This year our performance was strong. Our ongoing focus on productivity and portfolio simplification have allowed us to fully capture the benefit of higher prices. We will carry this momentum into 2018 and beyond.

FY2017 Operational Reviews

-

For the year ended 30 June 2017

pdf

104196

-

For the year ended 30 June 2017

xlsx

371030

-

For the nine months ended 31 March 2017

pdf

117545

-

For the nine months ended 31 March 2017

xlsx

372925

-

For the half year ended 31 December 2016

pdf

107473

-

For the half year ended 31 December 2016

xlsx

372967

-

For the quarter ended 30 September 2016

pdf

309534

Key numbers

Key FY2017 highlights

Maximising cash flow

US$12.6 billion of free cash flow, our second highest on record, supported by productivity gains and capital discipline.

Increased productivity gains

Over US$12 billion of productivity gains achieved in the last 5 years.

Increased profit

Delivered US$6.7 billion profit this year, up from US$1.2 billion last year1.

Disciplined capital approach

Approved low risk, high-return major development projects in copper and oil.

Learn more about our Capital Allocation Framework.

Higher dividends

Our full year dividend of US$0.83 cents per share is equivalent to a 66% payout ratio.

Improved performance and value

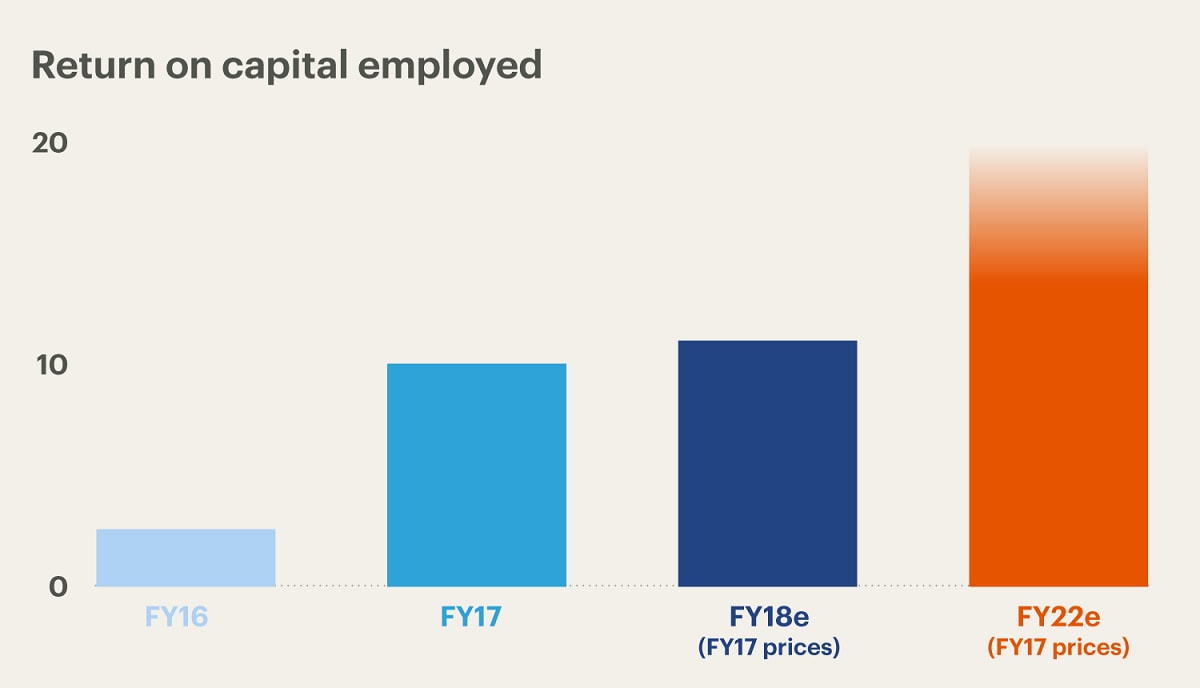

We increased our return on capital to 10%.

Our plan to grow shareholder value

Key activities for FY2018

- Grow overall production output by 7%.

- Generate >US$10 billion of free cash flow2.

- Average returns of over 20% on development project spend.

- Focus on smaller, low-cost, high-return projects across the portfolio - to make the most of what we have.

Key activities - medium term

- Further reduce costs and embed over US$2 billion of additional productivity gains over the next two years.

- Continue to strengthen our balance sheet with a targeted medium-term net debt range of US$10-15 billion.

- Maintain discipline and keep capital and exploration expenditure below US$8 billion over the next few years.

- Potential to significantly increase our return on capital by FY20224