05 December 2025

| 6 minute read |

Summary

|

As steel demand continues to rise, decarbonisation remains a key industry wide challenge. |

|

|

BHP is supporting steelmakers with multiple technology pathways to reduce greenhouse gas emissions. |

|

|

Cheaper renewable energy and infrastructure for carbon capture transport and storage are key enablers to the transition to 'near zero' emissions steel production. |

Steel is essential to the global energy transition — but it’s also one of the hardest sectors to decarbonise. BHP is supporting our customers to develop multiple technology pathways to reduce steelmaking emissions. We believe industry will adopt transition options to lower steelmaking emissions while enablers of ‘near-zero emissions’1 work towards viability in the longer term.

Transition to new pathways, progress and industry insights

The world needs more steel. It’s essential to modern life and the backbone of the infrastructure, housing and transport systems we need for a growing and increasingly urbanised global population.

Steel is central to the world’s decarbonisation ambitions too. The rewiring of our energy networks and the build out of renewables will require more steel. Additionally, under numerous 1.5 degree Celsius scenarios, steel production remains resilient out to 2050, with cumulative demand growing roughly 1.5 to 2 times over the next 30 years compared to the previous 30 years2.

The key challenge is meeting the world’s growing demand while also reducing the steel industry’s contribution to global greenhouse gas (GHG) emissions – which the International Energy Agency estimates is around 7-10 per cent3.

It’s a challenge our steelmaking customers have recognised. Nine out of the world’s ten top steel producers4 have public net-zero goals or targets (or ambitions). But it’s not easy. Steelmaking is energy and capital-intensive and strong global competition means margins are tight.

This has given rise to different approaches in different regions. Europe pushed early to develop hydrogen direct-reduced iron with the electric arc furnace but momentum on those commercial scale transitions has slowed. Steelmakers in Asia have been growing their focus on reducing emissions intensity in existing blast furnaces through carbon reduction or replacement, where feasible, and piloting carbon capture. Indian steelmakers, in particular, are looking to progress these technologies as they increase output. Steel producers in all regions are continuing research and development (R&D), pilots and trials.

BHP’s role in decarbonising steel

As one of the world’s leading iron ore and steelmaking coal producers, there is a role for BHP in supporting steelmakers in the transition. Our steel decarbonisation program – launched in 2020 – has seen us partner with customers and others in the industry to support R&D projects and pilots.

These projects span multiple technical pathways, including the Modified Blast Furnace, Direct-Reduced Iron Electric Steelmaking, and Electrochemical Reduction.

Each pathway is at a different stage of technical and commercial readiness and could have different utility for our steelmaking customers in different regions.

The modified blast furnace pathway, including carbon capture, utilisation and storage (CCUS) – which is mentioned in the decarbonisation plans of 14 of the leading 20 steelmakers, describes potential reductions for our customers’ existing operations. These are important to progress while the direct reduced iron-electric furnace pathway and the more transformative, but longer-term, electrochemical reduction pathway develop further technologically to enable commercial proliferation and use of Pilbara ores as a feed material.

Lowering emissions intensity in the blast furnace

The steelmaking sector can’t afford to wait for the longer-term. It needs commercially viable technical pathways to lower GHG emissions in the near-term. And they need to work in the blast furnace. This is where around 70 per cent of global steel production comes from today and we expect it will continue to be a major contributor for decades to come.

Blast furnaces are capital-intensive, long-life assets. In Europe, Japan and the US, some have been in operation for more than 50 years. The average age of blast furnaces in China is 12–14 years and India is targeting 300Mt of steel capacity by 2030 up from ~ 200 Mt now, with blast furnaces expected to provide the majority of this growth. So these furnaces in Asia could be expected to operate well into the second half of this century.

Blast furnace reduction trials in action

Through our steel decarbonisation program, BHP has helped progress a number of trials to reduce GHG emissions intensity in the modified blast furnace.

Initial trials were focused on optimisation of raw materials, and while the emission reductions were minor (<5 per cent compared to the conventional blast furnace5), this allowed us to establish a basis of collaboration for further trials and projects with more impactful abatement potential. Examples include our work with multiple producers to test use of BHP Pilbara ores in blast furnace pellet blends, with lower CO2 intensity, and with Zenith Steel for natural gas injection in sintering, both with lower emissions pathways than conventional sintering of iron ore fines. We have also been working on trials of novel screening and drying of lump with HBIS Group in China to reduce plant fuel consumption.

A good example of further reductions to blast furnace fuel rates is our subsequent joint project with Zenith Steel. We recently began commissioning a project to test hydrogen-rich gas injection into the blast furnace, which aims to achieve 5-10 per cent CO2 intensity reduction through the replacement of coal. Trials will continue throughout FY2026.

We have also progressed construction and testing on a range of carbon capture trials for the blast furnace in different countries6 and across different technologies and scales. Capturing CO2 from blast furnace gas, or with utilisation or storage, could potentially reduce the CO2 intensity of steel production by 15-35 per cent. Evaluating different technologies helps identify challenges, improve performance and identify ways to manage costs, while sharing results to support further innovation.

We’re not going it alone on CCUS either. We recently joined an industry consortium with steelmakers ArcelorMittal, Nippon Steel India, JSW Steel and Hyundai Steel Company, as well as Chevron and Mitsui & Co to undertake a pre-feasibility study to assess the development of CCUS hubs across Asia. This is the first independent industry-led study of its kind in Asia and will examine the technical and commercial pathways to utilising CCUS in hard-to-abate industries across the region.

Blast furnace CO2 capture trials in action at Ghent.

Electrifying steelmaking for Pilbara iron ore

Another emerging technology is the Direct Reduced Iron – Electric Steelmaking pathway, using the electric arc furnace (DRI-EAF) or the electric smelting furnace (DRI-ESF). This reduces GHG emissions by removing coal from the steelmaking process and replacing it with renewable electricity and hydrogen.

We have successfully trialled BHP iron ores blended into pellet and shaft DRI production at two commercial plants in China. The trials with China Baowu and HBIS Group demonstrate the use of BHP Pilbara ores in the DRI process, reducing CO2 intensity by 50 per cent in the ironmaking stage versus the blast furnace. When combined with an ESF, DRI has the potential to achieve an 85 per cent CO2 emission intensity reductions compared with the conventional blast furnace steelmaking route. Our challenge is to increase and optimise the use of Pilbara iron ores in the pellet feed, and subsequent DRI and ESF steps. Our collaboration with POSCO, announced in late October, focuses on advancing POSCO’s hydrogen reduction ironmaking technology, HyREX, using Pilbara iron ore fines directly in a fluid-bed hydrogen DRI step, which would avoid the challenges and costs of pelletising and offer integration with ESF. We look forward to progressing the collaboration to further enable the DRI–ESF pathway.

In Western Australia, we’re working with BlueScope, Rio Tinto, Mitsui Iron Ore Development and Woodside Energy on the proposed NeoSmelt ESF pilot. The partners have advanced from pre-feasibility into a final design phase and expect to make a final investment decision in 2026. The pilot seeks to demonstrate that DRI-ESF can be commercially viable for steel and optimised using a majority Pilbara iron ore feed.

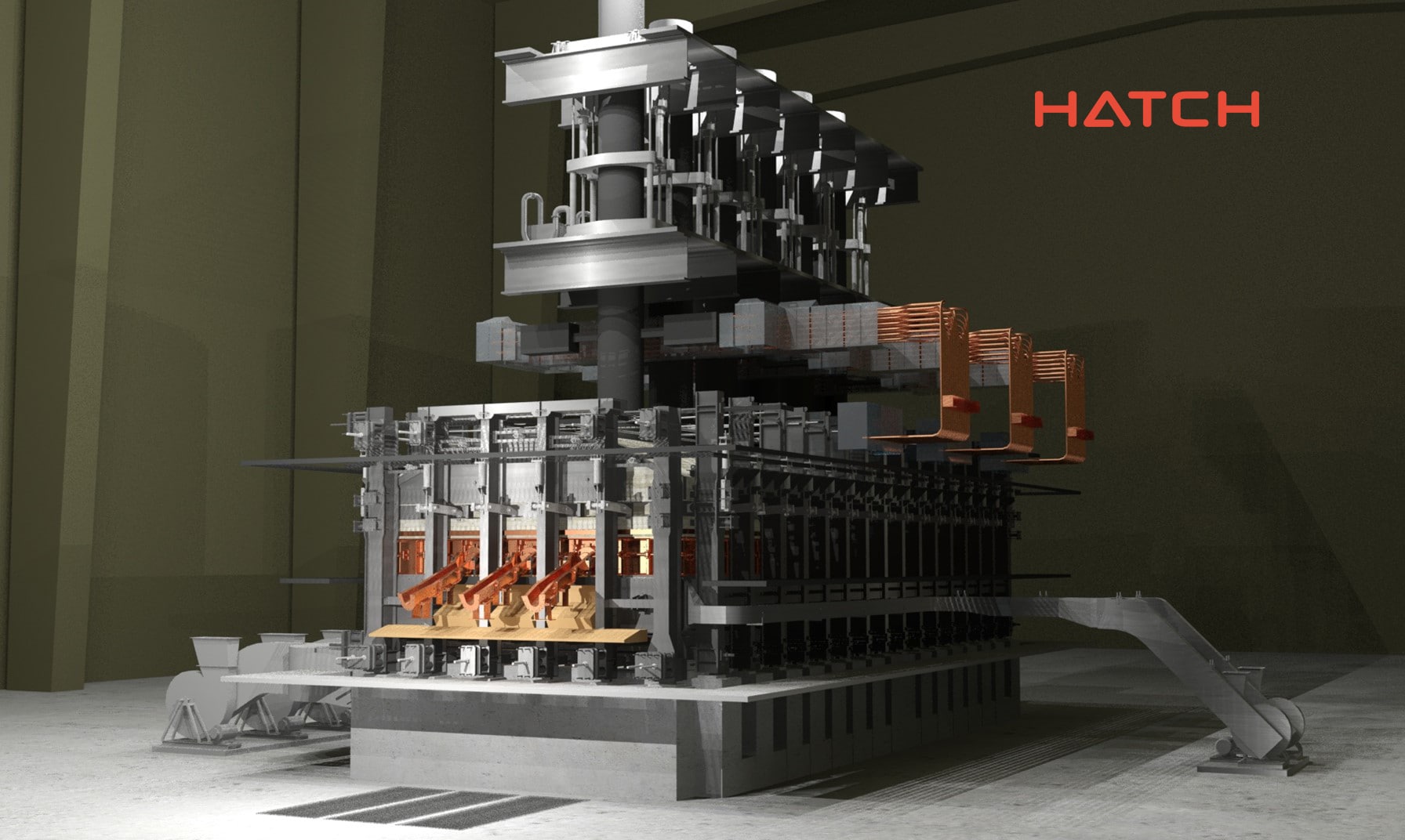

Render of Electric Smelting Furnace. Source: image supplied by Hatch

Turning potential into progress

While we’ve made positive steps with many partners, there is clearly a lot more to do to enable widespread adoption of new pathways once proved as commercially viable.

The momentum toward full scale transition toward hydrogen powered DRI-EAF has slowed. Three projects have been delayed or indefinitely postponed by steelmakers in Germany this year due to rising costs and uncertainty on hydrogen supply. Project announcements have fallen from 134 across 2022-23 to 46 in 2024 to October 20257.

Yet we are seeing increased interest from steelmakers in decarbonising the blast furnace. Focus on the steel sector is expected to increase in China, having recently included the sector in the emission trading scheme. We’re also seeing movement toward this in India, with the government releasing draft frameworks to reduce emissions intensity as blast furnace capacity grows to 2030. R&D, pilots and demonstrations continue to progress in all regions in preparation for more viable economic conditions long term.

Key enablers

There are two major enablers to advance the adoption of ‘near zero emissions’ steel production routes.

The first is getting the cost of renewable energy down. The economics of renewable hydrogen-DRI and EAF do not currently stack up which is reflected in the project delays in Europe. According to BNEF, the levelised cost of steel from this route is 70-200 per cent higher than existing blast furnace capacity in China on the back of high hydrogen costs versus carbon fuels8.

The second enabler is the further development of the value chains, infrastructure and regulatory mechanisms for carbon capture transport and storage options in key regions like China and India.

Steel producers are keen to progress carbon capture pilots to understand technology performance and how this impacts feasibility at commercial scale. We have seen this firsthand with our project hosted by ArcelorMittal in Belgium, our pilot with HBIS in China and study for a CCU demonstration plant with JSW and Carbon Clean in India.

Uncertainty with technical, commercial and regulatory developments in the transport and storage components is holding back progress.

BHP will keep playing its part

At BHP, we believe our best role is to play to our competitive advantage by helping our customers do the same.

Our strategy is about enabling our customers to decarbonise by supporting development of new technologies and pathways that are compatible with the iron ore and higher-quality steelmaking coals expected to be needed for decades to come.

We’re making good progress demonstrating multiple pathways. We’ll continue to invest, alongside our customers, towards our medium-term goal to support industry to develop steel production technology capable of 30 per cent lower GHG emissions intensity relative to conventional blast furnace steelmaking, with widespread adoption expected post-CY2030.

Footnotes

- 0.40 tonnes of CO2-e per tonne of crude steel for 100 per cent ore-based production (no scrap), as defined by the International Energy Agency (IEA) and implemented in Responsible Steel International Standard V2.0 (‘near zero’ performance level 4 threshold). IEA (2022), Achieving Net-zero Heavy Industry Sectors in G7 Members, IEA, Paris, License: CC BY 4.0, which also describes the boundary for the emissions intensity calculation (including in relation to upstream emissions).

- Multiple sources including Wood Mackenzie, International Energy Agency, Bloomberg NEF

- International Energy Agency – approximately 7% from combustion and processes (World Energy Outlook 2024) and 10% if indirect emissions from electricity generation are included (Emissions Measurement and Data Collection for a Net Zero Steel Industry 2023).

- According to World Steel Association 2024 figures for reported global steel production.

- All percentage reductions in this ‘Blast furnace reduction trials in action’ section are comparisons with the conventional blast furnace.

- With ArcelorMittal/MHI/MDP in Europe, HBIS in China, and JSW/Carbon Clean in India.

- As reported by Bloomberg New Energy Finance (BNEF)

- BNEF Steel Production Valuation Model

Get the latest BHP news alerts, straight to your inbox

Get BHP news first. Stay in touch with our latest updates, investor news and media releases.