21 mayo 2019

One of the mega-trends expected to shape our long run operating environment is the electrification of transport.

This is the first episode in a series on this vital topic.

It is two and a half years since we inaugurated this blog site by publishing our bullish outlook for electric vehicles (EVs). At the time, there were very few forecasts in the public domain. Those that were available described a bi-modal range: either dismissive or ebullient. There was little in between.

Much has changed since that time. The space is now “crowded” with forecasters1. Indeed, we observe something resembling a game of leapfrog as various institutions fight to be perceived as more bullish than their counterparts.

As for ourselves, we have made one fundamental change since our initial release. We have raised our low case for EV market share.

Why even mention a change in the low case, if our expected case is still on schedule? As highlighted at our Capital Allocation Day, we do not make decisions based on mid-case forecasts. We think, instead, in plausible ranges. Low cases take on especial importance in our framework. The likelihood of achieving positive expected returns, scaled for risk, in a low case operating environment is one of the critical metrics for any investment that seeks to advance in our internal process.

Our EV cases, consistently applied across the portfolio, are essential to establishing the plausibility of our long run copper, nickel, oil and power demand ranges. That is turn flows into price estimates and our assessments of the relative attractiveness of commodities inside and outside our portfolio.

So, what are our cases?

First of all, it is important to define exactly what we mean by EVs. EVs are the sum of wholly battery powered vehicles and plug-in hybrid vehicles. Traditional hybrids like the Toyota Prius are not captured in this category.2

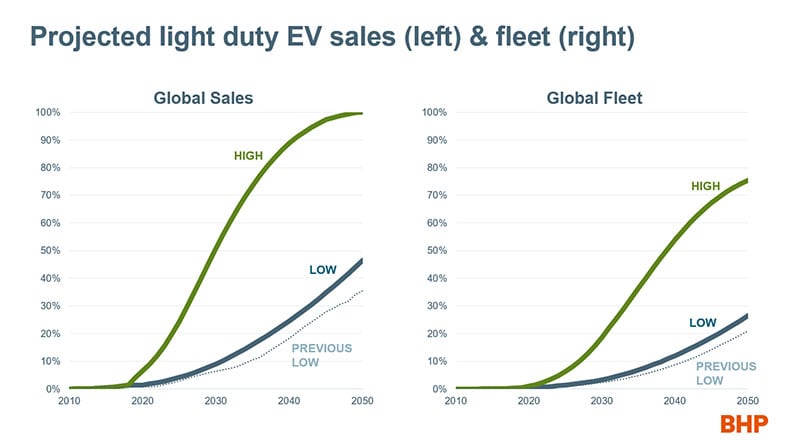

In 2035 and 2050 respectively, we now see the lowest plausible rate of EV penetration in the light vehicle fleet (i.e. vehicles on the road) as 7 per cent (previously 5 per cent) and 27 per cent (previously 21 per cent). We see the highest plausible penetration rates at these two points as 36% and 75%.

The associated share of light vehicles sales in those years are 16% (previously 10 per cent) and 47% (previously 35 per cent) in the low case and 73% and 100% in the high case.

To convert those market shares into auto units, in the low case we envisage there will be 132 million EVs on the road in 2035 and 561 million at mid-century.

In the high case, the EV fleet is expected to surpass 700 million by 2035 and reach 1.6 billion by 2050.

Naturally, the low and high case market shares do not share the same denominator. One of our more important end-use assumptions is the size of the total light duty fleet, and the production (where and when) required to keep it at the required level to deliver estimated future transport services.

In the low case, in 2035, we expect the total light duty fleet will reach 1.68 billion units. We expect 2.26 billion in the high. In 2050, the gap is even wider: 1.79 billion versus 2.5 billion.

Put simply, in the high case, EVs penetrate faster in a larger and more rapidly expanding market for vehicle ownership and transport services; in the low, they penetrate more slowly in a smaller and less rapidly expanding market for vehicle ownership and transport services. Hence the impact on demand for materials to build and power that fleet, such as copper, is very different indeed, as is the rate of displacement for those materials, such as crude oil, involved in powering traditional vehicles.

How did we arrive at these forecasts?

Our view on EVs is one of the hundreds of common assumptions and end-use forecasts that we compile to assemble an internally consistent, bottom up view of the world, and by extension, the demand for commodities. That process starts with demographics; extends to economic growth, geography and structure; drills down into sectoral and sub-sectoral detail; while taking account of technical factors such as substitutes, complements, scrap, replacement cycles and time-varying manufacturing intensities of use; as well as qualitative factors such as policy and evolving consumer preferences.3 Where EVs specifically are concerned, over-laid on all of that is a bespoke framework for projecting rates of technological change.

We first introduced that framework to readers of Prospects by comparing the historical rise of smart phones to the prospective rise of EVs. To recap, once an emerging technology reaches a point where it has achieved a cost, performance or utility advantage over an incumbent technology4 (whichever is most relevant), this is what we need to come to a position on to project its diffusion rate:

- Are incumbent producers embracing the technology?

- What is the turnover rate or product lifecycle?

- Does the technology generate positive network effects?

- Does the technology require new infrastructure or does it leverage existing infrastructure?

With EVs, as we have not yet reached the point where the product is superior to internal combustion engine (hereafter ICE) vehicles, we must first project if and when we will reach the tipping point for mass market consumer preferences. The key parameters here are all battery related: full pack cost, range and charging.

Average battery costs have remained on a trajectory of annual percentage decline in the low twenties.

Average battery costs have remained on a trajectory of annual percentage decline in the low twenties. The full pack now costs less than $180 per kWh on average, according to Bloomberg New Energy Finance, down from almost $290 per kWh two years ago and over $1000 per kWh in the early part of this decade. We agree with the consensus position that when battery pack costs fall to $100 per kWh, EVs become cost competitive in the mass market – with a “people’s EV” very likely to emerge. Just how competitive EVs will be on an all-in basis once today’s purchasing cost disadvantage is neutralised will depend upon the ability of manufacturers to increase their range – the ability to go at least 200 miles (320 kilometres) on a single charge is the threshold – as well as the speed and availability of charging infrastructure.

Looking specifically at our framework, EVs obviously leverage the existing infrastructure for electricity generation and distribution, but they need non-trivial additional investment to access the grid via charging units. It is questions related to charging that are the main strike against a more rapid, near-term EV diffusion case at this stage. Right now, charging units are neither pervasive nor fast versus the incumbent technology.5 The global stock of chargers is advancing roughly one-for-one with EV sales. That is okay, but it is far from spectacular. To paraphrase the now clichéd phrase “build it and they will come”; we argue that “build them [the chargers] and they [consumers] will buy [EVs]”.

To move towards our high case, we would need to observe the many national and sub-national governments that have announced either future ICE vehicle bans or EV targets to move to accommodate this transition by building charging infrastructure in advance of demand: and the most populous emerging markets to join them on this path.

Elsewhere in the framework, incumbents – i.e. globally established automakers and China’s up-and-coming indigenous firms – are embracing EVs, with model availability increasing steadily and many self-imposed sales targets instituted. EV ownership does not, however, generate conventional network effects, although a virtuous circle between rising sales and improving economics of charging investments might be interpreted as a network effect of sorts that can sponsor diffusion.

That leaves the question of product life cycle. This is, we believe, a factor that is under-estimated in the mid-cases of the most bullish forecasters.6 Light vehicles tend to have a life cycle of at least 10 years, with the exact timing varying across regions and usage. That means that the vehicle fleet will only turn over fully around two and a half times by mid-century. Given the evidence presented above, that is not enough time for the entire fleet to be – plausibly - electrified. Hundreds of millions of ICE vehicles will be retired and replaced with new ICE, or traditional hybrids, in the 2020s and 2030s. With each future projected ICE sale, the life cycle clock starts ticking again, and the ultimate theoretical EV takeover point is delayed.

In our high case, where we assume EV sales reach 100% in the 2040s and all ICE bans are perfectly executed, the global fleet will still have to turn over three full times before saturation.

In our high case, where we assume EV sales reach 100% in the 2040s and all ICE bans are perfectly executed, the global fleet will still have to turn over three full times before saturation. In the low case, the fleet will have to turn over more than four times, with full electrification of light vehicles sales not achieved until after 2070.

The first 100 million EVs on the road are expected to reduce global oil demand by 1.3 million barrels per day... while the mid-case EV fleet will consume around 5 per cent of the world’s electricity at mid-century

In terms of commodity demand, the first 100 million EVs on the road are expected to reduce global oil demand by 1.3 million barrels per day; our mid case EV production will provide cumulative net copper demand of 17.3Mt out to 2035, an average annual pace of close to 1Mt; while the mid-case EV fleet will consume around 5 per cent of the world’s electricity at mid-century.

If you want to know more about what our EV outlook means for other commodities via our views on battery chemistry; are looking for more detail on the prospects for charging; or what we think about EV penetration in medium and heavy duty vehicles; you will have to wait for further episodes in our series on the transport electrification mega-trend.

Stay tuned.

[1] The space is actually crowded only up to 2025 – there are still only a few benchmarks in the more “exciting” time horizons beyond the 2020s.

[2] Plug-in hybrids can operate like a pure battery powered vehicle for approximately 40 kilometres before reverting back to the conventional engine. In traditional hybrids the battery complements the internal combustion engine, it doesn’t supplant it.

[3] This sequence is based on our energy and metals commodities. Where potash is concerned, there are points of overlap, as well as some truly distinct components, such as dietary change, levels of food waste upstream and downstream in the supply chain, availability and use of crop residues and manures, among others.

[4] If the technology is not yet commercialised, we also assess what sort of breakthroughs are required to bring it to market – basic science or engineering incrementalism – and their probability. The world of battery chemistry throws up many examples of this type to keep us busy.

[5] The first “ultra–fast” chargers have started to come online, but they are both scarce and costly. To reach a twenty minute, 80 per cent charging time, they must be matched with a battery system with double the normal voltage of 400v. Vehicles containing such batteries come at a price point that is far removed from “people’s car” territory. The Porsche Taycan, with a retail price between £60-70k or

US$78-91k, is a good example of this. With an 800 volt battery system, coupled to a 350kwH charger, it can reportedly achieve an 80 per cent change in 20 minutes.

[6] Forecasts that are not long term (they stop before 2030) and are expressed solely through sales (they do not reference the development of the fleet) and thus are implicitly assume questions of flow-stock interaction away, are to be treated with extreme caution.