Our latest disclosures

Our most recent climate-related disclosures and performance data can be found in the BHP Annual Report 2025, Operating and Financial Review 9.8 – Climate change and BHP ESG Standards and Databook 2025. Refer also to the BHP Climate Transition Action Plan 2024 for BHP’s climate change strategy, subject to updates of certain aspects of our assumptions and plans in the BHP Annual Report 2025, Operating and Financial Review 9.8 – Climate change.

Our operational GHG emissions target and goal

Notes and definitions

Information is valid at August 2025

- The baseline year, reference year and performance data of our GHG emissions, targets and goals will be adjusted for any material acquisitions and divestments, and to reflect progressive refinement of GHG emissions reporting methodologies.

- Our operational GHG emissions medium-term target is referrable to an FY2020 baseline year and long-term goal is referrable to a FY2020 reference year. The boundary of each target and goal may, in some cases, differ from required reporting boundaries. The use of carbon credits will be governed by BHP’s approach to offsetting, available at bhp.com/climate.

- Baseline/baseline year (in relation to GHG emissions targets and goals): A year used as a basis to compare and measure performance of future years.

- Carbon credit: The reduction or removal of carbon dioxide, or the equivalent amount of a different GHG, using a process that measures, tracks and captures GHGs to compensate for an entity’s GHG emissions emitted elsewhere. Credits may be generated through projects in which GHG emissions are avoided, reduced, removed from the atmosphere or permanently stored (sequestration). Carbon credits are generally created and independently verified in accordance with either a voluntary program or under a regulatory program. The purchaser of a carbon credit can ‘retire’ or ‘surrender’ it to claim the underlying reduction towards their own GHG emissions reduction targets or goals or to meet legal obligations, which is also referred to as carbon offsetting or offsetting. We define regulatory carbon credits to mean carbon credits used to offset GHG emissions for regulatory compliance in our operational locations (such as the Safeguard Mechanism in Australia). We define voluntary carbon credits to mean carbon credits generated through projects that reduce or remove GHG emissions outside the scope of regulatory compliance (including Australian Carbon Credit Units not used for regulatory compliance).

- Goal (for BHP with respect to GHG emissions): An ambition to seek an outcome for which there is no current pathway(s), but for which efforts are being or will be pursued towards addressing that challenge, subject to certain assumptions or conditions. Such efforts may include the resolution of existing potential or emerging pathways.

- Greenhouse gas (GHG): For BHP reporting purposes, these are the aggregate anthropogenic carbon dioxide equivalent emissions of carbon dioxide (CO2), methane (CH4), nitrous oxide (N2O), hydrofluorocarbons (HFCs), perfluorocarbons (PFCs) and sulphur hexafluoride (SF6). Nitrogen trifluoride (NF3) GHG emissions are currently not relevant for BHP reporting purposes.

- Net zero (for a BHP GHG emissions target, goal or pathway, or similar): Net zero includes the use of carbon credits as governed by BHP’s approach to carbon offsetting, available at bhp. com/climate.

- Offsetting (in relation to GHG emissions): The use of carbon credits. Refer to the definition of carbon credit.

- Reference year (for a BHP GHG emissions target or goal): A year used to track progress towards GHG emissions targets and goals. It is not a baseline for GHG emissions targets and goals.

- Target (for BHP with respect to GHG emissions): An intended outcome in relation to which we have identified one or more pathways for delivery of that outcome, subject to certain assumptions or conditions.

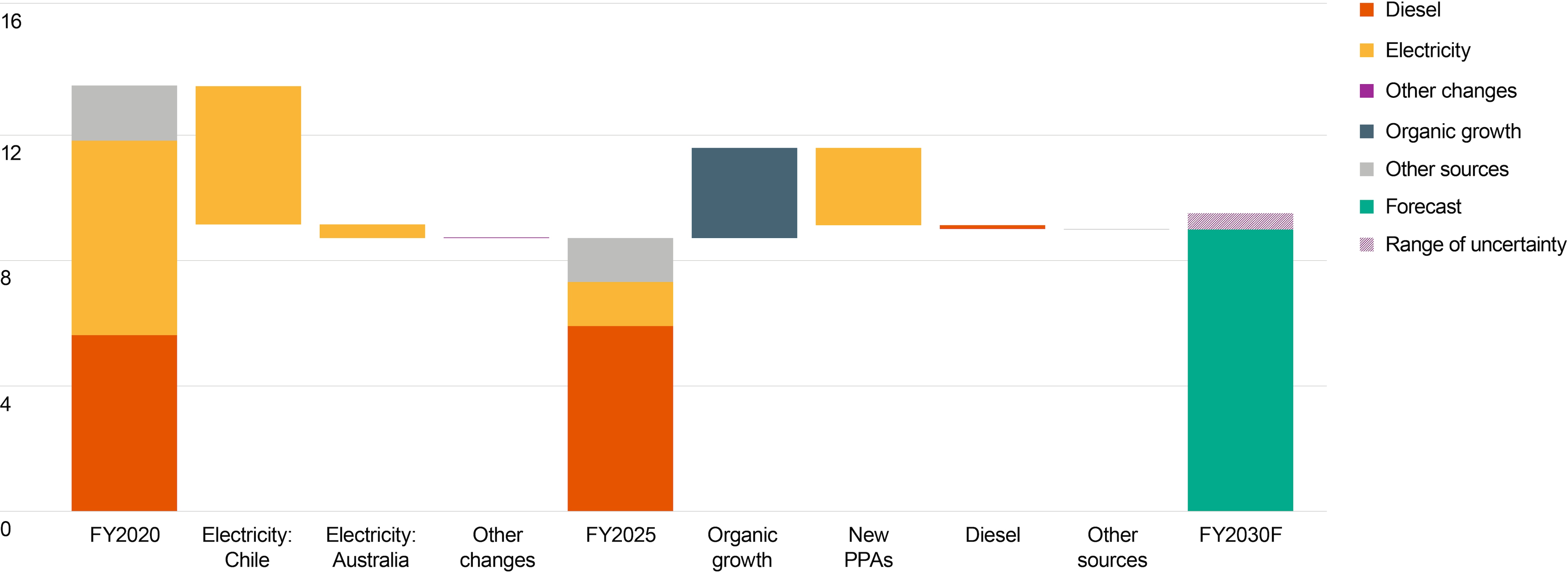

Our projected pathway to our medium-term target

To achieve our medium-term target, we are taking the following actions:

- procuring renewable and other low to zero GHG emissions electricity

- working to minimise the increase in operational GHG emissions from organic production growth and new operational sites

- working towards a reduction in risk exposure to diesel displacement solutions through testing, piloting and de-risking battery-electric haul truck technology, battery-electric locomotives, and the electrification of excavators and other diesel equipment

- pursuing solutions to abate fugitive methane emissions

- planning to meet our medium-term target through structural GHG emissions abatement instead of offsetting. We will not use carbon credits surrendered to meet regulatory compliance obligations (i.e. those used for compliance under regulatory schemes, such as the Safeguard Mechanism in Australia) to meet our medium-term target.

Our projected pathway, as shown in the chart below, does not include use of voluntary carbon credits1 to meet our medium-term target. However, if there is an unanticipated shortfall in our pathway, we may need to use voluntary carbon credits that meet our integrity standards to close the performance gap.

Projected pathway to our medium-term target for operational GHG emissions (Scopes 1 and 2 emissions from our operated assets)2

Operational GHG emissions (million tonnes of carbon dioxide equivalent (MtCO2-e)) (adjusted for acquisitions, divestments and methodology changes)

Footnote:

1 We define voluntary carbon credits to mean carbon credits generated through projects that avoid, reduce or remove GHG emissions outside the scope of regulatory compliance (including Australian Carbon Credit Units not used for regulatory compliance).

2 Future GHG emission estimates are based on current annual business plans (excluding OZ Minerals Brazil assets). FY2020 to FY2025 GHG emissions data has been adjusted for acquisitions, divestments and methodology changes. ‘Other changes’ refers to changes in GHG emissions from energy consumption other than electricity. ‘Organic growth’ represents the increase in GHG emissions associated with planned activity and growth at our operations. ‘Other sources’ refers to GHG emissions from fugitive CO2 and methane emissions, natural gas, coal and coke, fuel oil, liquefied petroleum gas or other sources. GHG emissions calculation methodology changes may affect the information presented in this chart. ‘Range of uncertainty’ refers to higher risk options currently identified that may enable faster or more substantive decarbonisation but which currently have a relatively low technology readiness level or are not yet commercially viable.

Our potential pathways to our long-term net zero goal

Our operational GHG emissions target and goal remain unchanged from prior years. Our pathway in coming years is complicated by factors including projected organic changes (i.e. arising from our existing business) in our production of commodities and the current lack of available technology solutions to support rapid GHG emission reductions for diesel displacement and fugitive methane abatement.

Many of the technologies we will need to achieve our long-term net zero goal are not yet ready to be deployed. A pathway between our medium-term target in FY2030 and our long-term net zero goal in CY2050 will require a significant technological step change in safety, reliability, operability, commercial availability and economics, and the pace of development of some decarbonisation technology has slowed since we published our Climate Transition Action Plan (CTAP 2024), as described below. We will continue to actively assess options and partnerships as technology readiness progresses and seek to optimise our plans as we maintain pursuit of our long-term net zero goal. We do not expect the technology delays to materially impact our plans to achieve our FY2030 medium-term target as we expect Power Purchase Agreements (PPAs) to provide sufficient abatement to meet the target.

In Figure 1.2 of our CTAP 2024, we published our operational GHG emissions reduction projected pathway to FY2030 and potential pathways between FY2031 and CY2050. The outcomes of our most recent annual planning process since then, reflecting technology delays, have resulted in the following primary updates to Figure 1.2 of our CTAP 2024:

- A delay in all projects for diesel displacement for materials movement and their associated GHG emissions abatement. Due to the low technology readiness level of the products, our Original Equipment Manufacturers (OEMs) are adapting their products to ensure they are technically, commercially and operationally viable. This has resulted in a delay to the previously projected timeframes and we now expect to adopt diesel displacement technologies at scale in our operations post FY2030.

- Safe and successful trials are an essential enabler of our ability to confidently scale and deploy the technologies required to decarbonise our operations. We will continue to progress existing trials and pursue new opportunities where products have reached a suitable technology readiness.

- These delays will impact our previously projected timelines for deploying battery-electric heavy mobile equipment and locomotives at Western Australia Iron Ore (WAIO).

- The delays to adoption of electrified fleet at scale similarly delay the associated electricity demand, which will also impact timing for our interdependent low to zero GHG electricity investments.

- A delay in the deployment of trolley assist at Escondida and Spence to post FY2030.

- The commercial operations of the Port Hedland solar farm and battery energy storage system (BESS), which connects to the existing Port Hedland power station and supplies WAIO’s port facilities under a PPA, commenced in July 2025 following completion of construction activities in CY2024.

- While the key changes to our projected and potential decarbonisation pathways are the timeline deferrals described above, the potential variability around the scale and timing of abatement as we progress towards our goal of net zero by CY2050 (shown in Figure 1.2 of our CTAP 2024 as the ‘range of uncertainty’) also increases. This is due to greater uncertainty of technology and commercial readiness of diesel displacement options as well as our additional insights into the operational integration challenges presented by a change as complex and farreaching as large-scale electrification. Operational integration challenges include safety-related risks associated with high-voltage direct current batteries, integration of cable management of tethered equipment, inter-operability challenges between different voltages, requirements for integration with automation, and the extent of workforce skills and training required.

Expenditure to support operational decarbonisation

Capital allocation towards operational GHG emission reduction projects is considered as part of the maintenance capital category within our Capital Allocation Framework (CAF) (described in the BHP Annual Report 2025, Operating and Financial Review 3 – Our key differentiators) along with other forms of risk reduction, asset integrity, compliance and major, minor and sustaining projects intended to preserve the ability to generate value at our operated assets. This enables consideration of a risk assessment across qualitative and quantitative criteria relevant to each capital allocation decision. However, an important principle within the CAF prioritises operational GHG emission reduction projects prior to organic development and the other options for excess cash flow (shown in the BHP Annual Report 2025, Operating and Financial Review 3 – Our key differentiators) where they are critical in supporting the achievement of our operational GHG emissions medium-term target and long-term net zero goal. Individual operational GHG emission reduction projects must justify the investment based on abatement efficiency, technology readiness, maturity, operational impact and relative economics.

Operational GHG emission reduction projects are incorporated into our corporate planning processes that include review of our mine plans, which are critical to creating alignment across BHP. These processes guide the development of plans, targets and budgets to help us decide where to deploy our capital and resources. We have several Investment Review Committees that assist our decision-makers with review of proposed investments. The appropriate Investment Review Committee, based on investment size and any complexity elements, provides endorsement for whether to progress operational GHG emission reduction projects based on qualitative and quantitative measures. Our Quarterly Business Review forums in each region also review and update strategic direction and tactical progress on operational GHG emission reduction. Execution is monitored through periodic reporting to senior leaders and project sponsors on key performance indicators.

For FY2025, our incremental capital expenditure, operating expenditure and lease payments on initiatives associated with operational GHG emission reductions was approximately US$50 million.1

As indicated in our April 2025 Quarterly Operational Review and noted above, the pace of development of some decarbonisation technology has slowed, particularly in the displacement of diesel used for materials movement. As a result, we have updated our approach to capital and operational expenditure on decarbonisation based on the viability of commercially available technology. The introduction of diesel displacement technology into our operations accounted for most of our previously allocated operational decarbonisation expenditure in the decade to FY2030 and this expenditure will now be delayed into the 2030s. The revised estimate of spend to execute BHP’s operational decarbonisation plans over the decade to FY2030 is US$0.5 billion (reflecting capital expenditure and lease payments). As technology readiness progresses, BHP anticipates its continued decarbonisation efforts will result in spend of at least US$4 billion in the 2030s. We will continue to prioritise the decarbonisation of our business activities and explore alternative decarbonisation projects subject to their satisfying our capital allocation hurdles. We will continue to work closely with our OEM partners to advance diesel displacement technologies, including by investing in site-based trials, so that additional decarbonisation expenditure can again be allocated to the introduction of this critical technology as soon as practicable. We remain on track to meet our medium-term target to reduce operational GHG emissions (Scopes 1 and 2 emissions from our operated assets) by at least 30 per cent by FY2030 from an FY2020 baseline (baseline year and performance data adjusted. For more information on the adjustments we make refer to climate-related metrics, targets and goals in the BHP Annual Report 2025, Operating and Financial Review 9.8 – Climate change.

Footnote

1 The calculation of this amount is considered on an incremental basis, referring to the incremental cost to facilitate BHP’s reduction in operational GHG emissions. For example, in a circumstance where a diesel-powered excavator is due for replacement, the incremental decarbonisation cost would be the difference between the cost of replacing it with a like-for-like diesel model versus the cost of replacing it with an electric alternative. This differential represents the additional investment made for the purpose of reducing operational GHG emissions.

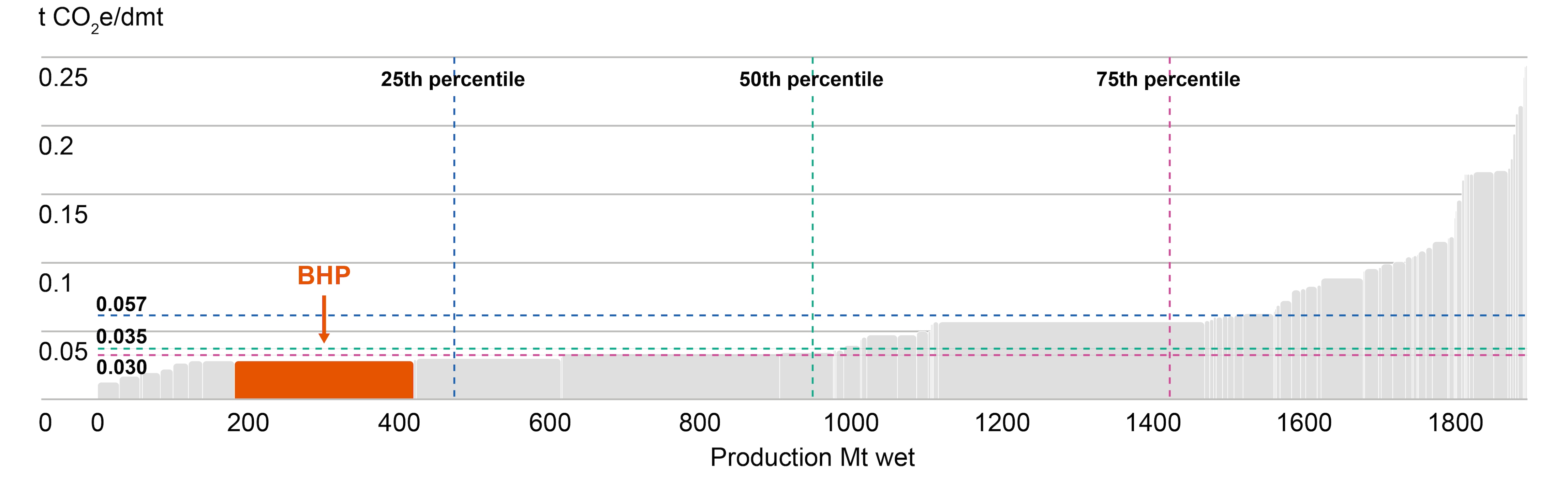

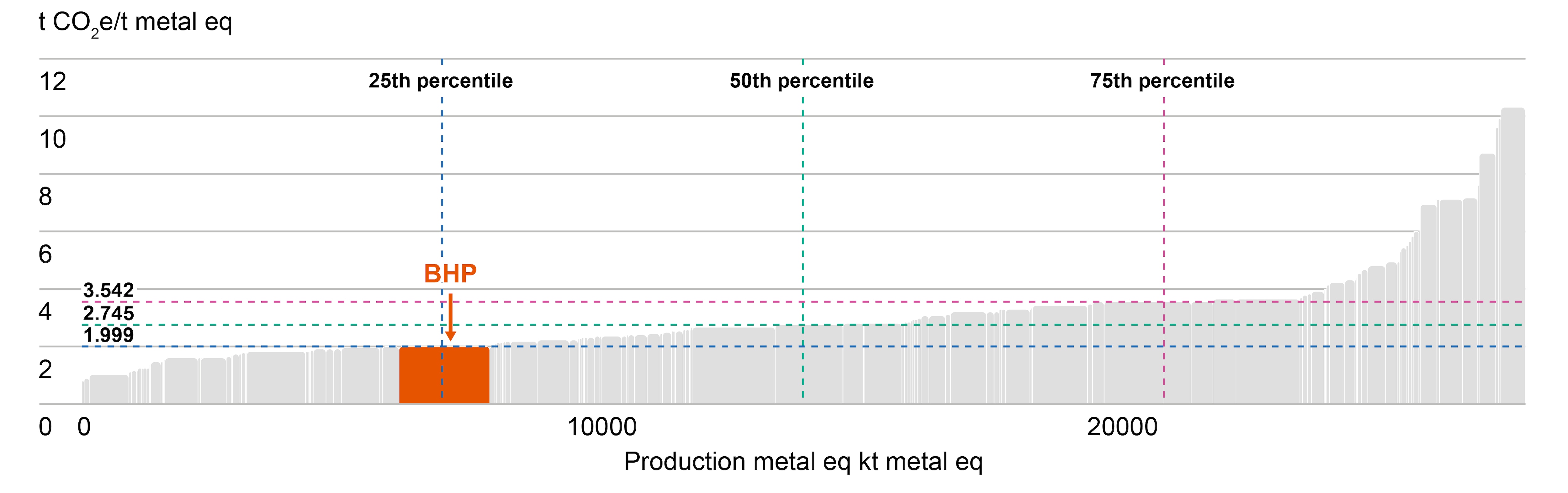

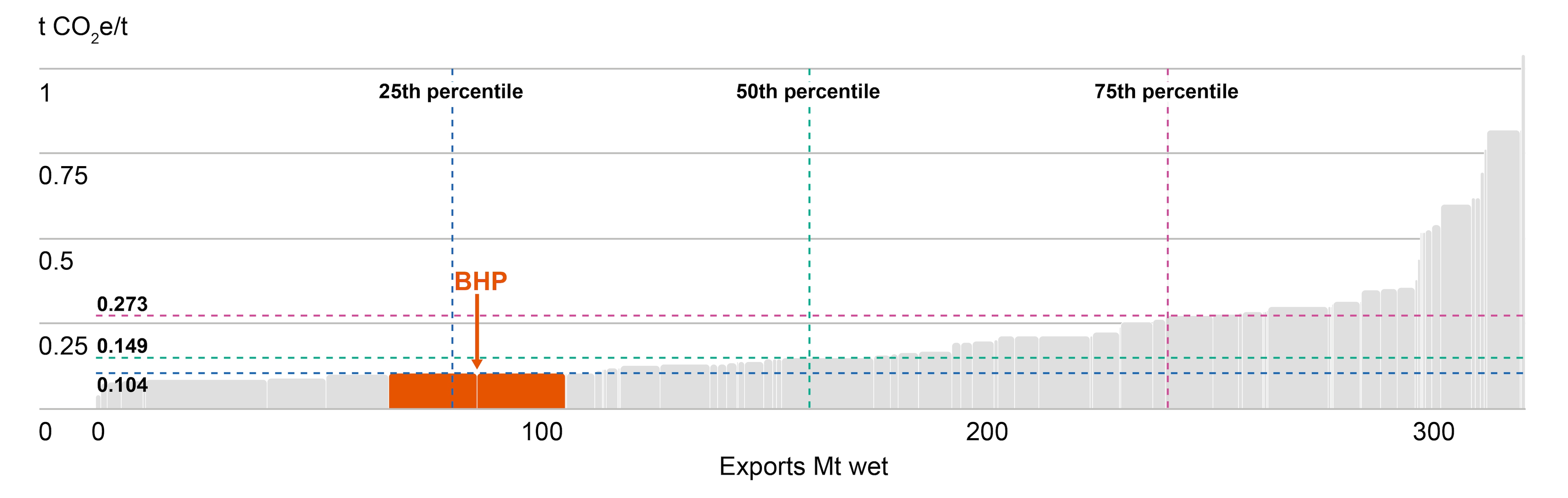

GHG emissions intensity rankings of our commodity production

For CY2024, the GHG emissions intensity of our production of our commodities is estimated to rank in the first quartile, for our iron ore mines, and the second quartile for our copper and steelmaking coal mines of global mining operations analysed by CRU. This analysis is based on CY2024 data from CRU (as CRU data is prepared on a calendar year basis) and includes CRU’s assumptions and estimates of BHP’s operations. For more information on how GHG emissions intensity of our production of our commodities has been calculated and compared, refer to the BHP ESG Standards and Databook 2025. We have not included analysis for our nickel operations as Western Australia Nickel remains in a period of temporary suspension.

GHG emissions intensity ranking of our iron ore production (CY2024)

GHG emissions intensity ranking of our copper production (CY2024)

GHG emissions intensity ranking of our steelmaking coal production (CY2024)

Sustainability case studies, organisational boundary, definitions and disclaimers, and downloads

Prior year versions of some of the listed documents are available on the Past reports page.-

BHP Annual Report 2025

pdf

17068205

-

Sustainability reporting organisational boundary, definitions and disclaimers

pdf

170075

-

Límite organizativo de los informes de sostenibilidad, definiciones y descargos de responsabilidad

pdf

234993

-

BHP ESG Standards and Databook 2025

xlsx

2541694

-

BHP Group Modern Slavery Statement 2025

pdf

7308735

-

BHP GHG Emissions Calculation Methodology 2025

pdf

1124687

-

BHP Climate Transition Action Plan 2024, subject to updates of certain aspects of our assumptions and plans in the BHP Annual Report 2025, Operating and Financial Review 9.8 – Climate change

pdf

8480121

-

Global Industry Standard on Tailings Management - Public Disclosure 2025

pdf

25537144

-

Tailings Storage Facility Policy Statement 2023

pdf

73457

-

Case studies