26 abril 2021

Green hydrogen could make a considerable contribution to global decarbonisation efforts, especially in the “harder-to-abate” sectors such as steelmaking, other industrial processes requiring high heat, and heavy duty transport. As the EU’s Energy Commissioner Kadri Simson has argued, “Hydrogen is not an answer to all the questions on the clean energy system of the future, but it can answer some of the hardest”.1 Indeed it can. But will it? And if so, where and when? That is the sequence of questions we aim to address below.

The positive signposts are obvious. There is increasing confidence that 2020 may well be remembered as a watershed year for green hydrogen. We witnessed rising decarbonisation ambitions in key regions and loftier voluntary commitments by a rising number of influential global companies. Green stimulus packages were rolled out amidst the Covid-19 pandemic. The EU’s hydrogen strategy was announced. Electrolyser learning rates are now close to those achieved by wind power historically. Searches on Google for “green hydrogen” tripled from the 2019 level.2

On the other hand, actual funds directed at hydrogen remain very small relative to total energy transition investments (a meagre $1.5bn out of ~$500bn in 2020 according to green think tank BNEF), logistical challenges in the prospective value chain are very real, and the standalone cost competitiveness of green hydrogen remains a huge challenge to surmount, with shortfalls across capex, opex, distribution and storage to overcome, in addition to questions of achieving ample electrolyser supply. And the relative level of social interest in green hydrogen, as proxied by Google searches once again, is still low, at less than one third of “carbon capture utilisation and storage” (CCUS)3, a competing technology for application in the harder-to-abate sectors of the energy and industrial system. The funding gap was somewhat less, but CCUS still attracted $3 billion in spending in 2020 according to BNEF, double the outlay on hydrogen.

Against this mixed backdrop of hope and doubt, we note that the energy system modellers producing Paris-aligned technical pathways are positioned almost universally on the cautious side of the green hydrogen debate.

In ten such scenarios that we have studied, including the 1.5 degree pathway we discussed in our Climate Change Report, hydrogen’s share of final energy demand (all hydrogen, not just the green variety) is expected to average around 8½% in 2050.4 If you exclude BNEF’s “strong policy” pathway, which puts hydrogen’s 2050 share at 24% (double any other estimate in our sample), the average drops to around 6½%. That represents spectacular growth from today’s starting point of less than 2%, but it hardly establishes hydrogen at the heart of the global energy system by the middle of this century.

Why the faint praise? To paraphrase a former US president, “it’s the economics, stupid”.

The dilemma facing climate modellers where hydrogen is concerned is clear. To back solve the most cost efficient energy and land-use system that also respects a 1.5 degree carbon budget (exhausted in a decade or so on current projections)6, the time for patience is long gone. Decarbonisation must begin immediately and jump straight to a consistent run-rate of decline that has never been sustained beyond a single year in the historical record (ex the economies of Eastern Europe after the collapse of the Soviet Union). Even in 2020, with everything that Covid-19 entailed in terms of constraints on economic activity, global emissions were still up year-over-year by the month of December 2020.

The logical inference is that we must deploy the most competitive carbon abatement technologies we have ready right now, in the most efficient way: at serious scale.

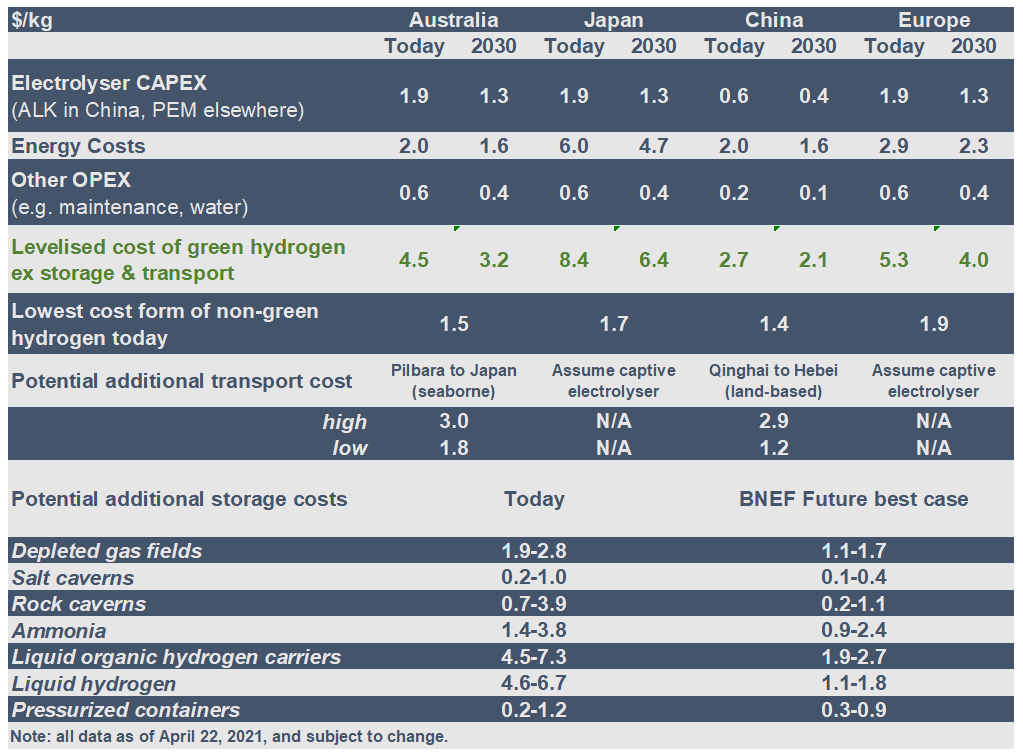

With green hydrogen economics are far from competitive today (due to a combination of high standalone capex [electrolysers] and opex [mostly power but also operations and maintenance and water costs], storage and distribution challenges and low regulatory carbon pricing), other options are deployed first, and these technologies monopolise the economies of scale that emanate from rapid ramp-up.6 They also derive the self-reinforcing benefits of incumbency, not the least of which is the development of enabling infrastructure (e.g. the public and private sector can confidently go “all in” on charging units for electric vehicles [EVs], as there is a network effect at play. This leaves others, like hydrogen refuelling stations, on the outer).

And from an efficiency standpoint, let’s not forget that only 8% of power generation worldwide came from wind and solar in 2019. The most efficient use of this rapidly growing but as of now scarce green energy is to progressively decarbonise the grid by displacing fossil power, as we argued in the first episode of this series . Diverting this resource towards low efficiency7 uses while it is still scarce would be a poor one: and the models don’t make that mistake.

You can see a detailed cost build-up for green hydrogen here

The laws of technological diffusion are clear: when a solution emerges with superior utility (blend of cost, convenience and performance) to the incumbent technology, the disruptor will diffuse rapidly and will eventually come to dominate. The time it takes for the takeover to ensue depends critically on the effective lifetime of the incumbent capital stock. In smart phones, it took just a handful of years for the entire “fleet” of handsets to turnover and be replaced. Light duty vehicle lifetimes are in the range of 10-13 years, and this is a key parameter for assessing the timing of EV takeover points from internal combustion engine (ICE) vehicles. In steel-making, it took more than 60 years for the BF-BOF process to displace the open hearth.8

The self-reinforcing, circular dynamics of rising scale and lower cost are very powerful once a technology S-curve reaches its first inflection point. But getting to that initial point of take-off is extremely difficult and wishful thinking does not change that fact. Many promising technologies get stuck in the starting blocks, because their utility advantage versus incumbents are not significant enough to offset the cost disadvantages inherent in a nascent product. That leads to the concept of the low level equilibrium trap, where a technology is high cost because it is low scale, and it is remains low scale because it is high cost. Technological purgatory, in fact.

Markets tend to be ill-equipped to resolve such conundrums. Policy makers though have the capacity to intervene at scale, skew the incentive matrix and attempt to set a technology free. Nothing is assured of course. Governments can try to sponsor a technology to break out of the low level loop through some combination of directly subsidising the new technology (e.g. concessional financing for new capacity, production and/or use subsidies) and disadvantaging the old one (e.g. carbon pricing, fuel taxes, ICE bans). Programs like the EU Hydrogen Strategy are attempting to do aspects of that, noting of course that the gap between stated ambition and on-balance sheet commitments by governments’ anointing technology winners can be large, with much left to the vagaries of animal spirits in the private sector once the initial signalling is done.9 The additional complication of social acceptance of the technology can be a major headwind for government initiatives of this kind.

Historically, we have seen these dynamics clearly in what are now seen as the “easier-to-abate” sectors: renewables-for-power and the electrification of light duty transport. It is easy to forget that while solar and wind power feel like something of an overnight success, their story has been half a century in the making. The wind and solar revolution of the 2010s had its genesis in the cluster of experimentation and innovation in alternative energy sources that emerged in the 1970s. Robust data on the solar learning curve dates back to that time, as does the introduction of concessional feed-in-tariffs (by the US Carter administration) to spur investment in alternative energy sources.

This upsurge in activity was a response to two major forces. The first was the massive price signal commonly referred to as the first oil price shock. The second was the belief at the time that scarcity of resources was likely to be a major long term constraint on societal progress, with influential predictions that the world was going to run out of critical raw materials within a few generations. This created an interest in the pursuit of revolutionary change in the energy system. Hydrogen was among the promising technologies and alternative fuels that were experimented with at that time (noting it was promising but not new, even in the 1970s: alkaline electrolysers have been in use for over a century). However, when oil prices receded in the 1980s and the scarcity doomsayers were shown to be wildly off the mark, interest died down rapidly.

Hydrogen also saw an upsurge in interest in the late 1990s, when the Kyoto Protocol was fresh, and with the US tech bubble in full swing, technological optimism was high. On both occasions though the hype exceeded the reality, leaving hydrogen firmly trapped in the low-level equilibrium.

In contrast to hydrogen, wind and solar power were able to build significant downward cost momentum in tandem with impressive efficiency gains in the 2000s and 2010s, led by supportive Chinese industrial policy towards manufacturers and generous feed-in-tariffs in Germany that subsidised generators.10 As a result, they are now the single most important element in the push to decarbonise power, which in turn enables so much else in the climate change arena. The battery technology that powers electric vehicles have also established a consistent learning curve to lower costs and improve competitiveness with the incumbent ICE (range, cycle life, safety, power) and are now established as the clear way forward for the decarbonisation of transport. Add these two sectors to land use, and around three-fifths of the world’s decarbonisation challenge (expressed as a share of GHG emissions) has a non-hydrogen champion. Where head-to-head technology competition is concerned, there are rarely prizes for second place. Or in this specific context, you only need to decarbonise a sector once, not twice. With hydrogen seemingly likely to play a niche rather than major role in power and transport, the best opportunities for it to scale quickly, reduce cost dramatically and make a major front-loaded contribution to the Paris-aligned imperative, have been taken by others.

So where will green hydrogen have more influence, despite its present cost disadvantage, over and above displacing traditional, GHG emitting hydrogen production? In sectors where there is currently no compelling incumbent decarbonisation route AND the process in question plays to hydrogen’s technical advantages AND developments in enabling technologies and infrastructure are accommodative – AND most critically, there is access to lots of really, really cheap green electricity.

Let’s return to the Paris-aligned pathways to see what these applications might be. Recall that hydrogen’s share of final energy demand (all hydrogen, not solely the green variety) was expected to average around 8½% in 2050. Not all the pathways allow for a like-for-like comparison of hydrogen use by sector, but for the seven that do (see table below), there are a variety of opinions on where it fits best. Our 1.5 degree pathway sees hydrogen contributing 2% of final energy demand in 2050, 70% of which is expected to be in industry, 19% in shipping and 11% in road transport. The majority of the remaining pathways in the table are much more optimistic on road transport, but less so on shipping and aviation. Three pathways put hydrogen forward as an option for storage in the power system, and four do not. Road transport ranges from 11% to 63% of projected hydrogen use and industry ranges from 18% to 70%. The utility of hydrogen as a supplement or even replacement for residential gas heating in very cold climates, where electrification may not be achievable, is a niche application with some promise, which shows up in "other".

The picture that emerges from this benchmarking exercise is more confusing than enlightening. Our interpretation is that these diverse results are a function of the fact that hydrogen is a general purpose energy carrier and source of primary energy, so in theory it can be used for anything: but in practice, it does not necessarily provide superior utility (recall this is a blend of cost, convenience and performance) in any single application. At least at this high level of generality.

Hydrogen’s role in 7 unique Paris-aligned pathways

Going deeper, within industry, as we highlighted in the second and third episodes in this series, steelmaking stands out as a potential area for hydrogen deployment, first substituting for pulverised-coal-injection (PCI) in retro-fitted blast furnace-basic oxygen furnaces (BF-BOF: the dominate route for steelmaking today, at 70% of global capacity), and as a substitute for natural gas reductant in existing direct reduction iron (DRI) facilities, which produce around 100Mt of iron feedstock for primary use in electric arc furnaces (EAF: where DRI would compete principally with scrap) annually.

Longer term then, hydrogen seems very likely to play a role in a green end-state for steelmaking. Quoting directly from episode two of this series, we argued that “Currently, we see hydrogen based DRI/EAF steelmaking as the only plausible pathway to green steelmaking that is deployable at scale”.

How far away is this green end state for steel? That will depend not only on the progress of green hydrogen costs and the development and optimisation of alternative steelmaking technology that can compete with the traditional BF-BOF, but also on policy decisions and the life of capital stock argument we introduced earlier. Where decarbonising the steel fleet is concerned, a key metric is the age and share of BF-BOF facilities by region. As we highlighted in episode 3 of this series , developed countries should rationally be preparing for the development of end-state technologies to replace their ageing integrated steelmaking facilities when they reach end of life. In China, where the BF-BOF fleet is still young and the passive abatement opportunity provided by rising scrap availability will be inexorable but steady, a retro-fitted transitional abatement approach (CCUS, hydrogen or biomass injection to displace PCI), alongside a high-quality offset strategy of the appropriate scale, appears to be the commercially sound approach under the current regulatory framework. An abrupt shift in the regulatory framework could change behaviour of course, especially if that came with very large support from the sovereign balance sheet for early retirements and the construction of low carbon replacement capacity. We note here that China’s passive long run abatement opportunity via peaking demand, rising scrap availability, increasing availability of renewable power and increasing EAF penetration rates can comfortably bring about a large absolute decline in steel emissions in the coming decades. And China has pointedly given itself a 2060, rather than 2050, net zero target, which would seem to point to a back-loaded technological strategy in line with commercial logic, rather than a front-loaded one aimed at an earlier achievement of net zero in line with major developed countries.

In India, where the BF-BOF fleet is still young and it is also expected to expand rapidly to meet huge demands for affordable steel in coming decades, the challenge appears steep. There is an obvious opportunity to reduce overall emissions intensity in India by optimising the operation of existing BF-BOFs and displacing India’s high-emission intensity coal-based DRI fleet. Lowering absolute emissions while also meeting the steel demands that will come with an urban population increase of almost 400 million people over the next 30 years? That is tough.

Even in the developed regions that have both strong policy support for decarbonisation and ageing facilities, the combination of which makes aspiring to the green end state right now worthy of strong commercial consideration versus sinking capital into transitional solutions, the logistical challenges are considerable.

To put the size of the challenge in perspective, a single 2 Mt per annum green hydrogen based DRI plant requires roughly 3 GW of renewable power and electrolyser capacity. How much land would be used by a solar array powering that 3 GW electrolyser? 95 square kilometres (sqkm) – or just under two Manhattans.11 If the power comes from onshore wind, the land requirement increases by a factor of 5. All this for a single plant producing roughly one-thousandth of global supply in 2050. How much power would it take to turn over 100% of the EU’s 2019 steel production of 157Mt to this route? Over 600 TWh – or about half the total power generation of Japan: an industrial powerhouse whose economy is $1 trillion larger than Germany’s.

And the EU represents just 8% of global steel production … what about the other 92%?12 What are the land requirements for the renewable energy required to produce the green hydrogen to fulfil all the world’s steel needs in 2050 via DRI? For solar, that would require a land area the size of Portugal. Onshore wind? Sweden. We will have more to say on green steel economics in the next episode of this series.

So the power aspect of the challenge is immense. There are also transportation, storage and other cost issues that come with moving hydrogen around or managing the inevitable inventory that will accumulate under the variable electrolyser utilisation rates that come with intermittent renewables power supply. While the power supply can be “firmed” with battery storage (raising costs) or fossil power (non-green, or if using CCUS plus offsets, more expensive), the absolute lowest cost power case study (unfirmed green13) is the best one to pursue for illustrative purposes. Every cent counts.

Transport and storage are both complications. As the most attractive renewable resources (e.g. solar in remote northern Australia) may be far from the major industrial demand hubs (e.g. steel making in China, Japan and South Korea), transport costs are not a trivial concern. Hydrogen’s low density makes transport by ship and trucks difficult. Responding to this problem by converting the hydrogen to either ammonia or methanol to serve as the energy carrier comes with energy losses at both ends of the chain, as well as higher costs. Liquefying it is even more expensive and once again there are energy losses. There is also a limit to the degree that hydrogen can be safely blended with natural gas in existing pipeline infrastructure (with ignition risk and pipeline integrity both issues of concern as hydrogen concentrations rise).14

Storage is another question. This cost is most manageable in salt caverns (estimates across regions and range from as low as $0.23 per kg up to about $1), or in pressurised tanks ($0.19 to $1.19) but this escalates quickly for liquid storage, which requires cryogenic temperatures ($4.5 to $7.3 per kg). When the objective is to deliver green hydrogen to industrial users at $1-2kg, every element of cost matters with no room for slippage. These midstream costs (which we note do not always get captured in publicised opex estimates even though someone most certainly has to pay them) put an even greater onus on the provision of extremely cheap power costs to drive green hydrogen competitiveness.

Zeroing back in on cost competitiveness more narrowly defined, our analysis suggests that even if electrolyser capex costs can come down many fold (which they are likely to do in the fullness of time), to reach the $1/kg level that is required for green hydrogen to be competitive versus brownfield steelmaking (for greenfield steel investments the figure is closer to $2/kg, but varies by region), opex costs will require renewables power costs of close to $10/MWh and carbon prices in the triple digits.15 None of these co-requisites for green hydrogen competitiveness are assured, noting that the low end of the range of long term projected firmed power prices in both Europe (a leader in steel decarbonisation technology) and Australia (a theoretical candidate for green steel making due to its natural endowment of iron ore and solar irradiation) are roughly triple the “magical” $10/MWh level.

With so many headwinds to consider, it seems unlikely that green hydrogen will achieve competitive narrow or all-in costs any time soon: certainly not in either the 2020s or the first half of the 2030s.

There are some optimistic views out there though. Utilising a mix of bullish technical assumptions on the key parameters, BNEF projects that by 2050 green hydrogen could cost less than natural gas in a little more than half of the 28 countries it monitors. That is a nice milestone with important implications for the second half of the century in some regions. It is not, however, the spectacular and universally applicable breakthrough on technological utility that drastic reorientations of the energy system might be built on.

Given the foregoing argument, it should not be a surprise that the detailed bottom-up plan we have assembled in our quest to achieve at least a –30% outcome for our scope 1 and 2 emissions by 2030, is not dependent on the deployment of green hydrogen in new applications.16 Note that roughly 80% of our scope 1 and 2 emissions come from purchased power and diesel. That is where our efforts are principally focussed.

Renewable power supply agreements over and above our existing arrangements in Chile, Queensland and Western Australia are likely to be NPV positive abatement solutions. A range of zero emissions hauling solutions are under active consideration, including hydrogen fuel cell trucks, but this is only one of the many potential options on the table.

All of that said, the future has a way of surprising you, and hydrogen may yet make a considerable contribution to our 2050 net zero objective for Scope 1 and 2 and assist with the material reduction of our value chain (scope 3) emissions generated by the transport and use of our products. The route to that end state is not visible today, but we do not completely count it out.

That would be both arrogant and imprudent. Looking that far ahead, it is prudent to keep all options open, as the decarbonisation task gets more and more difficult through time, no tool should be permanently discounted, and the overall rate of technological, behavioural and regulatory change may yet surprise us positively. Recall that the Paris-aligned pathway for the world we detailed in our Climate Change Report advantaged our portfolio vis-à-vis scenarios that were less green.

That is why it is important that we have been actively engaged in the green hydrogen eco-system right from its infancy. This engagement includes our membership of the Green Hydrogen Consortium (Hatch, Anglo American, Fortescue Metals & BHP), horizon scanning in our Ventures business (which can also provide exposure to a range of other emergent decarbonisation technologies, like electrolysis steelmaking) in addition to systematic monitoring of the cost, demand and supply landscape globally through regular market and customer intelligence activity. Our Scope 3 partnerships in steelmaking, so far covering three producers (Baowu and HBIS in China and JFE in Japan) that together account for around 10% of world steel output, give us a unique perspective on the steel decarbonisation question and the role various abatement levers, including hydrogen, might play.

A future episode of this series will consider the economics of green steel in greater detail.

References

1 https://www.euractiv.com/section/energy/opinion/renewable-hydrogen-a-strategic-opportunity-for-global-green-recovery/

2 Monthly data extracted by the author up to the March 2021. The comparison is between the average for CY2019 and the average of January 2020 to March 2021.

3 Source as for note 2.

4 A consistent set of 8 Paris aligned scenarios (IEA, two each from I.H.S and BP, plus Shell and Vivid Economics) for which we have data for 2030, 2040 and 2050 have the hydrogen share of final energy demand rising from 1.55% in 2030, to 3.13% in 2040 to 5.28% in 2050. Adding in those where a standalone 2050 estimate is provided (BNEF, Wood Mackenzie, TOTAL), increases the average to 8.53%, which is the number cited in the text.

5 The exact timing is complicated. The UN IPCC’s SR1.5 set the 1.5 degree carbon budget at 420-580 Gt of CO2 equivalent in late 2018. The width of the range is around four years of emissions at 2019 rates. With 2019 and 2020 estimated emissions coming in at 36.4 and 34.1 Gt respectively, that leaving 9.7 years of 2019 emissions to reach the lower end of the range, ~12 for the middle and ~14 for the top. As I said, complicated …

6 The one exception is where hydrogen is already used in a process and a green version can directly substitute this supply. This market is around 50Mtpa today.

7 Most electrolysers average less than 70% efficiency, meaning over 30% of energy is lost in the conversion from electricity to hydrogen. Round-trip efficiency (i.e. the ratio of energy put into storage versus the amount retrieved) is around 30%, compared to around 95% for lithium ion batteries.

8 To be more precise, it took 66 years from the introduction of BF-BOF steel-making route to reach 99% penetration in the United States.

9 For instance, in the EU, while Germany has committed the most budgetary funds to hydrogen among member economies, it has a relatively low target for electrolyser capacity. That implies there could be gap between commitment and ambition elsewhere in the bloc. In our operational jurisdictions of Australia and Chile, expectations of large private sector participation on the back of public seed funding is inherent in the hydrogen policy approach.

10 Germany’s 2004 Renewable Energy Law established a feed in tariff (FiT) of 457 Euros per MWh for 20 years for all solar panels (almost three times the average electricity price at the time), which was paid for via much higher end-user electricity bills. China similarly passed a series of laws in the mid-2000s guaranteeing grid access to renewables to prop up demand, while also offering an enormous amount of financial support for R&D and solar manufacturing companies.

11 This land use estimate assumes a 24% capacity factor for solar and 72 kilograms of green hydrogen per tonne of DRI. Higher (lower) capacity factors decrease (increase) cost. https://www.nrel.gov/analysis/tech-size.html

12 This is an exaggerated scenario given we assuming the displacement of scrap based EAF production as well as integrated steel making. Narrowing the exercise to the latter would produce the need for around 700 DRI facilities producing about 1.4Btpa.

13 “Firmed” renewables are backed-up by either traditional generation or storage to mitigate the problem of intermittency. “Unfirmed” are renewables without such mitigation, therefore utilisation rates will fluctuate with the supply of renewable resource. Operating solely on curtailed green power would be lower cost, and is put forward as a panacea in some quarters. However, for this option to scale, the degree of excess capacity build-out this would imply in the future renewables heavy grid would be a very inefficient use of capital.

14 For a discussion of pipeline transport see https://www.osti.gov/biblio/1068610

15 This illustrative exercise uses 2030 alkaline electrolyser costs in China running at (an optimistic) 30% utilisation rate and excludes storage costs. If you consider the much more expensive PEM (proton exchange membrane) electrolyser technology, which is more adept at managing intermittent power supply, either the power needs to be literally free, or you require 50% utilisation without adding cost.

16 Nickel West is studying electrolyser use alongside renewable power at the Kwinana refinery, with a grant for the same having been requested from ARENA. Other projects incorporating hydrogen are also being considered for both pre and post 2030 as we scour the Company for abatement opportunities.

Cost build up for green hydrogen