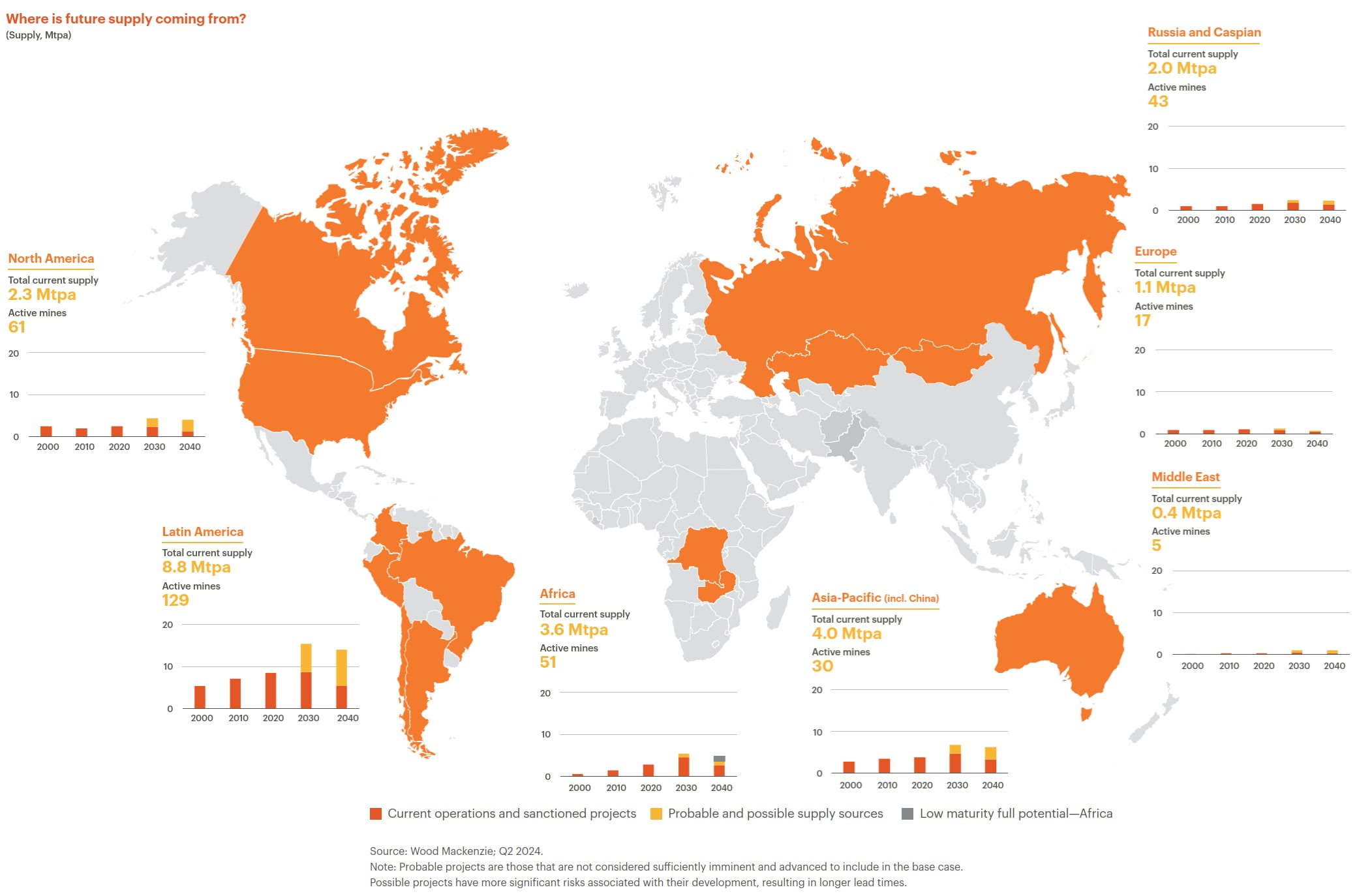

Copper reserves and production are concentrated in Latin America, Australia and Africa. The last 30 years has seen impressive supply growth globally, with production doubling to around 22 Mtpa today, primarily due to increases from Latin America (particularly Chile), the Asia Pacific region and Africa (over the last 10 years). This has been achieved through significant investment in greenfield projects and the wide-spread adoption of the leach-solvent extraction-electrowinning (SxEw) process from the mid-1980s, which unlocked previously uneconomic copper supply low grade oxide ores. This process now accounts for 20% of mine supply.

The industry’s current challenge is to repeat this substantial volume growth in less than half the time.

We expect supply growth over the next 10 years to be dominated by the same regions – Latin America Africa and Asia Pacific – with Africa having the highest growth rate (albeit off a much lower base than Latin America), and Latin America continuing to make the most significant contribution in absolute terms.

View the full size map here.

Against optimistic supply forecasts, which include the development of all probable copper projects, a significant gap to expected demand in 2035 is evident, even with our positive view on copper scrap supply.

Current mine supply

Currently operating copper mines are expected to provide more than half of the copper required to meet future global demand over the next decade. Even so, we estimate existing mines to be producing around 15% less copper in 2035 than they do today.14

These mines are already mature and are likely to need additional capital investment to replace or upgrade aging infrastructure or processing facilities. Alternatively, they may take advantage of new technologies that can improve their efficiency or recovery (e.g. converting oxide leaching plants to sulphide leaching, or recovering copper from waste). They are also likely to need to comply with new and higher standards when renewing or extending permits and licences to meet the evolving expectations of communities, customers and regulators.

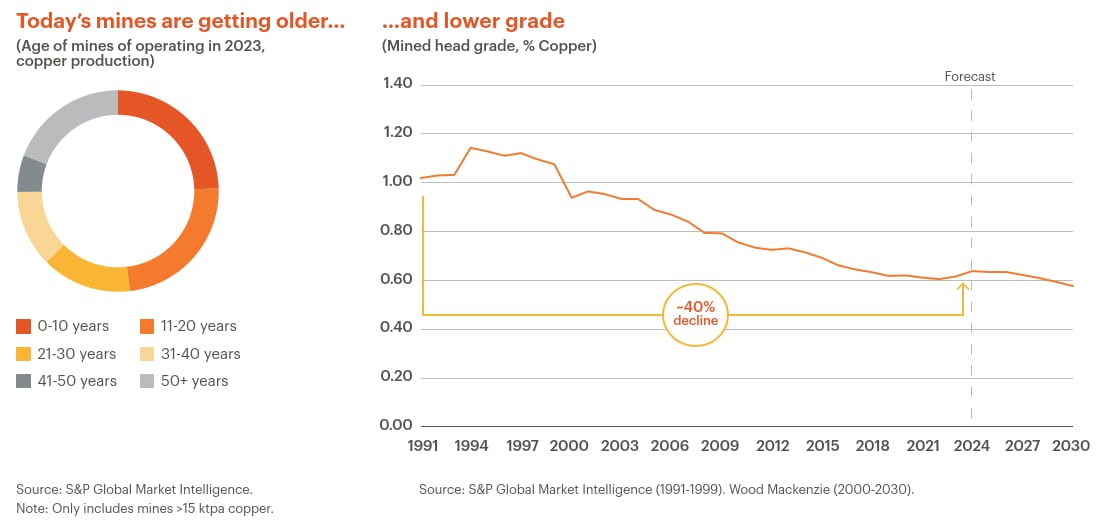

Existing copper mines also typically face declining grades, as higher grades are usually mined first, and lower grades are left for later. We estimate the average grade of copper mines has declined by around 40% since 1991. This is partly explained by processing advances, such as SxEw, which have improved the economics of lower-grade deposits and brought them into production. Declining grades also means that more ore needs to be mined, processed and transported to produce the same amount of copper. Without technological advancements, grade decline is likely to further increase production costs on a unit of output basis.

This trend may also increase potential environmental and social impacts, due to increased material movement if throughput is increased to maintain production levels.

We expect between one-third and one-half of global copper supply to face grade decline and ageing challenges over the next decade, which will drive increased unit costs and the requirement for capital reinvestment. While an incredible orebody can make a big difference, many older operations move up the cost curve as they progress through their life cycle. Given the strong demand signals, however, we expect the industry to vigorously pursue options to extend the life of these copper mines.

One way of overcoming these challenges is with technology. We see examples of incremental productivity improvements from AI-enabled insights in processing, the repurposing or reinvigorating of older facilities with latent capacity, and adoption of new technologies to improve leaching. But it will be difficult to see the impact of these technologies becoming widespread until at least the mid-2030s. Research and development of innovative sulphide leaching technologies is continuing and we expect to see test work and pilot projects improve understanding of their potential. This will allow the industry to evaluate their true capital requirements, and address permitting uncertainty. But in our view, adoption of any primary sulphide leaching technologies into existing operations will need to complement existing processing infrastructure in most life extension and brownfield options, and the economic trade-offs remain unclear at an industry level. For it to be a truly disruptive technology longer term (post 2035), we would also need to see significant advances in scalability, but adoption efforts to date suggest that leaching processes will need to be tailored to individual ore bodies.

Brownfield projects

For current operations with significant resources remaining, brownfield developments will be an attractive response to the challenges outlined above. Based on our project-by-project global review, we expect new brownfield supply to contribute up to 30% of total copper supply by 2035. Today’s pipeline of brownfield projects is healthy, and we see many high-quality options, particularly in Chile.

Brownfield life extensions and expansions benefit from existing infrastructure, facilities, workforce and knowledge, and usually face lower technical risk and uncertainty. However, they are not immune to changing regulatory and community expectations and standards. This can lead to increasing capital intensities, permitting delays and complexities where existing permits do not cover the full life of the project.

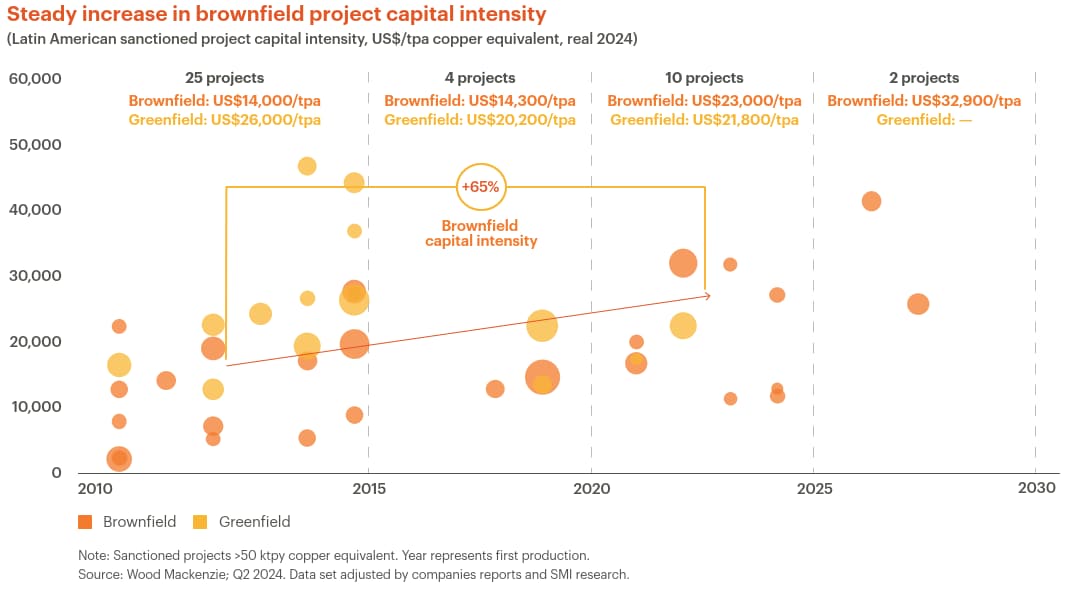

Our recent review of global project capital intensities shows a steady increase in brownfield capital intensity since 2010. When we look at the region with the strongest pipeline of brownfield projects – Latin America – average brownfield capital intensities for the projects sampled show a ~65% increase during that period (in 2024 real dollars), and since 2020, they have approached similar levels to greenfield projects.15

Our view is that while this increase has been driven by a number of factors, including higher costs for and availability of inputs (e.g. material and labour cost increases, supply chain constraints, skilled labour shortages, and Covid-19 effects), a major factor is that copper producers are, in general, simply building ‘better’ mines (e.g. incorporating newer technologies and addressing higher standards for health, safety and environmental performance).

Despite these cost challenges, we expect high-quality brownfield projects to be prized in the industry in the face of growing copper demand. While their historic cost advantages over greenfield projects are less guaranteed today than in the past, the experience, technical capability developed through years of production and detailed ore body knowledge remain as major advantages, particularly when it comes to more complex projects.

Greenfield projects

Greenfield projects continue to attract significant excitement and interest from developers and investors. They can avoid the challenges of aging facilities and grade decline and can unlock large and higher-grade copper deposits, develop new frontiers, and allow for the application of technology advances without the challenge of retrofitting.

But they also have potentially even greater challenges to brownfield developments, such as long lead times with environmental and social concerns needing to be navigated for the first time, and uncertainties associated with new jurisdictions or regions. And not all problems can be solved with money. For some projects, it is not a question of investability, but of executability.

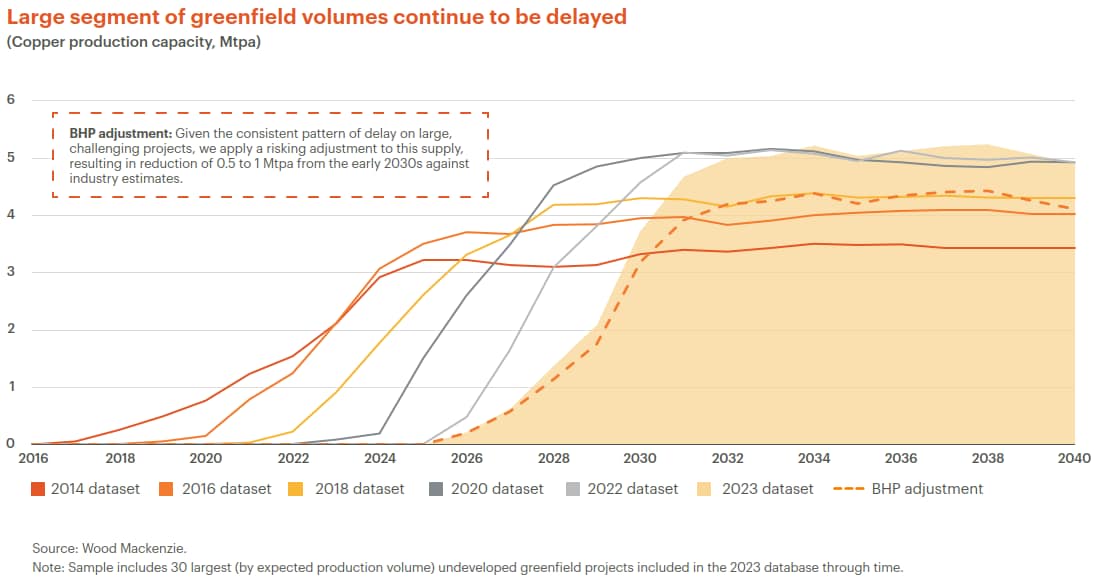

The current pipeline of ‘all possible’ greenfield deposits are generally at the higher-difficulty end of the spectrum – and many are experiencing delays. When we investigated a selection of today’s 30 largest (by expected production volume) undeveloped greenfield projects, we found that analysts (ourselves included) had continually moved the forecast supply stack out in time. We expect these projects to contribute around 5 Mtpa of copper by 2035, or 14% of total possible supply.

Start dates for more than 20 of these projects have shown a consistent pattern of delay since 2014, and all have been delayed in forecasts made from 2020 onwards. In 2014, the majority of these projects were forecast to be in operation by now. Given this trend, we now apply a risking adjustment to these projects, which removes between 0.5 to 1 Mtpa from our copper production forecast from 2030 onwards.

Those that have managed to eventually come online have still seen significant challenges on the journey. Copper mega projects (i.e. those with a capital cost more than US$5 billion) have experienced significant delays and cost overruns (e.g. QB2 and Oyu Tolgoi).

African greenfield projects, backed largely by Chinese investment, have been the exception to this global trend, delivering a 90% increase in copper production over the last decade at highly competitive capital intensities and execution rates. African deposits also make up eight out of the 10 highest grade deposits discovered since 1990. But in contrast to the porphyry-style deposits common in Latin America, in which mineralisation decreases gradually, African deposits tend to be ‘sediment hosted’, meaning mineralisation is more concentrated with sharp boundaries. This difference drives a more pronounced depletion in our African forecast. However, given recent trends in both discovery and development, we have revised upward our forecasts of expected volumes from the African region, including volumes related to projects or deposits that might, in other regions, be considered immature or insufficiently progressed to include in the forecast.

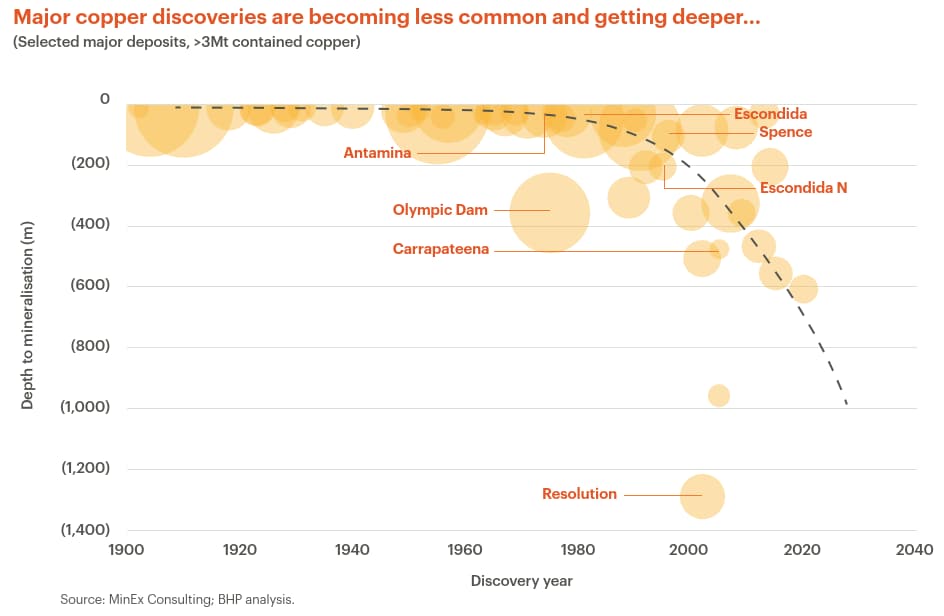

Despite the potential contribution from African copper, on balance, new greenfield supply globally will struggle to enter the market quickly and cheaply. This is exacerbated by a slowing rate of discoveries and the relatively long average time from discovery to production (17 years in 2023), which is making it less likely that greenfield developments will be able to respond to the strong demand signals.

According to S&P Global Market Intelligence’s most recent annual copper discovery report, there were:

…239 copper deposits discovered between 1990 and 2023… we have recorded only four discoveries from the past five years (2019–2023), totalling 4.2 Mt of copper… Discoveries from the past decade account for just 14 of the 239 deposits included in the analysis.16

Capital availability

Capital availability is the other hurdle for copper developers. While challenging to model, given the project-specific nature, we estimate the total bill for all expansion capex from 2025-2034 to be around a quarter of a trillion US dollars (in 2024 real dollars). This represents a significant increase from the previous 10 years, where the total spend on copper projects was approximately US$150 billion.

In the 1990s and 2000s we saw the impact of Japanese and western investments into copper around the globe, and we have seen significant Chinese investment into African copper projects in the past decade. Political support has often accompanied such investments (in various forms), and sovereign interest in copper from other regions is growing, most notably from the Middle East and with renewed interest from the United States. Given copper’s essential role in economic growth, the energy transition and digital transformation, we would expect sovereign interest and investment to continue to play a role in future copper projects.

Supply prospects are mixed

Taking all of these supply factors into account, we expect currently operating mines will need to work harder for longer, and both brownfield and greenfield projects will face cost and schedule headwinds, arising from skilled labour shortages, project complexity and higher ESG standards. Companies that can best navigate and adapt to these challenges, are experienced in managing more complex projects, and have solid social value credentials and a strong balance sheet will win.

Pricing

The copper price is driven by many factors, such as economic growth, investor sentiment, industrial activity, inventory levels, production costs, exchange rates, interest rates and geopolitical events. In the short term, the price is sensitive to changes in demand and supply, as well as to market sentiment and speculation, which can create price spikes or slumps.17

However, in the long term, the copper price is more determined by the fundamental supply and demand trends and drivers of the market, such as those we have set out in this blog. To narrow in on potential long-term pricing ranges, we prefer the long-run marginal cost (LRMC)-based inducement model, which seeks to identify the marginal unit of supply that will meet demand in the future, and what it will cost. It assumes new supply will be induced by a price signal that provides a sufficient return for the project. It uses a queue of projects that are ranked by their competitiveness and brings them on until future demand is met. It is the most reliable and consistent method for projecting the trend price of copper over long time periods, based on the fundamentals of demand and supply.18

The bullish drivers of demand (balanced by the forces of scrap, substitution and thrifting) present a huge task for copper miners. There is a shortage of ‘easy’ projects to replace existing supply and meet this growing copper demand. The projects that are available face new and increasing challenges that we believe will be reflected in their costs, and consequently, in the price required to incentivise their development. We think the price setting marginal tonne will come from either a lower-grade brownfield expansion in a mature jurisdiction, or a higher-grade greenfield in a higher risk and/or emerging jurisdiction. None of these sources of metal is likely to come cheaply, easily, or unfortunately— promptly.

Appendix

The chart below summarises the flow of copper units from mine through end-of-life capital stock.

Important notice

This article contains forward–looking statements, which involve risks and uncertainties. Forward-looking statements include all statements other than statements of historical or present facts, including: statements regarding: trends in commodity prices and currency exchange rates; demand for commodities; global market conditions; guidance; reserves and resources and production forecasts; expectations, plans, strategies and objectives of management; our expectations, commitments, targets, goals and objectives with respect to social value or sustainability; climate scenarios; approval of certain projects and consummation of certain transactions; closure, divestment, acquisition or integration of certain assets, operations or facilities (including associated costs or benefits); anticipated production or construction commencement dates; capital expenditure or costs and scheduling; operating costs, and supply of materials and skilled employees; anticipated productive lives of projects, mines and facilities; the availability, implementation and adoption of new technologies; provisions and contingent liabilities; and tax, legal and other regulatory developments.

Forward–looking statements may be identified by the use of terminology, including, but not limited to, ‘intend’, ‘aim’, ‘ambition’, ‘aspiration’, ‘goal’, ‘target’, ‘prospect’, ‘project’, ‘plan’, ‘pathway’, ‘objective’, ‘see’, ‘anticipate’, ‘estimate’, ‘believe’, ‘expect’, ‘commit’, ‘ensure’, ‘may’, ‘should’, ‘intend’, ‘need’, ‘must’, ‘will’, ‘would’, ‘continue’, ‘forecast’, ‘guidance’, ‘outlook’, ‘trend’ or similar words.

These statements discuss future expectations or performance, or provide other forward-looking information and are based on the information available as at the date of this article and/or the date of BHP’s scenario analysis processes. BHP cautions against reliance on any forward–looking statements or guidance.

Additionally, forward–looking statements in this article do not represent guarantees or predictions of future financial or operational performance, and involve known and unknown risks, uncertainties, and other factors, many of which are beyond our control, and which may cause actual results to differ materially from those expressed in the statements contained in this article.

There are inherent limitations with scenario analysis, and it is difficult to predict which, if any, of the scenarios might eventuate. Scenarios do not constitute definitive outcomes for us. Scenario analysis relies on assumptions that may or may not be, or prove to be, correct and may or may not eventuate, and scenarios may be impacted by additional factors to the assumptions disclosed.

Except as required by applicable regulations or by law, BHP does not undertake to publicly update or review any forward–looking statements, whether as a result of new information or future events. Past performance cannot be relied on as a guide to future performance.

No offer of securities

Nothing in this article should be construed as either an offer or a solicitation of an offer to buy or sell BHP securities, or a solicitation of any vote or approval, in any jurisdiction, or be treated or relied upon as a recommendation or advice by BHP. No offer of securities shall be made in the United States absent registration under the U.S. Securities Act of 1933, as amended, or pursuant to an exemption from, or in a transaction not subject to, such registration requirements.

Reliance on third party information

The views expressed in this article contain information that has been derived from publicly available sources that have not been independently verified. No representation or warranty is made as to the accuracy, completeness, or reliability of the information. This article should not be relied upon as a recommendation or forecast by BHP.

BHP and its subsidiaries

In this article, the terms ‘BHP’, the ‘Company’, the ‘Group’, ‘BHP Group’, ‘our business’, ‘organisation’, ‘we’, ‘us’ and ‘our’ refer to BHP Group Limited and, except where the context otherwise requires, our subsidiaries. Refer to the ‘Subsidiaries’ note to the Financial Statements in the BHP Annual Report for a list of our significant subsidiaries. Those terms do not include non–operated assets.

Footnotes

1 Data and events referenced in this article are current as of September 2024.

2 Some aggressive decarbonisation scenarios come in 10 to 15 percentage points higher in terms of end-use electrification than we are assuming in the base case. For a full list of deep decarbonisation scenarios that we track, see BHP’s Climate Transition Action Plan 2024 Additional information (page 62).

3 Forecast developed prior to the recent slowdown in EV adoption (ex-China). While the pace of adoption of EVs may underwhelm in the short term, the rationale for electrified transport remains compelling in the long run.

4 Offshore wind requires around 11 tonnes of copper per megawatt, or over 5 times as much as gas-fired power which uses around 2 tonnes per megawatt. Onshore wind and solar are also more copper-intensive, at around 1.7 and 1.4 times, respectively. In addition, the capacity factors of wind and solar power are generally lower than fossil power, which means you need to install more renewable power capacity to generate the same amount of electricity.

5 We estimate copper use in data centres (including those used for cryptocurrency and AI) to be around half a million tonnes of copper today, rising to around three million tonnes in 2050.

6 Note that Copper in power grids is counted under Traditional in the above splits.

7 Ratio of monthly average of LME Cash Settlement Price for Copper and Aluminium.

8 Global average CO2 footprint (CRU, 2021). Copper: ~4t CO2/t metal. Aluminium: ~13t CO2/t metal.

9 For more detail on the volumes of flows in the copper value chain, see the appendix

10 Please see the appendix for details of the copper cycle.

11 Examples of policies that, while potentially positive in the long run, we believe have hindered/are hindering scrap use in the short term: China’s Operation National Sword and recent review of tax and rebates (‘Fair Competition Review’), EU’s Regulation on Waste Shipments and Critical Raw Materials Act.

12 This assumption is underpinned by EV battery recycling targets, but also requires broader improvement in collection/recovery rates across end uses. This will necessitate changes in consumer behaviour (many consumer goods end up in landfill), as well as improvements in scrap processing and metal recovery. Recycling in many cases is labour and/or opex intensive. Current recycling rates are arguably a reflection of what is economic at current prices, so ‘carrot and stick’ policies will likely be required to alter behaviour and lift these rates.

13 The 10 Mtpa requirement considers: growth in primary copper demand, as well as reductions in current mine supply due to grade decline and resource depletion, and additional consideration for supply disruptions and metallurgical losses. The figure also includes mine life extensions for some currently operating mines.

14 This assumes mine life extensions and probable brownfield projects.

15 Wood Mackenzie; Q2 2024. Data set adjusted by companies reports and BHP analysis, inclusive of sanctioned projects >50 ktpa copper equivalent.

16 https://www.spglobal.com/marketintelligence/en/news-insights/research/new-major-copper-discoveries-sparse-amid-shift-away-from-early-stage-exploration

17 Refer to our 2024 Economic and Commodity Outlook for more details.

18 We recognise that LRMC has some limitations, such as being less helpful for the short and medium term, as it does not capture the cyclical and structural factors that can affect the price. This method is also sensitive to the exogenous assumptions that are imposed, such as the macroeconomic and financial variables, the return thresholds for projects, and the discrete decisions on project inducement. We also recognise that this method does not account for the possibility of price disconnecting from the cost curve, due to extreme tightness or scarcity in the market. Therefore, we also use other methods and models, such as cost-plus, historical average, substitution, probabilistic, and econometric, to complement and cross-check our price forecasts, and to generate alternative price scenarios and ranges to reflect the uncertainty and variability of the market.

Get the latest BHP news alerts, straight to your inbox

Get BHP news first. Stay in touch with our latest updates, investor news and media releases.