28 octubre 2020

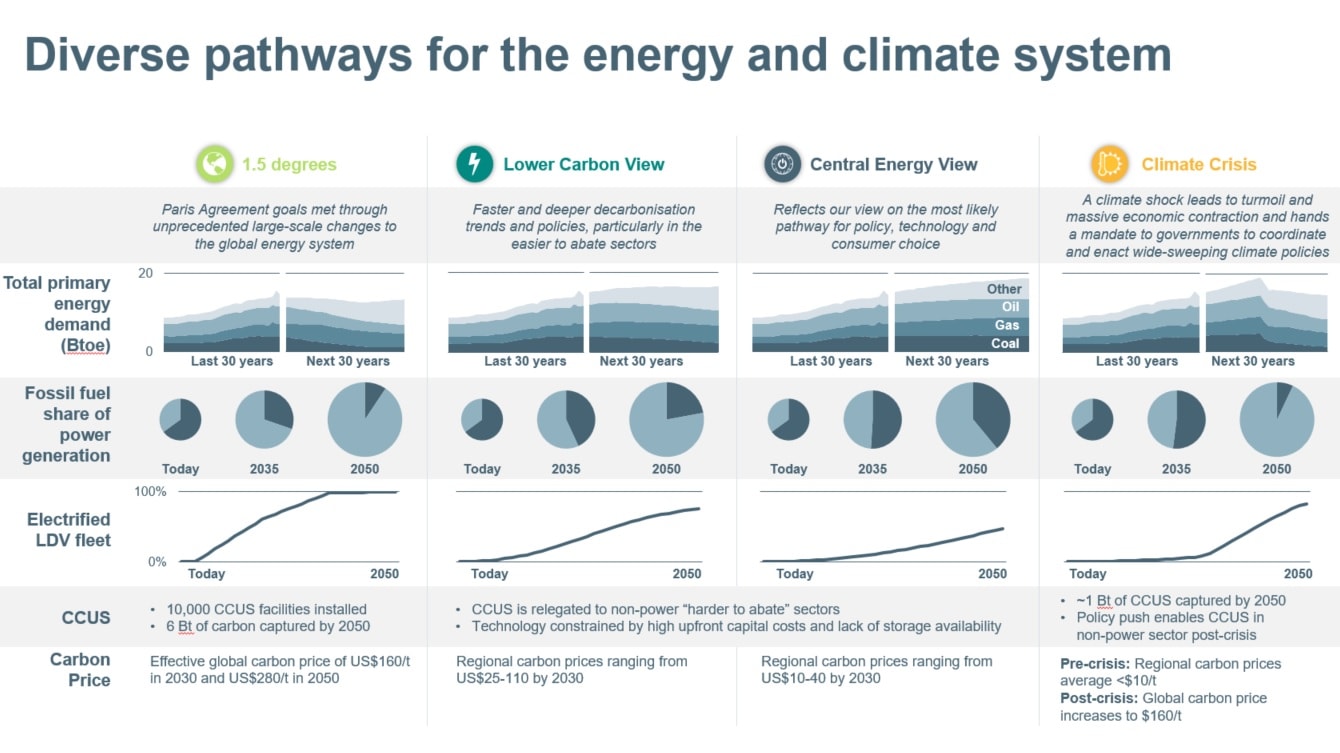

On September 10, we released our Climate Change Report 2020, following our initial “Climate Change: Portfolio Analysis” report in 2015 and “Views after Paris” in 2016. The latest update features two new scenarios. One is a Paris Agreement-aligned pathway, which tracks to 1.5 degrees Celsius of warming by 2100. The second is a dynamic, non-linear “Climate Crisis” scenario1. Taken together, they send three strong messages.

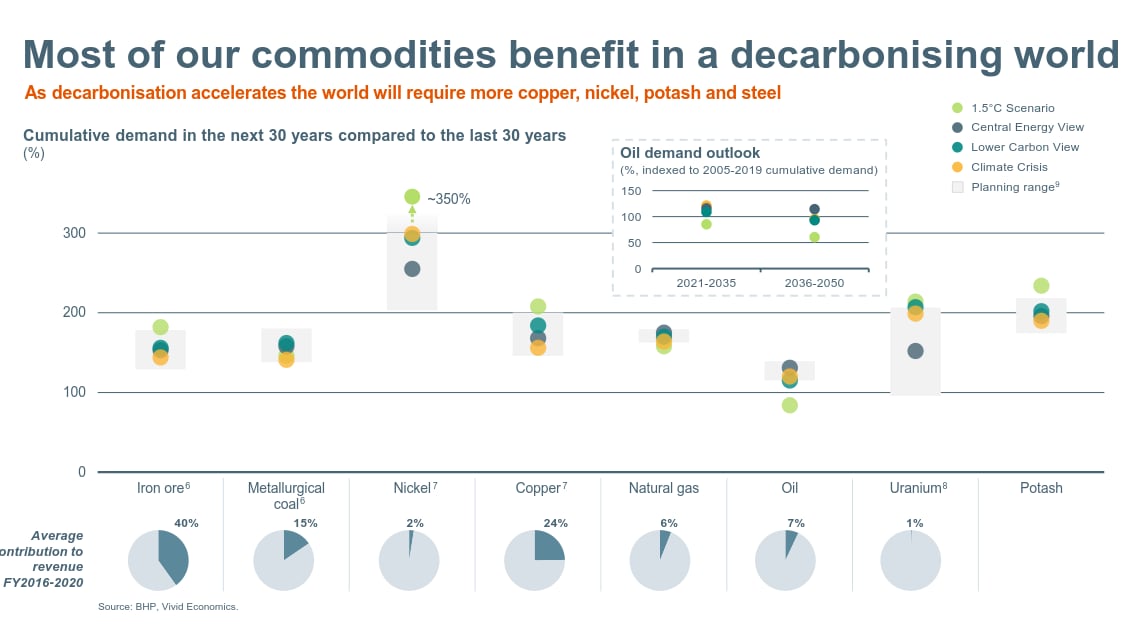

- Early and decisive global action to tackle climate change will benefit BHP’s overall portfolio.2

- To concurrently meet rising living standards and achieve wholesale decarbonisation, the resources sector needs to grow.

- The challenges for deep decarbonisation are immense.

Here we build on our analysis of the scenarios by diving into one of the essential questions in this field: how, and how fast, could stationary power decarbonise? This is the first episode in a series on decarbonisation, with steel decarbonisation coming next.

Any climate and energy system modeller knows that it’s one thing to run a technical scenario as an optimised lowest cost abatement exercise: and it is quite another to overlay the messiness of the real world. Most technical pathways ignore many complicated behavioural questions (temporal, regional, social, political) that drive investment and policy decisions. While technical pathways are useful to gauge what is possible, they may not always gauge what is plausible. That is why our (growing) scenario set comprises both technical and behavioural pathways, as well as hybrids of the two, underpinned by bottom-up sectoral simulation. We do not choose one over the other. At BHP, we do “clean”, we do “messy”, and many points in between.

Almost all Paris-aligned technical scenarios take decarbonisation of the “easier-to-abate” sectors—namely light duty transport and electricity—as a given. Our focus here is on electricity. Our aggressive views on electric vehicles are well known, and can be revisited in episode one, episode two and episode three of our Prospects series on the electrification of transport.

The stationary power sector, which today accounts for 40% of global CO2 emissions, must entirely decarbonise in the next three decades if the world is to stay within a 1.5 degree budget3. This is not just due to the emissions that must be abated from power generation; the sector’s growth also opens up large opportunities through the green electrification of other energy processes. It is the gateway to where the world needs to go.

Much has changed in the power sector over the last two decades. Solar costs have fallen by over 90% since 2008. Utility-scale batteries are being installed across the US, Australia and Europe. India has achieved 100% household electrification (on one set of estimates at least). Since its 2011 vintage of forecasts, the International Energy Agency has almost tripled its projection of solar and wind power generation in 2035. President Xi Jinping has announced an aim for China to reach net zero emissions by 2060. And yet, in big picture terms, much is still the same. Fossil fuels still represent almost two-thirds of electricity generation, and in 2019, net coal-fired capacity actually increased by +2% year on year. US$131 billion of additional investment flowed into new fossil plants just last year.4

So, if we start with the assumption that the world is able to replace two-thirds of the current generation mix (and still meet growing demand) so the resulting generation is nearly CO2 free by 2050, how do we get there?

We considered a wide range of pathways to reach this future state. The most plausible of them featured very deep renewables penetration. In short, we think that extremely rapid dissemination of wind, solar (depending on their relative competitiveness by geography) and eventually batteries is the most likely avenue if the world is to decarbonise in that time frame. The relatively low project risks of wind and solar projects, including their modular nature, strong policy support in many jurisdictions, steady technological progress and the ability to sustain rapid gains in manufacturing productivity, have created abundant opportunity for increased competitiveness. The solar industry, in particular, has leveraged manufacturing economies of scale to lower unit costs, while rapidly increasing the efficiency of solar cells.5

The progress made by wind and solar puts them well ahead of other low or zero emissions generation technologies — nuclear, carbon capture utilisation and storage (CCUS), tidal and wave technologies, among others — in the race to achieve cost parity with coal plants (in most regions) and gas plants (in the US). By the time these other technologies are projected to close the gap to the lowest cost fossil option in each region, that likely will no longer be the relevant benchmark: renewables will be.

We foresee a time when wind and solar are deeply entrenched as the lowest cost option across all major regions on an unsubsidised basis.

There will of course be a sequence to this based on local conditions, but the end-state looks clear.

A number of milestones must still be achieved, and surpassed, before a complete renewables takeover can realistically occur.

- New renewables need to compete with new fossil. This is the least challenging of the milestones, and thus should be the first to occur. When comparing the economics of different modes of power generation we look at the levelised cost of electricity (LCOE). This captures the annualised cost of a power plant or technology over its lifetime. Absent direct policy intervention, such as legislating that all power plants of a certain type must close or may not be built, this metric will likely determine what kind of new capacity is chosen to meet expanding demand or to replace retiring facilities. When will the LCOE of new unsubsidised renewables go below that of new coal or gas? In middle-income regions with abundant renewable resources, like Chile, and in high-income regions with carbon levies, like the EU, this has already happened. But in areas with access to cheap local coal resources (e.g. India and Southeast Asia, where power plants do not face seaborne pricing), LCOE is expected to continue to favour coal over unsubsidised renewables for some time. Once this inflection point is in sight, we think decision makers are unlikely to build (or, arguably, approve and finance) new fossil units.

And once the cross-over is breached, change can be expected to happen very quickly. That is especially true when replacement decisions for end-of-life coal, gas or nuclear plants occur in a cluster.

We believe the clustering effect will occur first in the high-income countries, where many plants are already very old, and somewhat later in China. It is likely to happen last in India and Southeast Asia (home to over 2 billion people), where the average coal plant is less than 10 years old. Indeed, if history is any guide, the 170 GW of new coal that reached final investment decision in developing Asia since 2015—roughly the size of Brazil’s total power complex—could stay online until well after 2050.

- Building new wind and solar needs to become cheaper than running existing fossil. Using renewables to add new capacity or replace retiring capacity won’t be enough on its own to achieve total decarbonisation by 2050. New unsubsidised renewables will also need to compete with the cost of simply buying the fuel for and maintaining the large fleet of coal and gas capacity already online. Once that occurs, new renewables builds will take preference to running existing plants, and we’ll likely see existing fossil units start to shut down. In our base case, barring any major policy interventions, this critical crossover point is not projected to occur on a global scale until the 2040s.

- Renewables eat into fossil’s profitability to such a degree that units retire ahead of their technical lifetimes on a mass scale. Once online, renewables’ low short run marginal cost means they will be cheaper to run than plants that require continual purchases of fuel to feed them. This would be expected to progressively erode the hours that existing fossil can run on any given day. Power plants are typically funded with the expectation that they’ll stay online for 30 to 40 years (or longer), maintain a certain utilisation rate and achieve a certain average power price. Not achieving this could force retirement of existing plants--a potentially financially damaging combination for companies, their shareholders, and their debt financiers. And yet, our 1.5 degree scenario forces the early closure of 1300 GW of coal capacity. That is the equivalent to the entire coal fleets of China, the US, Japan, Germany and Poland: nations where the power supply is sufficient to support more than $50 trillion in annual GDP.

- The electricity network must be able to meet daily and seasonal demand peaks. Renewables’ intermittency creates complexity for the management of the grid, with flexibility at a premium. The massive build out of renewable power envisaged will require a step-change in the technologies that provide grid flexibility. Multiple options will need to be deployed once renewables surpass the 30% global penetration mark at a global scale. These options include stationary energy storage (including lithium-ion batteries, which are experiencing their own electric vehicle-driven cost reductions), large-scale grid interconnections, and demand response technologies. In systems where existing nuclear and/or hydro capacity are major sources of low cost clean baseload power, preparation will be key. If baseload comes offline in a cluster (noting that a large number of OECD-based nuclear plants are expected to reach end-of-life in the 2030s), if there has not been sufficient investment in grid flexibility in advance of such closures, grid limitations could become apparent in a disruptive way.

- Policy intervention should complement all tipping points while allowing market signals to do their work. With many power markets regulated around the world, market signals can be distorted or diluted, thus potentially hampering change. Significant market reforms to address network pricing, ancillary service markets and reliability markets will likely be needed to avoid reaching a technical cap on variable renewable penetration and allow all flexibility services to compete. Government subsidies could also accelerate tipping points 1 and 2, and soften the blow for retiring plants that have not reached the end of their originally envisaged financial life (point 3). And if innovation is not enough to lead to technology cost reductions for flexibility and network augmentation, policy to mandate the change or subsidise the cost could accelerate the transition.

So what would it mean for our portfolio if all of these hypothetical milestones occur quickly enough?

Unsurprisingly, energy coal does not prosper under aggressive decarbonisation scenarios. On the other hand, copper thrives.

Copper is, quite simply, a mission critical player in the decarbonisation of the power sector, and of the energy transition generally.

On a slightly longer time horizon, we also expect that nickel will be a key ingredient for the battery storage required to support grid stability as renewable penetration passes threshold levels. The outlook for uranium is quite close to the high case in our business-as-usual range. Large-scale construction of renewables, particularly wind power, will benefit steel-making raw materials.

The role of natural gas is not straightforward.

Developing countries with young coal fleets are expected to rationally leapfrog gas and go direct to solar, wind and storage when they transition away from coal. This challenges the sacred cow that is generally left unchallenged by conventional forecasters: that natural gas will be a “bridging fuel” for decarbonisation in all sectors.

However, gas could still play a peaking or backup role in regions with existing infrastructure, providing support to the grid when the sun isn’t shining or the wind isn’t blowing. And of course, gas would be an important means of decarbonising harder-to-abate non-power industrial and heating applications, which make up 60% of total gas demand today. In sum, long term demand for gas from power in the developing world may ultimately disprove the conventional wisdom; but a durable switch towards gas in non-power industrial applications, likely paired with CCUS, remains a bulwark of decarbonisation in harder-to-abate activities.

Our analysis emphasises just how difficult it will likely be to fully decarbonise power by 2050. The challenges are greatest in emerging markets, which today make up almost 60% of global generation, and where the largest increases in power and (non-power) energy demand are expected6. Even so, this work has also made clear that the prospects for eventual achievement of the end state are sound.

Power decarbonisation will be critical to the broader response to climate change. It will enable the greening of transport through electrification and it offers hope in the harder-to-abate activities, either through direct electrification or by enabling alternative abatement technologies that require a green fuel source.

We will share our thoughts on the critical theme of steel decarbonisation on Prospects very soon.

Footnotes

1 The Climate Change Report also features our Central Energy and Lower Carbon View, which we use as inputs to our planning cases. There are inherent limitations with scenario analysis and it is difficult to predict which, if any, of the scenarios might eventuate. Scenarios do not constitute definitive outcomes for us. Scenario analysis relies on assumptions that may or may not be, or prove to be, correct and may or may not eventuate, and scenarios may be impacted by additional factors to the assumptions disclosed.

2 This Prospects episode should be read in conjunction with the BHP Climate Change Report 2020 available at bhp.com, including its disclaimers with respect to forward-looking statements and other matters. The information in this episode provides a concise overview of certain aspects of the portfolio analysis, including the four scenarios, included in the Report and may omit information, analysis and assumptions, and accordingly, BHP cautions readers from relying on the information in this episode in isolation.

3 The power sector made up 41% of energy-related CO¬2 emissions in 2019. Electricity and heat’s contribution to total greenhouse gas emissions is closer to 30%. Source: International Energy Agency; CAIT.

4 Coal-fired power generation dropped by -3% in 2019 off a high base. It will likely fall further in 2020 as electricity use has fallen and low cost renewable generation has eaten away at coal’s remaining share. However, as we have seen in China, where economic activity is back to pre-Covid 19 levels and June quarter thermal generation was up +5% YoY, it’s likely that coal will regain a large portion of its lost share in most regions as power demand recovers. Source: BHP; International Energy Agency, World Energy Outlook 2020; IHS Markit.

5 We estimate this rate is somewhere between 2½ per cent and 3 per cent annum, compound, since the 1980s. That is in excess of economy-wide measures of technological progress in high-income economies, which average less than 2 per cent per year over the long run. Going back a little further, the learning rate for solar PV has sustained comfortably above 20% since the 1970s, with gains split roughly equally between economies of scale and technical progress. Source: BHP; Bloomberg New Energy Finance; Kavlak, et al, ”Evaluating the causes of cost reduction in photovoltaic modules,” Energy Policy 2018.

6 International Energy Agency, World Energy Outlook 2020.