Our latest disclosures

Our most recent climate-related disclosures and performance data can be found in the BHP Annual Report 2025, Operating and Financial Review 9.8 – Climate change and BHP ESG Standards and Databook 2025. Refer also to the BHP Climate Transition Action Plan 2024 (CTAP 2024) for BHP’s climate change strategy, subject to updates of certain aspects of our assumptions and plans in the BHP Annual Report 2025, Operating and Financial Review 9.8 – Climate change.

Our value chain greenhouse gas (GHG) emissions targets and goals

Notes and definitions

Information is valid at August 2025

- The baseline year, reference year and performance data of our GHG emissions targets and goals will be adjusted for any material acquisitions and divestments, and to reflect progressive refinement of GHG emissions reporting methodologies.

- Our value chain GHG emissions targets and goals are referrable to a FY2020 reference year, except that our medium-term goal for shipping is referrable to a CY2008 baseline, which was selected to align with the base year for the International Maritime Organisation’s CY2030 emission intensity goal and its corresponding reasoning and strategy. The boundary of each target and goal may, in some cases, differ from required reporting boundaries. The use of carbon credits will be governed by BHP’s approach to offsetting, available at bhp.com/climate

- Our ability to achieve the target is subject to the widespread availability of carbon neutral solutions to meet our requirements, including low to zero GHG emission technologies, fuels, goods and services.

- Operational GHG emissions of our direct suppliers means the Scopes 1 and 2 emissions of our direct suppliers included in BHP’s Scope 3 reporting categories of: Category 1, Purchased goods and services (including capital goods); Category 3, Fuel- and energy-related activities, Category 6, Business travel; and Category 7, Employee commuting.

- Baseline/baseline year (in relation to GHG emissions targets and goals): A year used as a basis to compare and measure performance of future years.

- Carbon credit: The reduction or removal of carbon dioxide, or the equivalent amount of a different GHG, using a process that measures, tracks and captures GHGs to compensate for an entity’s GHG emissions emitted elsewhere. Credits may be generated through projects in which GHG emissions are avoided, reduced, removed from the atmosphere or permanently stored (sequestration). Carbon credits are generally created and independently verified in accordance with either a voluntary program or under a regulatory program. The purchaser of a carbon credit can ‘retire’ or ‘surrender’ it to claim the underlying reduction towards their own GHG emissions reduction targets or goals or to meet legal obligations, which is also referred to as carbon offsetting or offsetting. We define regulatory carbon credits to mean carbon credits used to offset GHG emissions for regulatory compliance in our operational locations (such as the Safeguard Mechanism in Australia). We define voluntary carbon credits to mean carbon credits generated through projects that reduce or remove GHG emissions outside the scope of regulatory compliance (including Australian Carbon Credit Units not used for regulatory compliance).

- Carbon neutral: Making or resulting in no net release of GHG emissions into the atmosphere, including as a result of offsetting. Carbon neutral includes all those GHG emissions as defined for BHP reporting purposes.

- Goal (for BHP with respect to GHG emissions): An ambition to seek an outcome for which there is no current pathway(s), but for which efforts are being made or will be pursued towards addressing that challenge, subject to certain assumptions or conditions. Such efforts may include the resolution of existing potential or emerging pathways.

- Greenhouse gas (GHG): For BHP reporting purposes, these are the aggregate anthropogenic carbon dioxide equivalent emissions of carbon dioxide (CO2), methane (CH4), nitrous oxide (N2O), hydrofluorocarbons (HFCs), perfluorocarbons (PFCs) and sulphur hexafluoride (SF6). Nitrogen trifluoride (NF3) GHG emissions are currently not relevant for BHP reporting purposes.

- Low to zero GHG emission(s) (for shipping): Capable of between 81 per cent to 100 per cent lower GHG emissions intensity (gCO2 -e/joule) on a well-to-wake basis compared to conventional fossil fuels used in shipping.

- Low to zero GHG emission(s) (for energy products other than shipping fuels): Capable of between 90 per cent to 100 per cent lower GHG emissions intensity during generation and/or combustion (as applicable) compared to conventional fossil fuel generation and/or combustion.

- Net zero (for a BHP GHG emissions target, goal or pathway, or similar): Includes the use of carbon credits as governed by our approach to carbon offsetting, available at bhp.com/climate.

- Offsetting (in relation to GHG emissions): The use of carbon credits. Refer to the definition of carbon credit.

- Reference year (for a BHP GHG emissions target or goal): A year used to track progress towards GHG emissions targets and goals. It is not a baseline for GHG emissions targets and goals.

- Target (for BHP with respect to GHG emissions): An intended outcome in relation to which we have identified one or more pathways for delivery of that outcome, subject to certain assumptions or conditions.

Our approach

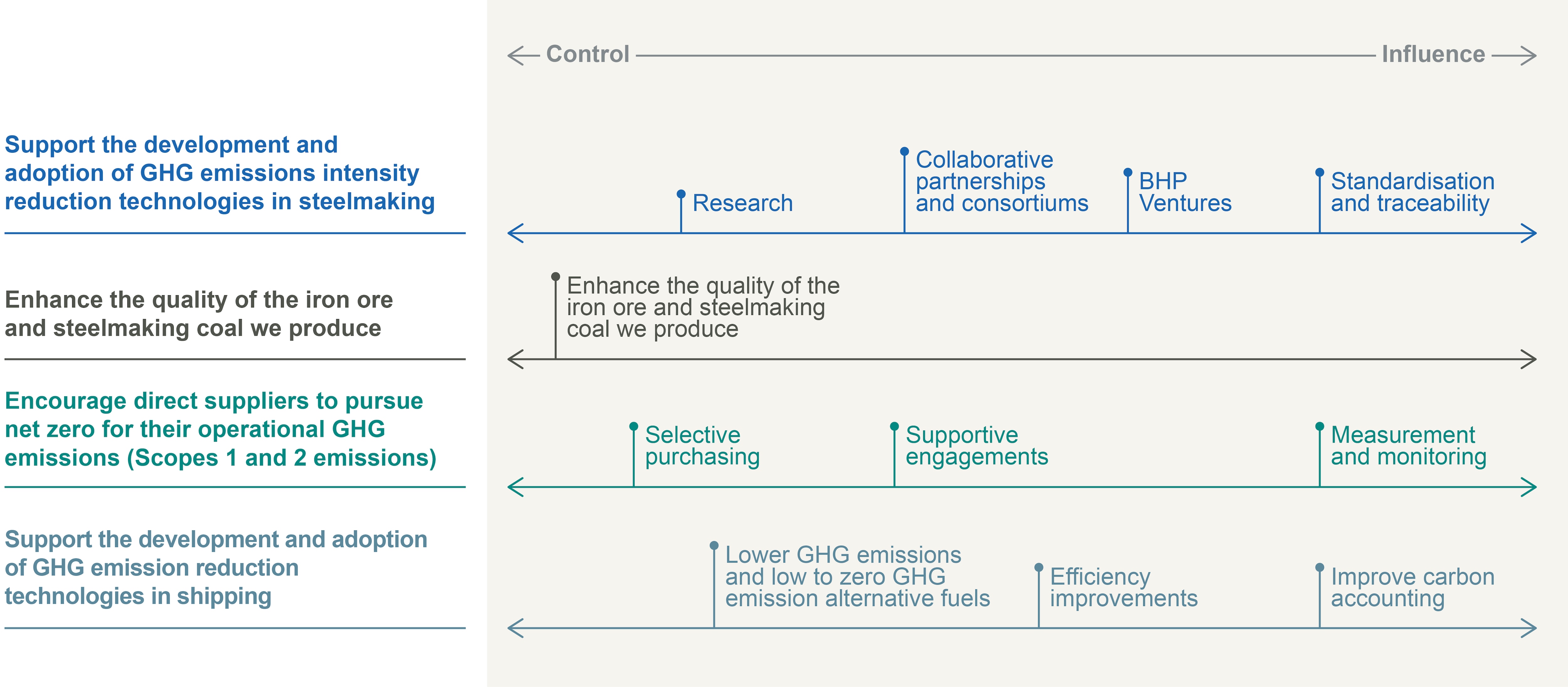

Our strategy to support reduction of GHG emissions in our value chain has four primary focus areas:

- support the development and adoption of GHG emissions intensity reduction technologies in steelmaking

- enhance the quality of the iron ore and steelmaking coal we produce (as the GHG emissions intensity of conventional blast furnace steelmaking can be reduced by improving the quality of the iron ore and steelmaking coal used)

- encourage direct suppliers to pursue net zero for their operational GHG emissions (direct suppliers’ Scopes 1 and 2 emissions)

- support the development and adoption of GHG emission reduction technologies in shipping

Our ability to support reductions in our reported Scope 3 emissions inventory

Steelmaking

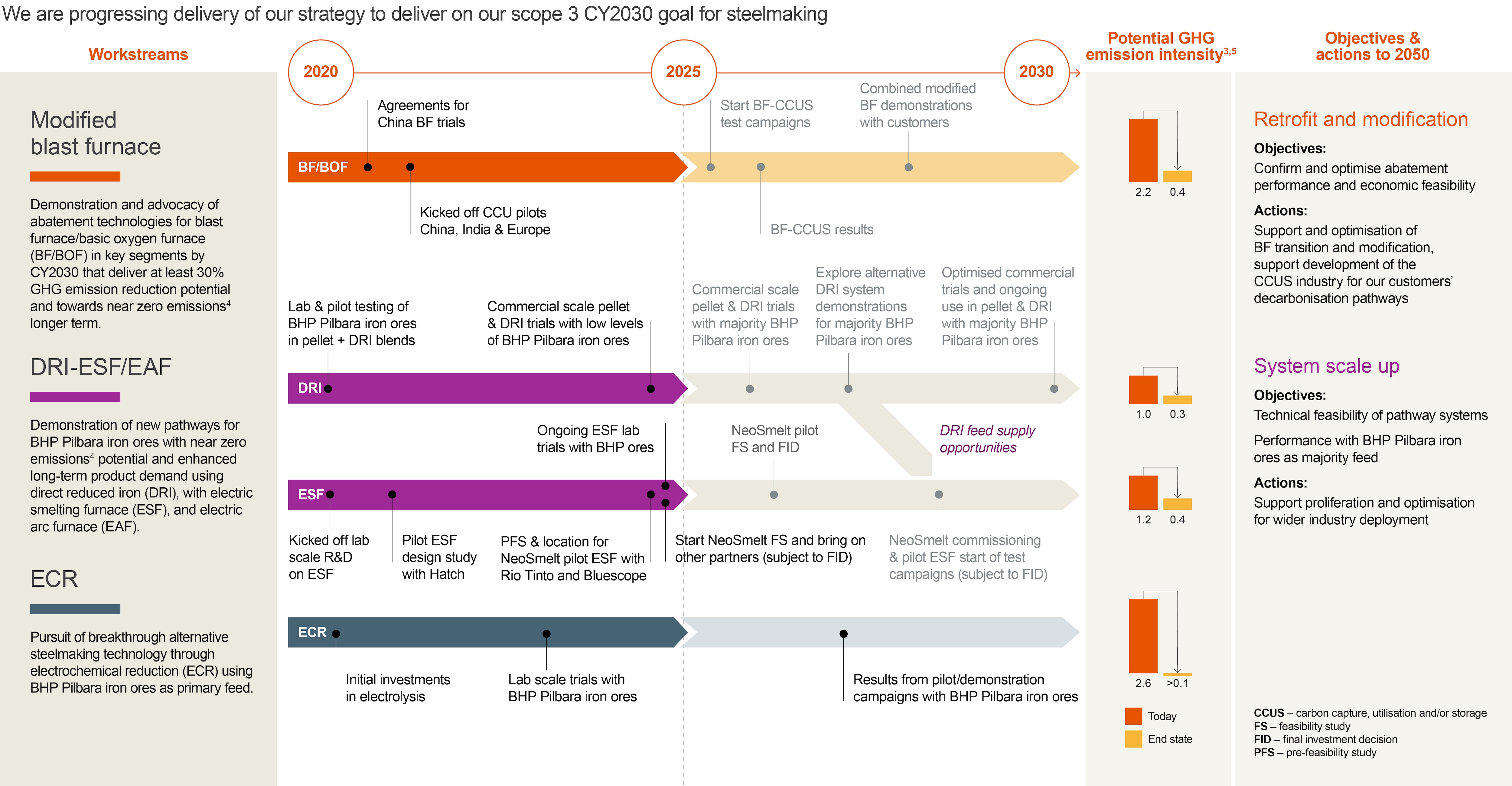

Our medium-term goal is to support industry to develop steel production technology capable of 30 per cent lower GHG emissions intensity relative to conventional blast furnace steelmaking, with widespread adoption expected post-CY2030.

For value chain GHG emissions, we have a long-term goal of net zero Scope 3 GHG emissions by CY2050. Achievement of this goal is uncertain, particularly given the challenges of a net zero pathway for our customers in steelmaking, and we cannot ensure the outcome alone.

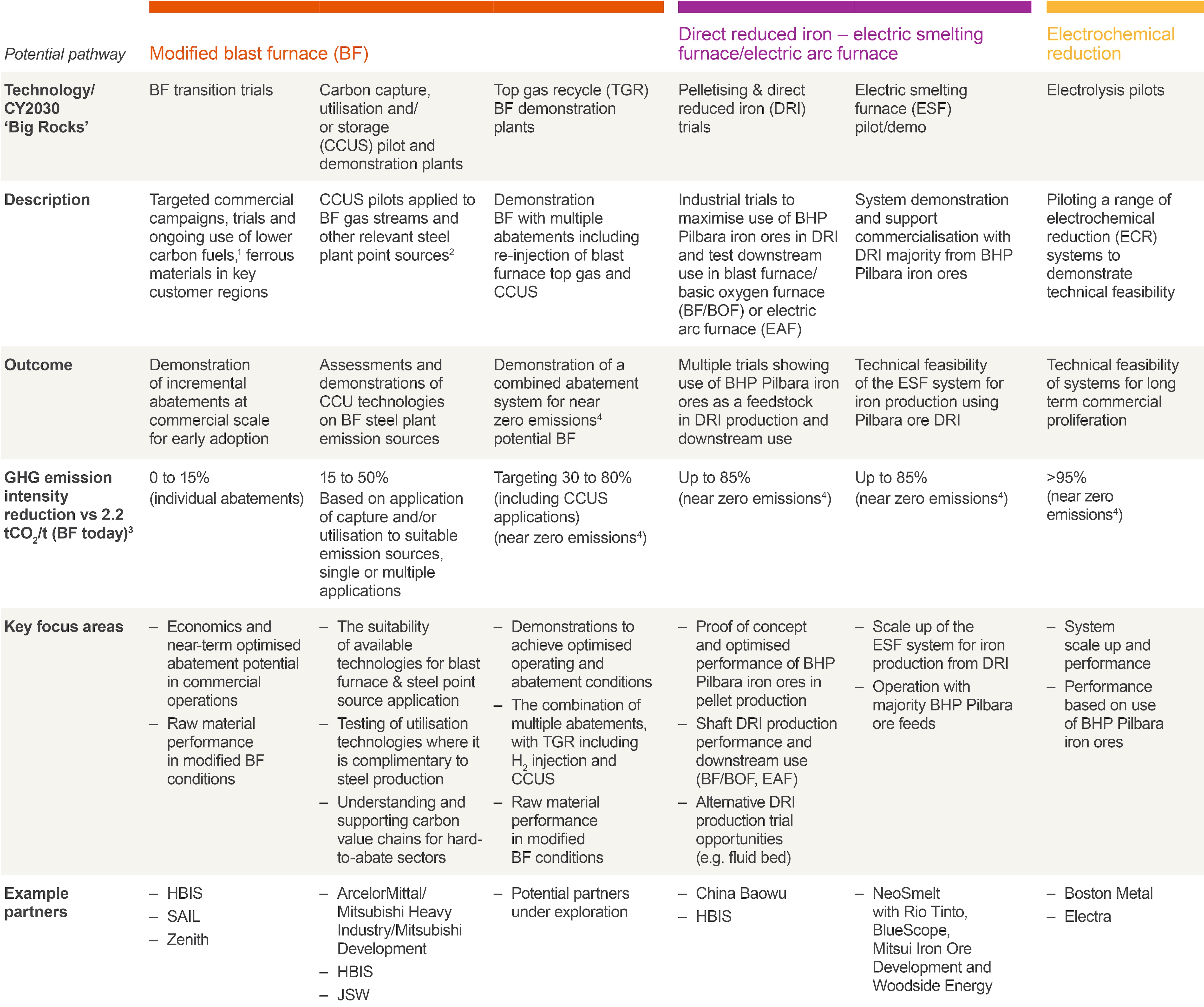

We use our conceptual ‘steel decarbonisation framework’1 as a foresight tool for how ore-based steel production may evolve. It consists of process routes1 which, in our view, offer the greatest potential for developing into near zero emissions2 steelmaking with sufficient flexibility, scalability and efficiency to support widespread adoption.

Our strategy is to support the development of technologies across multiple process routes. As we have previously stated in Pathways towards steelmaking decarbonisation, decarbonising the existing blast furnace process route is key to medium term decarbonisation in the steelmaking industry, while process routes must also be developed that can combine with low to zero GHG emissions3 hydrogen and with electric furnaces based on renewable or other low to zero GHG emissions3 power for long-term steelmaking decarbonisation. As outlined in CTAP 2024, BHP is technically and financially contributing to the development of technologies that can potentially provide a GHG emissions intensity reduction of at least 30 per cent. These technologies may be deployed either individually or in combination. Some of the technologies we are supporting have a potential GHG emissions intensity reduction greater than 30 per cent but are yet to reach the commercial readiness needed for widespread adoption. We are continuing to work with our customers, peers, research partners and government organisations to advance the commercial and technical readiness of these process routes in pursuit of our long-term net zero scope 3 GHG emissions goal. We prioritise projects for our steelmaking decarbonisation project program based on:

Scale: The depth of GHG emission abatement that could be attained, how quickly it could be brought to readiness and how broadly it could be adopted across the industry

Influence: Our capabilities and the leverage available to us to have a tangible impact on development and help enable the technology to be successfully propagated

Alignment: Relevance to our assets, our commodities and our customers, and the fit within the wider technology landscape

To progress towards our CY2030 goal for steelmaking, we participate in projects with partners that can demonstrate GHG emission abatement potential directly at commercial scale (such as blast furnace test campaigns or Direct Reduced Iron (DRI) plant trials) or improve the technology readiness for future industrial scale deployment, by participating in pilots or trials at pre-commercial/smaller scale (with minimum pilot scale equivalent to Technology Readiness Level 54) in relevant operational environments (such as the connection of pilot carbon capture technology to onsite blast furnace gas).

For each potential pathway, we have defined a set of activities that contribute to achieving our medium-term goal for steelmaking and support the potential for long-term commercialisation and wide-spread adoption of the technology in support of our long-term net zero Scope 3 GHG emissions goal. The scale and nature of the activities is closely aligned with the plans and objectives of our customers and industry partners and the status of each technology’s development. The list of the activities and their specific scope may evolve over time as we continue to progress the program, learn and adjust to results and industry change. Our project list includes:

- Modified blast furnace: Demonstrate by CY2030 and advocate abatement technologies in key steelmaking customer regions that show at least 30 per cent GHG emission reduction potential, individually or in combination, and progress towards near zero emissions2 in the longer-term, such as:

- blast furnace (BF) transition trials at commercial scale, using lower GHG emissions3 fuels, byproducts to reduce fossil fuel consumption and CO2 intensity of the process

- carbon capture pilots or demonstrations on blast furnace gas and potentially other GHG emission sources within the steelmaking plant, accompanied with engineering studies to assess the feasibility of commercial application

- modified blast furnace gas system demonstrations at or near commercial scale

- Direct reduction and electric furnace (DRI-ESF or EAF): Demonstrations through pilots and trials of new pathways for BHP Pilbara iron ores as a blend or majority feed via direct reduction and electric furnaces, including the electric smelting furnace, with near zero emissions2 potential:

- Pellet and shaft DRI production trials using BHP Pilbara iron ores, increasing to a majority feed ratio (>50 per cent BHP Pilbara iron ores), and subsequent testing as a blend feed to assess operational performance and develop optimisation techniques in existing BF, basic oxygen furnace or electric arc furnace (EAF) facilities

- Exploring alternative DRI production technologies in trials or pilots using majority BHP Pilbara iron ores as feed e.g. fluid bed reduction

- Pilot and demonstration campaigns of the electric smelter furnace (ESF) system for iron production, with BHP Pilbara iron ore as a majority raw material feed (via DRI)

- Electrochemical reduction: Use of BHP Pilbara iron ores as a majority raw material feed in campaigns of electrolytic iron or steel production at pilot or industrial demonstration scale for potential long-term commercialisation

We have estimated potential GHG emission reductions against the benchmark5 for conventional blast furnace steelmaking for these project types and expect to revise these estimates as we progress through project development and execution stages, validating or updating with project results.

Projects in our steelmaking decarbonisation program are making progress and we plan to share milestones and results as we progress.

We remain on track to achieve the steel production technology component of our 2030 social value scorecard Decarbonisation pillar goal.

Our achievements in FY2025 include:

- Under the Modified blast furnace pathway, we have progressed pilots in China and Europe jointly with our partners, with carbon capture trials commenced at customer sites. We plan to share key trial results in FY2026. We also initiated new partnerships in India, including studies to progress a next generation carbon capture demonstration with steelmaker JSW, and progressed low-carbon fuel installations (hydrogen injection to blast furnace) with Zenith Steel in China with the plan for testing campaigns to operate in FY2026.

- Additionally, in August 2025 we announced our participation in an industry consortium comprising leading steelmakers ArcelorMittal, Nippon Steel India, JSW Steel, Hyundai Steel Company and other value chain participants, Chevron and Mitsui & Co. Ltd, to undertake a pre-feasibility study to assess the development of Carbon Capture, Utilisation and Storage (CCUS) hubs across Asia. The CCUS Hub study is the first independent industry-led study of its kind in Asia and will examine the technical and commercial pathways to utilising CCUS in hard-to-abate industries across Asia.

- In FY2025, under the DRI-electric smelting furnace pathway, we successfully trialled BHP iron ores in pellet and DRI production at two commercial plants in China. One of these achieved a lower emissions intensity in the trial (50 per cent lower iron unit intensity replacing blast furnace iron in existing basic oxygen furnace steelmaking) than conventional blast furnace-basic oxygen furnace operation. Importantly, the trial demonstrated the use of BHP Pilbara ores in pellet-shaft DRI production, which when combined with an ESF has the potential to achieve 85 per cent emission reductions compared with the conventional blast furnace. In FY2026 and FY2027, we plan to continue to support work to optimise the performance of pellet and DRI trials at higher BHP Pilbara ore ratios. We also confirmed Kwinana in Western Australia as the location for the NeoSmelt ESF pilot with our partners BlueScope, Mitsui Iron Ore Development, Rio Tinto and Woodside Energy, and advanced the project from pre-feasibility into a final design phase. Subject to approvals, the NeoSmelt ESF project remains on track to be commissioned in the second half of CY2028 and begin demonstrating the system as a technically viable pathway.

- Within the Electrochemical reduction pathway, our BHP Ventures portfolio company, Boston Metal, successfully commissioned a large-scale pilot using BHP iron ore fines and lump, producing iron metal using electrolysis at tonnage scale and we made an additional investment into Boston Metal in June 2025. We also joined Electra’s series B funding round as it continues to develop its low temperature electrolysis process. With successful pilots, these solutions could help support our medium-term goal for steelmaking and our long-term net zero goal.

- We continued to engage with our direct iron ore and steelmaking coal customers on GHG emission reduction pathways and carbon accounting methodologies.

Footnotes

1 The ‘steel decarbonisation framework’ and its process routes can be found at Pathways towards steelmaking decarbonisation.

2 0.40 tonnes of CO2-e per tonne of crude steel for 100 per cent ore-based production (no scrap), as defined by the International Energy Agency (IEA) and implemented in ResponsibleSteel International Standard V2.1.1 (‘near zero’ performance level 4 threshold). ResponsibleSteel (2024), Achieving Net Zero Heavy Industry Sectors in G7 Members, IEA, Paris, License: CC BY 4.0, which also describes the boundary for the emissions intensity calculation (including in relation to upstream emissions).

3 Lower GHG emission(s) (other than shipping fuels) capable of lower absolute GHG emissions or GHG emissions intensity than the current state or the conventional or incumbent technology, as applicable.

4 Technology validated in relevant environment (small scale pilot technical feasibility proven) and high-fidelity prototype in simulated environment.

5 The blast furnace process route GHG emissions intensity benchmark has been calculated using a baseline reference of 2.2 tonnes of CO2-e per tonne of crude steel, as sourced from IEA Iron and Steel Technology Roadmap (October 2020).

Links to recent announcements:

BF and CCUS: HBIS lump dryer, Zenith COG injection, AM/MHI carbon capture, HBIS CCU,

DRI-ESF: Baowu DRI trials, HBIS DRI trials, NeoSmelt ESF

We also participate in enabling activities outside the pilots and demonstrations described above that provide broader industry support to progress readiness or optimise technologies in the potential steelmaking decarbonisation pathways and to support the use of our products, including:

- R&D that can be used to identify, focus and optimise abatement technologies and potential pathways:

- Concept studies that can support steel producers understand areas for further study to improve feasibility, support funding and financing activities for decarbonisation initiatives:

- Knowledge sharing through our own, our partners or wider industry forums and publications:

- University of Newcastle International Symposium on Sustainable Cokemaking and Ironmaking (ICSCI) conference

- China Baowu-Monash University Industry Knowledge Centre for Low Carbon Metallurgy (LCM) Annual Workshop – a forum held in April 2025 in Suzhou, China for participating researchers to showcase their projects to academics and steel industry representatives from BHP’s customers

- Advocacy for technology pathways and methodologies through industry forums and associations such as ResponsibleSteel

Key demonstration projects contributing to BHP’s Scope 3 CY2030 goal for steelmaking

Steel decarbonisation program update

Footnotes:

1 A steelmaking reductant feedstock and/or fuel source capable of lower CO2 emissions intensity than the use of steelmaking coal in the blast furnace process route (e.g. hydrogen, coke syngas, biomass and recycled fuels). The degree of emissions intensity reduction varies significantly by source.

2 Other potential steel plant emission sources that may be considered include integrated power stations, blast furnace stoves, sinter plant flue gas and coke plant flue gas subject to technical and economic feasibility.

3 The blast furnace process route GHG emissions intensity ‘today’ value has been calculated using a baseline reference of 2.2 tonnes of CO2-e per tonne of crude steel, as sourced from IEA Iron and Steel Technology Roadmap (October 2020).

4 0.40 tonnes of CO2-e per tonne of crude steel for 100 per cent ore-based production (no scrap), as defined by the International Energy Agency (IEA) and implemented in ResponsibleSteel International Standard V2.0 (‘near zero’ performance level 4 threshold). IEA (2022), Achieving Net Zero Heavy Industry Sectors in G7 Members, IEA, Paris, License: CC BY 4.0, which also describes the boundary for the emissions intensity calculation (including in relation to upstream emissions).

5 The electric arc furnace route GHG emissions intensity ‘today’ value is sourced from an average of a sample of natural gas-based direct reduced iron electric arc furnace sites utilising up to 25 per cent scrap in CY2023, as well as the CRU Steel Cost Model and BHP analysis. All other GHG emissions intensity values (other than for the blast furnace process route – refer to footnote 3) are sourced from BHP analysis.

Iron ore and steelmaking coal quality

The GHG emissions intensity of conventional blast furnace steelmaking can be reduced with higher quality iron ore and steelmaking coal. We anticipate that steelmakers will increasingly prefer higher-quality raw materials as the steel sector decarbonises. We have increased the ratio of high-grade lump ore that we produce through the recent development of our South Flank mine, which completed its ramp up to full production capacity in FY2024. In recent years we have divested our interests in BHP Mitsui Coal and BHP Mitsubishi Alliance’s Blackwater and Daunia mines to high-grade our steelmaking coal portfolio. We continue to study ways to improve quality and optimise for yield and value chain efficiency.

Shipping

As one of the world’s largest dry bulk charterers, our strategy to support the International Maritime Organisation (IMO)’s ambitions encompasses efficiency improvements, the adoption of lower and low to zero GHG emission alternative fuels, and enhanced carbon accounting practices. Our actions align with the requirements of the IMO’s mid- and long-term GHG reduction measure.

Our shipping medium-term goal, long-term net zero target and CY2030 commitment are generally consistent with or exceed the IMO’s ambitions. Our strategy, which encompasses efficiency improvements, the adoption of lower GHG emissions1 and low to zero GHG emissions2 alternative fuels, and enhanced carbon accounting practices, is designed to support the IMO’s ambitions. Our actions are designed to ensure that we contribute to the global effort to reduce GHG emissions and promote more sustainable maritime operations.

Our pathway will be accelerated directly by our actions and indirectly by the impact of our actions and influence in the industry. Our strategy to support our pathway encompasses three areas of focus:

- Efficiency improvements: Drive operational efficiency through vessel and voyage optimisation and technological energy efficiency improvements. Operational efficiency measures include consolidating parcel sizes to use larger and more efficient vessels and using alternative routes. Technological measures include chartering vessels with energy saving technologies, such as vessels with premium hull coatings and wind-assisted propulsion, which we are trialling with Pan Pacific Copper and Norsepower.

- Lower GHG emissions1 and low to zero GHG emissions2 alternative fuels: Establish demand and incentivise industry uptake of lower GHG emission fuels and low to zero GHG emissions fuels, such as our dual-fuelled LNG chartered vessels and biodiesel-fuelled voyages, respectively. We are also working across the ammonia value chain for the design and build of ammonia fuelled vessels, and supply of low to zero GHG emissions ammonia. We continue to work with regulatory bodies, shipyards and other key stakeholders to address the challenges for use of ammonia onboard vessels as well as with participants across technical, commercial and supply assurance aspects for the supply of electrolytic ammonia, commonly referred to as ‘green ammonia’.

- Improve carbon accounting: Step-change improvements in the completeness and accuracy of our carbon accounting through digitisation and automation in our value chain. This builds on our partnership with DNV and our use of their Veracity data platform for validation and reporting of shipping-related value chain GHG emissions since FY2022.

Footnotes:

1 Capable of between 5 per cent to 80 per cent lower GHG emissions intensity (gCO2-e/joule) on a well-to-wake basis compared to conventional fossil fuels used in shipping. Well-to-wake basis is inclusive of the GHG emissions across the entire process of fuel production, delivery and use onboard vessels.

2 Capable of between 81 per cent to 100 per cent lower GHG emissions intensity (gCO2-e/joule) on a well-to-wake basis compared to conventional fossil fuels used in shipping. Well-to-wake basis is inclusive of the GHG emissions across the entire process of fuel production, delivery and use onboard vessels.

Direct suppliers

- We continued to engage with and encourage our top 500 direct suppliers by spend to set their own operational GHG emissions targets or goals (for their Scopes 1 and 2 emissions) to align with our Scope 3 long-term target to achieve net zero by CY2050 for the operational GHG emissions of our direct suppliers.

- We commenced a pilot with four strategic suppliers that represent 5 per cent of our reported Scope 3, Category 1 emissions inventory to assess the viability and scalability of sharing their product-level emissions data. This pilot seeks to improve our reported Scope 3, Category 1 emissions inventory accuracy and ability to reflect GHG emissions reduction initiatives being implemented by our direct suppliers.

- We are currently working to update the methodology we use to calculate our reported Scope 3, Category 1 emissions inventory to more accurately reflect the GHG emissions associated with the products and services we procure by improving the emissions factors used to calculate emissions and ultimately shifting to supplier specific data for key products and services. This may have a significant impact on our reported Scope 3, Category 1 emissions inventory in future.

Our strategy targets the top 500 direct suppliers by spend, which contributed to 78 per cent of our FY2025 total spend on suppliers. It encompasses three areas of focus – selective purchasing, supportive engagements and measurement and monitoring.

Sustainability case studies, organisational boundary, definitions and disclaimers, and downloads

Prior year versions of some of the listed documents are available on the Past reports page.-

BHP Annual Report 2025

pdf

17068205

-

Sustainability reporting organisational boundary, definitions and disclaimers

pdf

170075

-

Límite organizativo de los informes de sostenibilidad, definiciones y descargos de responsabilidad

pdf

234993

-

BHP ESG Standards and Databook 2025

xlsx

2541694

-

BHP Group Modern Slavery Statement 2025

pdf

7308735

-

BHP GHG Emissions Calculation Methodology 2025

pdf

1124687

-

BHP Climate Transition Action Plan 2024, subject to updates of certain aspects of our assumptions and plans in the BHP Annual Report 2025, Operating and Financial Review 9.8 – Climate change

pdf

8480121

-

Global Industry Standard on Tailings Management - Public Disclosure 2025

pdf

25537144

-

Tailings Storage Facility Policy Statement 2023

pdf

73457

-

Case studies