Sustainability is key to our purpose of bringing people and resources together to build a better world.

Our ambition

We are committed to finding new ways of operating more sustainably while supplying products that are essential for the global transition towards a more sustainable future.

Our approach and position

Our sustainability approach is defined by our purpose, building strong foundations and creating social value. For more information on our social value framework, approach to governance and annual performance against our social value scorecard refer to the Social value webpage and the BHP Annual Report 2025, Operating and Financial Review 9.4 – 2030 goals. For more information on our approach to sustainability-related risk management refer to the Sustainability-related risk management webpage and the BHP Annual Report 2025 Operating and Financial Review 7 – How we manage risk.

-

Governance and oversight

-

Engagement

-

Contributing to sustainable development

-

Performance

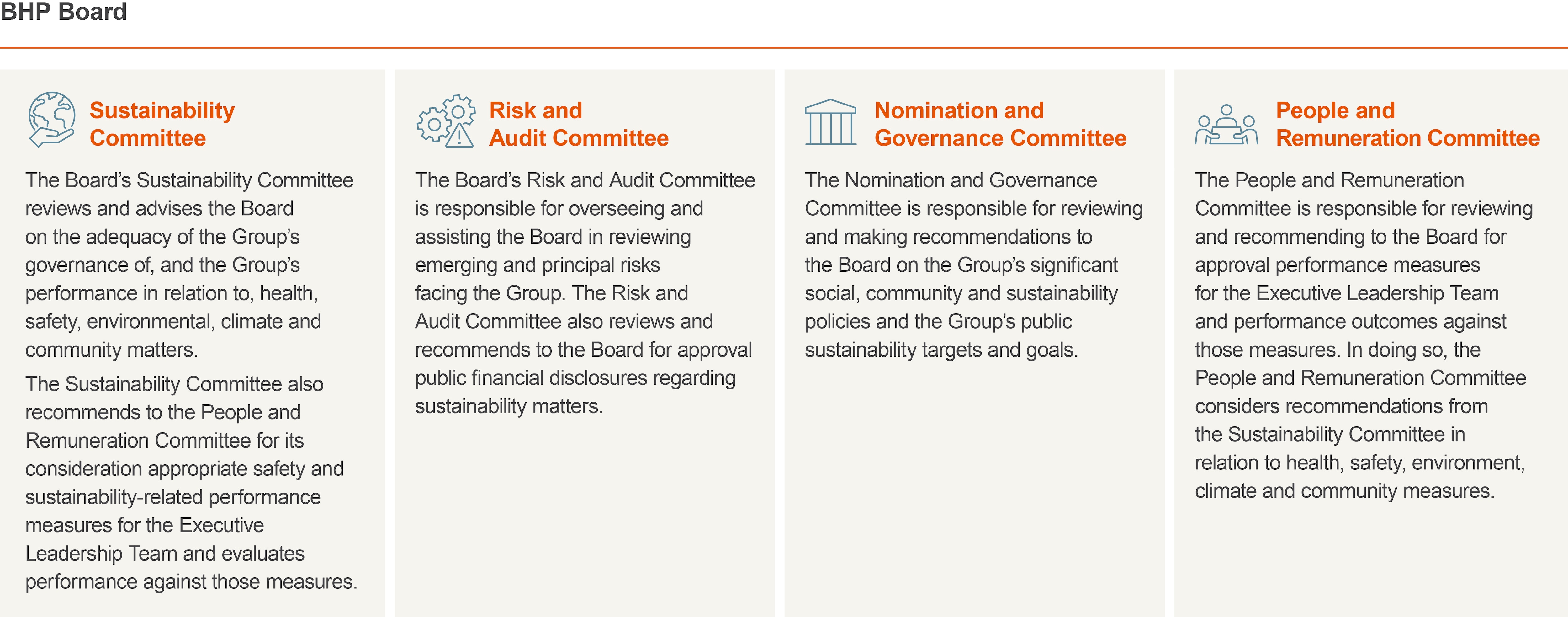

The BHP Board is responsible for overseeing our approach to sustainability and sustainability performance, including the topics of safety, health, community, environment and climate change. All four standing Board Committees support the Board’s oversight of sustainability-related issues, including climate-related risks (threats and opportunities):

Sustainability oversight by the Board

For more information on the Board and each Committee refer to the 2025 Corporate Governance Statement, Board Governance Document and Committee Charters on the Corporate Governance webpage.

As a global company, we interact with a range of partners and stakeholders. Our methods, frequency of engagement and approach to listening to partners and stakeholders are diverse. We use a range of formal and informal communication and engagement channels to understand partner and stakeholder views. The following table provides an overview of our partner and stakeholder groups, their range of interests and how we engage with them.

| Stakeholder / partner | Interest | How we engage |

|

Customers Broad customer base, geographically dispersed across multiple commodities |

Sales agreements, product quality, performance and price, environmental laws and regulations, sustainability metrics and performance, alignment with regional regulations | Regular engagement according to commodity, sector and geography to understand our customers’ needs and determine the optimal product placement; participation in relevant industry associations and conferences and establishing partnerships and collaboration in areas of mutual interest, such as supply chain innovation and sustainability |

|

Employees Our global workforce of more than 90,000 employees and contractors |

Group financial and sustainability performance, health and safety, our work with communities, working conditions, mental health and wellbeing, inclusion and diversity, development opportunities, proposed changes to our operated assets or practices | Regular communication through tailored internal channels, which include our intranet, email and newsletters, town hall meetings, toolbox talks, field leadership activities, ongoing dialogue between leaders and teams, HSEC Awards and through our Engagement and Perception Surveys |

|

Governments where we operate National, regional or state level and local governments in the countries where we have a presence |

Fiscal and tax arrangements, global trade systems, labour relations and employment practices supplier payment arrangements, environmental laws, regulations and project approvals, mineral royalties, local infrastructure and community wellbeing | Direct Group engagement at all levels of government, as well as participation in industry associations where relevant to national (or international), regional/state or local issues |

|

Indigenous peoples A broad spectrum of Indigenous representatives, including community leaders and members, Traditional Owners and representative bodies |

Environmental, social and cultural impacts associated with our operated assets, cultural heritage, human rights, opportunities for social investment, local employment, local suppliers and business creation, improved community engagement mechanisms and environmental performance | Consultation, negotiation and agreement making processes, community engagement, work and local supply opportunities, social investment, preserving cultural heritage, targeted communications, community perception surveys |

|

Industry peers and associations Commodity-specific associations, as well as sector-specific associations at regional, national and international levels |

Diverse range of issues associated with the resources sector or specific commodities or issues, including the environment, climate change, health and safety, communities, skills and training for employees, economic policy and sustainability management and performance | Representation on specific committees and engagement on specific projects with industry associations, to develop guidelines, standards and programs, agree advocacy priorities and share best practice We use our Climate Policy Principles to seek to influence the advocacy of the industry associations of which we are a member and review alignment of our material association memberships against these Principles in our Industry Associations Reviews, conducted every two years |

|

Investment community Debt and equity analysts, ESG analysts and corporate governance analysts |

Alignment of our performance with shareholder interests, including good financial returns, strong governance and expectations of strong performance and management of financial and non-financial risk | Regular communication through analyst briefings on key issues, exchange releases, sharing Group publications, such as Annual Reports and Operational Reviews, participation in external benchmarking activities |

|

Labour unions Labour unions represented at many of our operated assets |

Workers’ rights and interests, freedom of association and collective bargaining, health and safety, remuneration, working hours, roster arrangements and risk management | Direct communication as required, respecting the right to freedom of association |

|

Local communities A broad spectrum of local communities with interests and concerns |

Environmental, economic and social impacts associated with our operated assets, opportunities for social investment, local employment, local supplier and business creation, support for social infrastructure and programs, improved community engagement mechanisms and environmental performance | Community consultation, engagement and participation in BHP activities, work and local supply opportunities, social investment, targeted communications, community perception surveys |

|

Media Representatives from print, online, broadcast and social media |

Broad range of issues reflecting diverse stakeholder interests | Media releases, briefings, presentations and interviews, publicly available information (Annual Report and other topic-specific reports, our website, LinkedIn, YouTube, X, Facebook) |

|

Non-government organisations (NGOs) and civil society Environmental, social and human rights organisations at local, national and international levels |

Ethical, social and environmental performance of our operated assets, proposed operated assets or closed operated assets, governance mechanisms, risk management, complaint and grievance mechanisms and remedy, transparency, practices to respect human rights, social investment, non- operated joint ventures, social and environmental impacts | Local engagement through each operated asset’s stakeholder engagement plan, regular engagement at the Group level with relevant national and international organisations, various multi-stakeholder initiatives and partnerships, and through the BHP Forum for Corporate Responsibility |

|

Shareholders A diverse group that has invested in our business with significant representation in Australasia, the United Kingdom, Europe, South Africa and North America |

Creation of long-term shareholder value through consistent financial returns and good governance. Ensuring high-quality governance and maintaining focus on continuous improvement and understanding shareholder concerns, including ESG performance | Annual General Meetings, publicly available information (Annual Report, other topic-specific reports, our website), regular meetings with institutional shareholders and investor representatives, ESG roundtables and investment and community presentations |

|

Society partners Public or private organisations we partner with on specific projects to benefit society, the communities where we operate or the environment |

Ethical, social and environmental performance of our operated assets, proposed operated assets or closed operated assets, governance mechanisms, risk management | Boards and operating committees, publicly available information (Annual Report and other topic-specific reports, our website), regular engagement at both the Group and local/regional levels |

|

Suppliers Businesses local to our operated assets (including local Indigenous suppliers) as well as national and multinational suppliers, including maritime vessel charterers |

Procurement, inbound marketing procurement and charter party agreements, payments and minimum supplier requirements, safety standards | Regular engagement through the supplier lifecycle determined according to supplier segmentation and risk, including with respect to health, safety, environment and community, modern slavery, transparency, inclusion and diversity, and business conduct more broadly |

BHP also seeks advice from external experts and forums on issues relating to sustainability as inputs into our policy development and decision-making processes, such as from our Forum on Corporate Responsibility (FCR). Together with BHP’s CEO and other members of the Executive Leadership Team, the FCR comprises independent civil society leaders in various fields of sustainability, who make an important contribution to our approach to a range of sustainability-related topics and the development of our related policies, strategies and standards. The FCR’s civil society members provide insight into current and emerging issues, challenge our thinking and allow us to understand and consider the broader impacts of our actions. For more information on the FCR refer to the FCR webpage.

The United Nations Sustainable Development Goals (SDGs) aim to create a better, fairer and more sustainable world by 2030. The 17 SDGs address the global challenges society faces, including those related to poverty, inequality, climate change, conservation and economic growth. We can contribute to these broader goals through working in partnership with many different stakeholders, from global to local.

We recognise our business activities can contribute positively to the SDGs, but our operations can also create negative impacts. Therefore, sustainability must be integral to how we do business. The interconnectedness of the SDGs means a positive contribution to one can either have a multiplier effect or lead to potential negative impacts for another, so we recognise the importance of understanding the linkages, managing and mitigating any adverse impacts, and determining how we can make a positive contribution to those most relevant to our business and social value priorities. We considered our contribution to the SDGs when developing our social value framework, and have mapped our FY2025 sustainability-related material topics and impacts to their relevant SDGs in our BHP Annual Report 2025, Operating and Financial Review 9.3 – Material topics for sustainability reporting.

We use various metrics to measure our sustainability progress and performance. Our sustainability performance metrics are independently audited and a copy of the EY independent assurance report is available in the BHP Annual Report 2025, Operating and Financial Review 9.14 – Independent assurance report.

For details on our FY2025 sustainability performance data refer to the ESG Standards and Databook 2025.

For our FY2025 performance on our social value scorecard refer to the Social value webpage.

Disclosure

We commit to a number of sustainability frameworks, standards and initiatives and we disclose data as required by law and according to the requirements of those frameworks, standards and initiatives. Our sustainability performance data is included in relevant sections of the BHP Annual Report 2025, Operating and Financial Review, and in our ESG Standards and Databook 2025 Our Annual Reporting suite also includes our Modern Slavery Statement 2025, prepared under the Australian Modern Slavery Act (2018), the UK Modern Slavery Act (2015) and the Canadian Fighting Against Forced Labour and Child Labour in Supply Chains Act 2023, our Responsible Minerals Program Report 2025 and our Economic Contribution Report 2025. We have obtained external limited assurance over the sustainability disclosures included in the BHP Annual Report 2025, Operating and Financial Review and our ESG Standards and Databook 2025 and reasonable assurance over reported Scope 1 and Scope 2 greenhouse gas emissions in the BHP Annual Report 2025.

Our sustainability disclosures are informed by and/or consistent with the principles, position statements and requirements of the following disclosure frameworks, standards and initiatives.

Alignment between BHP reporting and the external sustainability reporting landscape

For information on our approach to responsible production and sourcing standards, including details on some of our relevant memberships, refer to the Value chain sustainability webpage.

Sustainability case studies, organisational boundary, definitions and disclaimers, and downloads

Prior year versions of some of the listed documents are available on the Past reports page.-

BHP Annual Report 2025

pdf

17068205

-

Sustainability reporting organisational boundary, definitions and disclaimers

pdf

170075

-

Límite organizativo de los informes de sostenibilidad, definiciones y descargos de responsabilidad

pdf

234993

-

BHP ESG Standards and Databook 2025

xlsx

2541694

-

BHP Group Modern Slavery Statement 2025

pdf

7308735

-

BHP GHG Emissions Calculation Methodology 2025

pdf

1124687

-

BHP Climate Transition Action Plan 2024, subject to updates of certain aspects of our assumptions and plans in the BHP Annual Report 2025, Operating and Financial Review 9.8 – Climate change

pdf

8480121

-

Global Industry Standard on Tailings Management - Public Disclosure 2025

pdf

25537144

-

Tailings Storage Facility Policy Statement 2023

pdf

73457

-

Case studies