Each year we undertake an impact materiality assessment in alignment with Global Reporting Initiative (GRI) recommendations to determine which sustainability topics are most material to our business, partners and stakeholders for the purpose of our sustainability-related reporting (which may differ from the materiality standards applied by other reporting regimes). These are referred to as our material sustainability topics.

Our approach

In alignment with the recommendations of the GRI, we consider the actual and potential negative and positive impacts of our business in order to determine our material sustainability topics for the purposes of our sustainability approach and sustainability-related reporting. Our materiality assessment considers our potential and actual positive and negative impacts through the assessment of a broad range of inputs, including BHP’s material1 risk profile, information recorded in our internal event management system, our social value framework and industry standards and guidance. Our material sustainability topics are reviewed by the Sustainability Committee annually.

Key inputs for our materiality assessment

Identification of negative impacts

BHP’s event management system is used to help identify both actual and potential negative impacts arising from our operations. Specifically, the system is designed to capture events, such as operational incidents, that have or could have resulted in adverse consequences to people (health and safety), the environment or local community, and to our legal, reputational or financial standing. Hazard reporting is also encouraged as a proactive measure to help reduce the likelihood of actual and high potential impacts. We consider BHP’s material1 risk profile to identify the potential for negative impacts on our people, the environment or local community and the wider business. This covers threats that have been identified and assessed under BHP’s Risk Framework to determine their potential impacts and likelihood. For more information on the process by which we identify and manage risk at BHP under our Risk Framework, including our Group Risk Architecture and risk factors (which include sustainability-related risks), refer to the BHP Annual Report 2025, Operating and Financial Review 7 – How we manage risk.

We review the actual and potential for negative consequences identified via the event management system and BHP’s material1 risk profile with a variety of internal and external sources, such as issues raised through industry-specific sustainability standards. Subject matter experts across the business are also engaged in reviewing actual and potential negative impacts.

Assessing the significance of the negative impacts

BHP then uses an internal severity rating scale (tiered from one to five by increasing severity), as defined in our mandatory minimum performance requirements for risk management, to assess the significance of the actual or potential impacts identified.

For actual and potential negative impacts, we consider a current material1 risk to be relevant for consideration for GRI reporting purposes where it satisfies one or both of the following criteria:

- The maximum foreseeable loss (MFL) if the risk was to materialise is assessed as severity level four or five (five is the highest level) and the most significant potential impact of the risk is associated with a sustainability-related category under our Group Risk Architecture. The MFL is the estimated impact to BHP in a worst-case scenario without regard to probability and assuming all risk controls, including insurance and hedging contracts, are ineffective.

- The level of residual risk is above a certain threshold. This is determined by considering the estimated probability and impact to BHP assuming all risk controls that are in place are operating in accordance with their design.

Identification and assessment of positive impacts

Our positive impact on the economy, environment and people is captured through mechanisms such as our social value framework and social investment.

The social value framework was developed through extensive consultation and identified the opportunity to build value, beyond minimum compliance, through proactive initiatives and investments that focus on sustaining long-term, mutual value with those who help to enable the realisation of our purpose. We consider our six social value pillars under our social value framework and scorecard are material for reporting.

Our material sustainability topics

Our materiality assessment informs the depth of coverage of key topics to be included in our Annual Report in alignment with the GRI Standards. The Board’s Sustainability Committee reviews our materiality assessment approach and the list of material topics each year. In addition, the alignment of the BHP materiality assessment process with the GRI materiality assessment guidance is subject to independent third-party limited assurance as required under our ICMM membership. EY’s assurance statement is available in the BHP Annual Report 2025, Operating and Financial Review 9.14 – Independent Assurance Report.

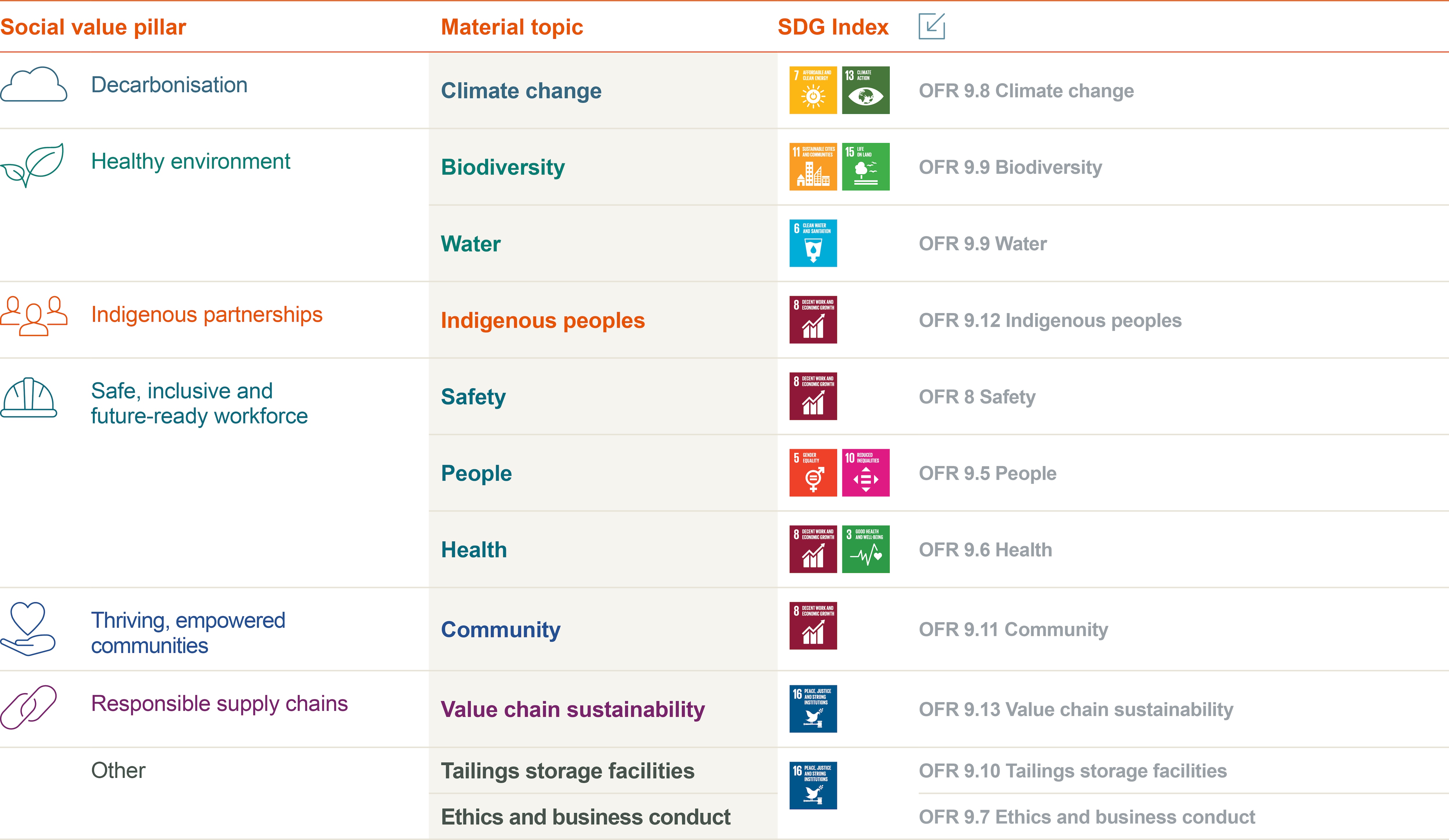

The material sustainability topics shown in the table below are the areas of focus for our sustainability disclosures in the BHP Annual Report 2025, Operating and Financial Review 9 – Sustainability. Refer to the section references in the table for where our most material sustainability topics are covered, and the relevant risk factor, in the BHP Annual Report 2025, Operating and Financial Review.

The alignment of the material sustainability topics identified through our FY2025 assessment to our social value pillars is shown below.

Material topics and impacts for sustainability reporting

1 ‘Material’ in this context refers to the materiality of a risk under BHP’s Risk Framework. For information on our Risk Framework refer to the BHP Annual Report 2025, Operating and Financial Review 7 – How we manage risk.

Sustainability case studies, organisational boundary, definitions and disclaimers, and downloads

Prior year versions of some of the listed documents are available on the Past reports page.-

BHP Annual Report 2025

pdf

17068205

-

Sustainability reporting organisational boundary, definitions and disclaimers

pdf

170075

-

Límite organizativo de los informes de sostenibilidad, definiciones y descargos de responsabilidad

pdf

234993

-

BHP ESG Standards and Databook 2025

xlsx

2541694

-

BHP Group Modern Slavery Statement 2025

pdf

7308735

-

BHP GHG Emissions Calculation Methodology 2025

pdf

1124687

-

BHP Climate Transition Action Plan 2024, subject to updates of certain aspects of our assumptions and plans in the BHP Annual Report 2025, Operating and Financial Review 9.8 – Climate change

pdf

8480121

-

Global Industry Standard on Tailings Management - Public Disclosure 2025

pdf

25537144

-

Tailings Storage Facility Policy Statement 2023

pdf

73457

-

Case studies