05 mayo 2023

In the seven years since the Paris Agreement was adopted, thousands of scientists and economists have set out to model how the world might go about containing the global temperature increase to “well below 2 degrees Celsius above pre-industrial levels, and pursuing efforts to limit the temperature increase to no more than 1.5 degrees Celsius”. In our Climate Change Report 2020, we added our voice to the ever-expanding suite of analysis, releasing a 1.5 degree1 scenario that sat alongside three other scenarios that collectively explored the performance of our commodities in a range of alternative future worlds.

Scenarios are a very effective way of wrestling with uncertainty and obtaining strategic foresight,and they are increasingly displacing traditional forecasts in sophisticated organisations with an interest in the long run. But just because they are often deployed in similar contexts to traditional forecasts, they should not be conflated with each other. Forecasts are an expression of the expected future state, with explicit or implicit likelihood applied. Scenarios, by contrast, are a useful way of investigating a hypothesis or a theme of great uncertainty – such as how we will achieve our climate ambitions – and framing the problem in an internally consistent way. And unlike a forecast, assigning likelihood to a scenario is optional. Unfortunately, these distinctions have been lost in some areas of the public debate, with some energy transition scenarios being treated as forecasts, some elements within scenarios being treated as standalone facts rather than conditional hypotheticals, and some scenarios have been elevated above others in the climate discourse. Inexpert interpretation and use of scenarios is a potential root cause of poor policy making and poor capital allocation – both in the financial sector and in the real economy. When decisions on the direction of a multi-decade gigatrend are in play, the stakes are monumental.

Our position on the use of scenarios in the climate discussion is that given their nature, scenarios are best analysed and interpreted as part of a set, rather than individually, and the larger the set, the better. The bouquet of evidence that can be derived from diverse scenario suites provides the base for a robust strategic thought process. The smaller the set of scenarios, the less diversity, the narrower the field of view, and the greater the risk when moving from the abstract world of scenario modelling to the messiness of the real world. Those who advocate for a single “consensus” pathway, or a unitary benchmark to stress test all portfolios, are ignoring the inherent complexity of the systems under consideration, and are simultaneously understating the unintended consequences of taking a monocular approach.

So what is our present take on the “bouquet of evidence”? Our 1.5 degree scenario and virtually all of the more than 100 Paris-aligned scenarios that we have looked at converge on three important, common conclusions:

- the need to radically transform the way the world produces and consumes energy and uses land;

- the need for massive investments in low-carbon energy to meet this transformative challenge; and

- the need for a lot more of the essential minerals required for decarbonisation and energy transition infrastructure, such as the future-facing commodities that BHP produces to get there.

That is often where the similarities end. The complexities of the energy system, the array of decarbonisation options and policy choices available to modellers – which can, at least in theory, be deployed in almost infinite combination - mean that an almost limitless variety of pathways can be generated that purport to align with the aims of Paris.

The International Energy Agency’s (IEA’s)2 net zero emissions (NZE) scenario, first released in May 2021, and updated as part of the Agency’s World Energy Outlook in late 2022, was (and is) an important contribution to the discussion around achieving “Paris-alignment”. It is also the scenario that is most often put forward for the “consensus” role. As stated above, at our current state of knowledge we don’t think that this concept is appropriate, regardless of the technical skill or institutional credibility underpinning any specific piece of work. Accordingly, the IEA’s NZE fits neatly into the growing suite of pathways consistent with 1.5 degrees, as one among many. We seek to learn from and use all credible opinions to improve the quality of the range of foresight tools and techniques that we deploy internally, including our own 1.5 degree scenario. To be absolutely clear:

We have not, and do not intend to use any pathway exclusively as the unique or superordinate road to Paris. That is too heavy a burden for any one scenario to carry. And more than that: applying superordinate status to any single scenario comes with much greater inherent risk than a range-based approach.

Hypothetically speaking, if we were to soften our position on a “consensus” pathway, and our own work was excluded from the available choices, would we choose the IEA NZE? Before we answer that, it’s worth noting that, versus our own 1.5 degree scenario, the IEA NZE scenario would be even better for our future-facing non-ferrous metals in coming decades, given the stunning uplift in decarbonisation technology it has modelled – albeit with different impacts elsewhere in the portfolio.

With those observations on the table, let’s delve a little deeper into IEA NZE.

In NZE, the IEA has solved for three layers of complexity, with social acceptability and technical feasibility as core criteria alongside cost-effectiveness. The principles of a just transition and the right to economic development are respected, appropriately, through vehicles such as universal electricity access and differential carbon pricing in developed and developing countries.3 The IEA also engaged in detailed analysis of major sectors within the industrial segment which is an advance on other scenarios incorporated in IPCC reports. These findings for the industrial sector though were not disclosed at the regional level, so we can only comment on the global outcomes. That makes the use of NZE a little challenging, in our view, as a tool directly relevant for decision-making in industry.

Heightened analytical ambition and qualitative distinctions come at a cost though. There is no universal definition of what social acceptability is: and nor can or should there be. It will vary by culture, nation, city and postcode. That makes elements of the scenario based upon this qualitative concept more difficult to interpret than those assessed solely on cost effectiveness, or solely on technological feasibility (or as is the norm, a combination of both).

Global scenarios of this type often suffer from a lack of transparency on how they address sub-global questions – whether they be differences in openness to trade, large gaps in standards of living, regionally specific age and lifetime of capital stock questions, or different natural and physical endowments that are highly relevant for policy and technological choices. As noted above, the IEA has usefully attempted to inject some sub-global differentiation, but there is not enough of such detail to serve a business operating within the hard-to-abate heavy industrial complex.

While the IEA does provide some high-level regional energy outcomes for the NZE pathway, like most scenarios of this type, there is no country-by-sector pathway to study and assess in bellwether emitters such as steel, cement and chemicals. That is a major issue in our mind in terms of practically applying the hypothetical world of NZE, or that of other scenarios with similar limitations, directly to real world problems. The reality on the ground is very different between, say, Brazil and Belgium, or India and Iceland, or Chile and Cameroon.

Picture a benevolent global government carefully calibrating the global division of the abatement task, and you have a sense of how high-level global models like this work. They are “normative” – an ideal view of how the world should be – rather than seeking to describe the world as it actually is or will be (once again, that is what forecasts attempt to do, and scenarios are not forecasts). In this instance, IEA NZE assumes very high levels of global cooperation, coordination and diffusion as amplifying tools to achieve the desired pathway, and a very rapid convergence of behaviour, policy and technology adoption. On page 25 of the IEA’s May 2021 report, its assessment of the costs of not cooperating are laid bare – a four-decade future delay in the transition to net zero.

In our own work, we have argued that while high-level global models certainly have their place – and our 1.5 degree scenario has been a very useful tool for us – at the sectoral and country level they are no substitute for detailed bottom-up analysis infused with on-the-ground intelligence capturing the rich local context in which policy choices and industrial eco-systems co-evolve. We are particularly conscious of this in steelmaking, where we note a considerable difference between the IEA NZE idealised path for this sector and our own views on the central and stretch decarbonisation cases for this systemically important value chain. (Episodes two and three of this series covered these topics in detail and a forthcoming episode will revisit this question again.) That is another way of saying that if real world decisions need to be made at the individual sector and region level, a tilt back towards forecasts (with likelihoods assigned), and away from scenarios (where likelihood is vague), is the most defensible stratagem.

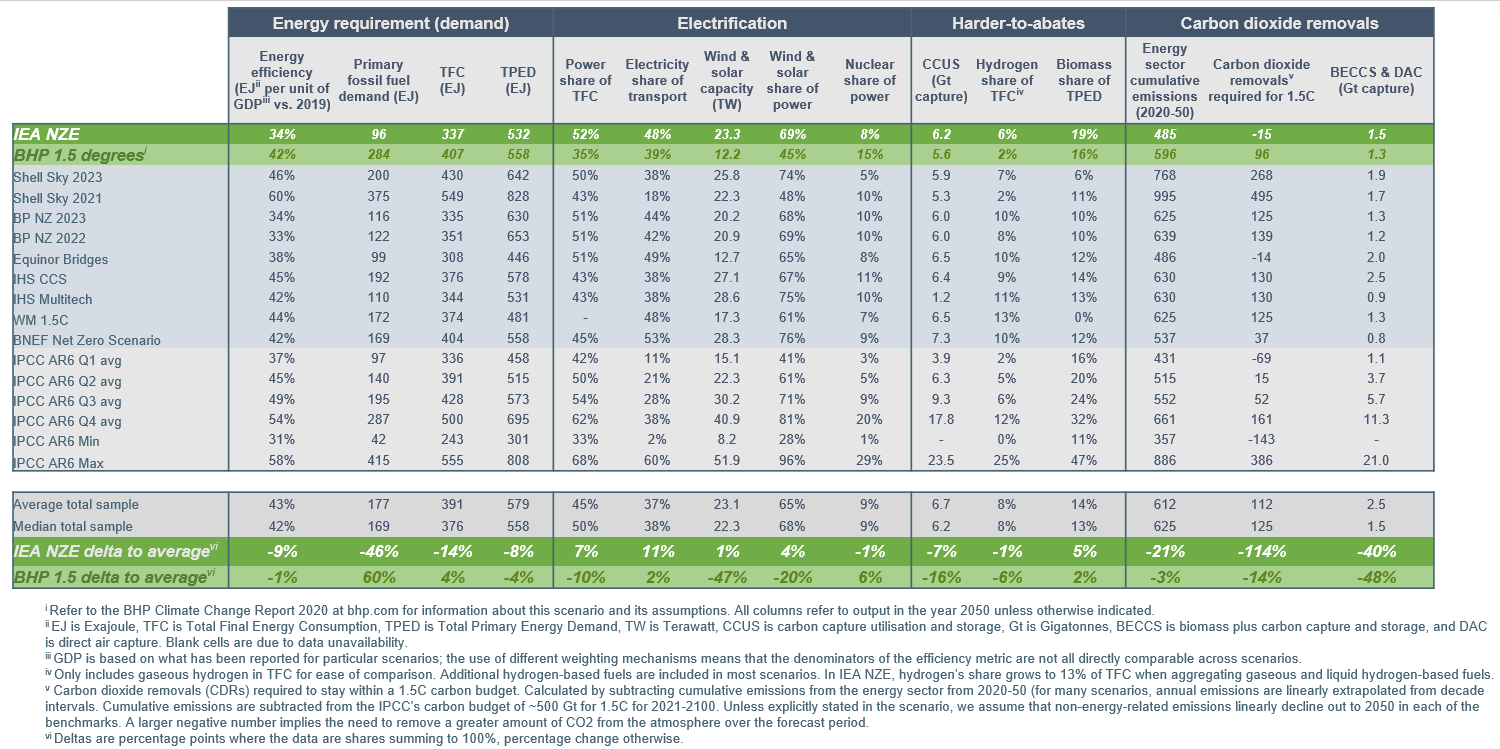

Before we proceed any further, here are some key summary figures from a range of scenarios that all seek to describe internally consistent pathways to a Paris-aligned future:

Exhibit 1. The diverse evidence base of the many paths to Paris: scenarios worlds in 2050.4

See full size image here.

In exhibit 1 we can quickly see where each scenario is distinctive and where it is closer to what has been done elsewhere. The very first impression is that NZE was nothing like the central tendency of existing work at the time of its publication.

First, the assumptions on the rate at which energy efficiency would improve are aggressive: 9 percentage points (ppts) below the average and deep in the first quartile of IPCC scenarios. BHP’s 1.5 degree scenario is close to the average on this point: i.e. less efficient than the NZE assumption, thus requiring more primary energy to meet final consumption needs. Many of the corporate and research consultancies, and second quartile IPCC scenarios, are in this approximate range. The IEA’s aggressive efficiency assumption allows NZE to lower final energy consumption by 14% and primary energy inputs by 8% versus the average before anything else happens: a strong head start on the path to net zero.

Second, we note the stark difference between the IEA and others in its choice to interrogate the decarbonisation problem without relying significantly on carbon dioxide removals, particularly from nature, to offset emissions in the energy sector, choosing instead to think about energy as an essentially closed system.5 Artificially limiting the world’s recourse to natural climate solutions - a major, cost competitive emissions reduction option - results in the IEA’s assumed direct energy system decarbonisation pathway moving extremely rapidly, with cumulative emissions over the next 30 years almost one quarter lower than the average of our benchmarks. In a forecasting environment, we would consider it unrealistic to think that every country that has natural advantages in this space would eschew cost competitive climate-positive land-use and choose instead to prioritise higher cost abatement in heavy industry up-front. That would be asking them to act against their national interest. In a scenario setting, where likelihood is opaque, extreme ex ante parameters can lead to intriguing outcomes. Just don’t conflate them with forecasts.

Other large deltas are in primary fossil fuel demand (-46% to average) and the electrification of transport (+11ppts to average), and the use of negative emissions technologies (-40% to the average).

Sitting underneath this, IEA NZE lays out an aggressive timeline for important secondary outcomes: no investments in new oil and gas projects are needed if this rapid decline in demand is met; no internal combustion vehicles sold globally in just 15 years if the consumer utility of electric vehicles proceeds at the required breakneck speed; all coal-fired power offline in 20 years if the rapid uplift in alternative options is put in place; and 90% of heavy industry decarbonised in just 30 if the required technological advances are able to keep pace.

It is important to recognize that all outcomes in an integrated

scenario are conditional on each other. They are interdependent as a set – they are not a series of discrete choices that can be selectively applied. Faster decarbonisation in a sector like power will unlock faster gains elsewhere as an enabler – and slower action will likewise slow everything that relies on green power down too. These are “and, and” & “if, then” conditions, not “and, or”.

The way the IEA’s derived outcome on the requirement for new oil and gas projects has been both seized upon and railed against is a good example of how scenarios can be misinterpreted or caricatured. Focusing on that outcome independently, without acknowledging the pre and co-requisites elsewhere in the NZE system that enable it to occur smoothly, has led some to advocate for policies that place considerable stress on energy security and affordability in the current environment. We believe the appropriate interpretation of the IEA NZE is “if all of the demand reduction policies and behaviours in the integrated scenario unfolded exactly as hypothesized on paper, or faster, then there would be no need for additional investments in new oil and gas projects”.

Here we are reminded of the IMF’s6 April 2022 study, where they simulated the differential impact on oil prices of climate change policies [within a net zero framework] that focussed solely on lowering demand, and policies that focussed solely on lowering supply. A set of policies that reduced oil demand saw the price fall to between US$11/bbl and US$43/bbl in 2030 (median US$23/bbl – a little above the low point for Brent crude during the peak of Covid-19 lockdowns in 2020). Supply side policies? They pushed the price of oil up to a range of US$102/bbl to US$372/bbl in the same year (median US$193/bbl).

Specifically, the IMF argued that “… divestment from fossil fuels at a pace commensurate with the speed of adoption of renewable energy would help reduce the risk of high and volatile energy prices. And less policy uncertainty would help countries make necessary adjustments.” The IMF’s rendering is exactly right. The blunt “no new oil and gas” sound-bite, without caveats, is not.

The above highlights not only the risk of choosing a single pathway to the exclusion of all else, but also the risks that can arise from the inexpert interpretation of any particular element of a single scenario. A range of scenarios provide richer input for strategy: and it is also the superior risk mitigation approach.

Let’s take a step back and think about scenario construction from the modeller’s perspective. You have a staggering task in front of you: fit the energy and land use needs of a growing and wealthier population into a very small remaining carbon budget to meet 1.5 degrees. That remaining budget is not just small – it is also continuously shrinking outside of monumental economic shock events like the Great Lockdown of 2020. The IPCC put that budget at 500 Gt (at the start of 2020) in its AR6 working group 1 report. Net GHG emissions released since that estimate have already lowered the forward-looking budget by almost a quarter7. How do you optimise what’s left in the short amount of time available to you?

To simplify matters, you must now go through a combination of four steps to get to net zero emissions:

- Reduce demand via energy and material efficiency gains, circular economy and/or behavioural change.

- Electrify end use sectors that are fed via low to zero carbon electricity.

- Deal with your hardest-to-abate sectors via some combination of carbon capture utilisation and storage (CCUS), zero emissions hydrogen [for which you need to divert clean power that could potentially be used directly in a much more efficient way], bioenergy or other emergent technology. Policy assumptions are very important here to determine which abatement technologies are competitive at a point in time and which are not.

- Offset the remaining balance through natural climate solutions and/or other carbon removal technologies like direct air capture or mineral carbonation. Policy may again determine whether nature-based or technology-based options are leaned on more heavily. And in practice, you do not have to proceed in the above order – you may choose to lower GHG emissions from least cost to higher cost, which means you will tend to reach natural climate solutions much earlier than, say, aviation.

The IEA NZE scenario clearly differentiates itself from a number of scenarios put forth by others that have relied quite heavily on step four. There are many abatement models that optimise for the lowest cost pathway which, unconstrained by feasibility parameters, induce gigatons of nascent negative emissions technologies (mostly bioenergy plus CCS, or BECCS) that are yet to be deployed at scale. The massive rollout projected by these models may well have under-estimated the land use impacts and supply chains issues that would be generated by them: if they were actively considered at all. Many of the IPCC scenarios are particularly susceptible to this critique—the group averages 5.2 Gt of BECCS in 2050. In contrast, the IEA’s use of negative emissions technologies in NZE reaches only 1.5 Gt of removals in 2050, placing it comfortably in the lowest quartile of the ~100 Parisaligned IPCC scenarios we examined.

In our assessment, if the IEA NZE was a forecast, and not a scenario, then we would argue that it had gone too far the other way in limiting step four, by not only restricting the unfettered expansion of carbon removal technology (a practical principle that we agree with), but also getting to net zero in the energy sector without relying on direct natural climate solution removal by 2050. As a result, NZE is one of the very few scenarios we’ve seen that are not “in the red” after accounting for cumulative energy sector emissions out to 2050 relative to the IPCC’s 1.5 degree carbon budget (see second column in from the right in the main table).8 While there was obviously some very important signalling value in the IEA’s approach in advance of COP26 (i.e. “to seek to demonstrate it isn’t impossible to decarbonise industry on a standalone basis without natural climate solutions”), 1.5 degrees is difficult enough without counting out valuable tools in advance.

Forests are not just inert carbon sinks. Avoiding deforestation and conserving and restoring highcarbon ecosystems like forests would help address the unprecedented rate of biodiversity loss the world faces.9 Both biodiversity loss and land use change are critical global boundary parameters, and stemming the current rate of decline would help sustain what scientists call the Holocene Epoch: the Earth system in which our species has survived and thrived.10 Conservation and restoration of natural ecosystems are also a cost-effective and immediately available solution to mitigate climate change, while also providing a host of co-benefits.

Note that BHP has set a “30 by 30” goal under our Social Value Framework to have at least 30% of the land and water that we steward11 under conservation, restoration, or regenerative practices by the 2030 financial year12.

Many of the scenarios we have examined agree with this basic argument. Carbon sequestration from land use increases in roughly half of the IPCC scenarios we looked at. The average pathway sequesters around 3 Gt more GHGs by 2050 compared to today. Other scenarios in our sample similarly look to nature to offset some of the emissions in hard-to-abate sectors, with Wood Mackenzie, BP’s Net Zero (both the 2022 and 2023 vintages), Shell’s Sky (both the 2021 and 2023 vintages) and IHS’ Accelerated CCS and MultiTech Mitigation scenarios all calling out natural climate solutions as key tools to keep to the 1.5 degree carbon budget. Natural climate solutions are a winwin. And as many options within this broad group do not come with traditional technological risks associated with engineered solutions –– in a head-to-head competition with a nascent technology which may or may not make its way out of the lab, they can have a lot going for them as part of a comprehensive decarbonisation strategy, even if their sequestration lifetimes are finite and they are not risk free.

Given the small GHG budget we’re starting with, a limit on any of the four steps is akin to squeezing a balloon—restricting one area means other areas will bulge out as a result. It’s no wonder then that with step four’s role being artificially stunted, the changes assumed in IEA NZE for steps one to three are both bigger and faster in comparison to many other scenarios. Simply put, the IEA is forced to make outlying assumptions elsewhere: on energy efficiency, behavioural change, the development and diffusion of nascent technology and international cooperation to keep within the constraints of the budget. That obviously lowers the likelihood of the aggregate outcome coming to pass as described. But the value of new scenarios is that they stretch our thinking and open new avenues of enquiry by illuminating gaps in the existing set and seeking to improve upon the collective state of knowledge. Going to extremes in some of these areas makes IEA NZE a great companion or book-end scenario within the wider set. That simultaneously makes it less appropriate as a “consensus” path.

As already indicated, NZE sees some of the largest energy efficiency improvements among the scenarios we’ve examined. BBy 2050, energy demand per unit of GDP in NZE is modelled to be just 34% of the level it is today. Digging deeper uncovers some stark assumptions around material efficiency and behavioural change. For example, the IEA’s scenario leans heavily on changes to design, construction, use and end-of-life use to achieve up to 50% of the GHG emissions reductions coming from the steel sector. In transport, by 2050, one third of energy demand reductions come from a combination of efficiency and behavioural change, with large segments of the population using rideshare, a major displacement of short-haul air travel by express rail, and governments restricting speed limits to less than 100 km/h on motorways to reduce GHG emissions. This catalogue of “ideal” behaviours asks searching questions about who we are and what we value, both individually and collectively.

The NZE scenario is fundamentally optimistic on technological progress. Half the technologies required for abatement in 2050 are still under development today.

Zero emission hydrogen, ammonia and methanol ramp up from being minor components of the energy system today to making up more than 10% of final energy demand by 2050. The electricity that would be needed to support this production is immense. By 2050, power generated just for hydrogen-related production reaches 14,500 TWh—over half of all the electricity generated globally in 2019. That is a staggering statistic. Re-directing that slightly, half of the global power system today would be required to produce around 10% of final energy consumption needs in 2050. Think about that for a moment. As we laid out in episode four of this series, where we discussed hydrogen, it is not an energy, land or cost efficient abatement lever at this point in its development.

In steelmaking specifically, by 2050, IEA NZE presumes the world to have around 300 operational hydrogen direct reduction iron (DRI) projects and 100 to 200 operational molten oxide electrolysis plants. However, currently the former technology is expected to be commercialised by around 2030 and the latter is still only viable at the laboratory scale. Hydrogen DRI certainty features as a major technology in our green end-state for steelmaking: but these timelines are very aggressive, especially for developing countries. The electric smelter furnace (ESF) is a promising route for long term steel decarbonisation, which BHP and others13 have put forward as a meaningful contributor to the sector’s challenges, does not feature in IEA NZE. You can read about our plans to construct an ESF pilot plant here. That is an example of how quickly technology can move and the difficulty of predicting such shifts, even in the very short term. It is also an example of the fundamental technological optimism of IEA NZE, where a simple but effective technology option like the ESF was overlooked in favour of an arguably more “exciting” but nascent option.

While likelihood assessments are inessential in the world of scenario building, there are tools available for those who would like to ascribe (rough) probabilities to their pathways. To develop and test our own 1.5 degree scenario as it evolved, we conducted expert elicitation surveys along the way to assess which individual assumptions were considered more or less plausible and to gauge the plausibility of the scenario as an integrated whole. The experts on our panel were cautionary on the outlook for BECCS, and as a result the final iteration of this modelling held BECCS to “just” 1.3 Gt in 2050. The expert panel placed our 1.5 degree scenario’s outlook for afforestation (+4 million square kilometres by 2050) at an equal likelihood to our outlook on hydrogen (which reaches 2% of final energy demand by 2050).

By incorporating natural climate solutions for a portion of carbon sequestration, our scenario eases some of the immense pressure bearing down on steps one, two and three. We think there is still a role to play for fossil fuels in hard-to-abate sectors where the incumbent capital stock is still a long way from natural retirement, but CCUS should be deployed at scale as a transitional solution. The technological readiness and cost of CCUS relative to emergent alternatives is competitive, particularly in developing countries that are in the early stages of considering how they might decarbonise their relatively young carbon emitting industrial fleets. We outlined how we think this might occur at a regional level for steel in episode three of this series.

Are we putting our 1.5 degree scenario forward as a candidate for the “consensus”? Of course not. It has strengths and weaknesses like all other top-down global scenarios of this type … and as we have already said many times, we fundamentally don’t believe any single scenario can fill this role effectively anyway.

No matter which way you cut it, a 1.5 degree outcome will only be achieved on the back of radical and rapid change, and that scale and pace is very difficult for us all to comprehend. The multitude of interdependent assumptions layered on top of one another mean that if any one of those failed, the world would need to have the infrastructure and knowledge in place to fill the gap with another solution: on the fly. No tool in the four-step toolbox can be ruled out without risking the global carbon budget balloon popping.

We also cannot underestimate the importance of international trade in a path to net zero. The IEA’s NZE scenario and all of the 1.5 degree scenarios we’ve examined rely explicitly on international cooperation, particularly when it comes to innovation and investment. Reduction of trade barriers for the required technologies, alignment around technological standards and linking of carbon markets are all important enablers of a smooth(er) transition. As indicated above, if the required level of international cooperation does not eventuate, the pathway to net zero could be extended by four decades by the IEA’s estimation. And the tyranny of interdependence of assumptions would bite.

We sincerely hope that climate change is the kind of universal issue where rivals in other areas can find common cause. That does not mean there should be no competition. Far from it.

Speculatively speaking, without China’s long-standing industrial policy in decarbonisation technology hardware manufacturing, the US’ Inflation Reduction Act (IRA) may not exist, and the European responses to IRA may not exist either: but both could prove to be powerful accelerants of positive global change. A concerted, and more ambitious, climate technological race between the world’s most powerful economies would almost certainly raise the likelihood of achieving 1.5 degrees, whatever path to that end you favour.

We also know that in almost all the Paris-aligned pathways that we’ve examined the world will need a lot more future-facing commodities to get there, including those within the BHP portfolio. Quoting the IEA, ‘The energy transition requires substantial quantities of critical minerals, and their supply emerges as a significant growth area’.

This is a message that already came through in the IEA’s inaugural report on “The Role of Critical Minerals in Clean Energy Transitions”, and subsequent updates. This is also a theme that we emphasised in our Climate Change Report 2020. It is heartening that many policymakers, investors and NGOs around the world are now also convinced of this basic truth.

If our 1.5 degree scenario eventuated, the world would need almost twice as much steel in the next 30 years as it did in the past 30. Iron ore and metallurgical coal will be vital in producing high quality steel that goes into wind turbines, solar panels and carbon capture pipeline infrastructure.14

If we want to keep pace with the development of workhorse decarbonisation technology such as electric vehicles, offshore wind and solar farms, then we estimate that global copper production will have to more than double over the next 30 years. For its part, the IEA indicates that the value of the copper market in NZE would increase in size by a factor of four by 2050 from where it was at the time of publication.

Under our 1.5 degree scenario, we estimate that primary nickel production (i.e. mined resource) would have to increase nearly four-fold to power future generations of battery technology. Nickel metal available from the likely boom in recycling would come on top of that.

And likewise under our scenario, potash demand would increase to drive higher agricultural yields as land use competition intensified further, with a surge in sustainable biofuel production as well as to support the productivity gains required to make room for reforestation and afforestation. You can read more about our views on potash here.

Versus our 1.5 degree scenario, the IEA’s NZE scenario would be even more favourable for our future-facing metals in coming decades, given the extraordinary speed and scale of the uplift in green technology they have modelled. Some of the additional demand for potash in our scenario though would not eventuate under NZE, given the latter’s decision to minimise positive land-use changes in its pathway. Prima facie, it would also be less favourable for steel-making raw materials, based on their estimates of total steel demand and technological routes to that end: although without regional detail on heavy industrial pathways, it is difficult to assess the plausibility of the global outcomes at the national level.

The common knowledge base of publicly available Paris-aligned scenarios continues to grow. We will continue to learn from this invaluable collective resource. Alongside ongoing expert elicitation, this will help us to continuously improve our own suite of proprietary scenarios in order to provide the necessary perspective and understanding of risks to shape BHP’s portfolio over time.

Important Notice:

This article contains forward-looking statements regarding assumed long-term scenarios; potential global responses to climate change; and the potential effect of possible future events on the value of the BHP portfolio. Forward-looking statements may be identified by the use of terminology, including, but not limited to ‘would’, ‘expect’ or similar words, and are based on the information available as at the date of this article and/or the date of BHP’s scenario analysis processes. There are inherent limitations with scenario analysis and it is difficult to predict which, if any, of the scenarios might eventuate. Scenarios do not constitute definitive outcomes for us. Scenario analysis relies on assumptions that may or may not be, or prove to be, correct and may or may not eventuate, and scenarios may be impacted by additional factors to the assumptions disclosed. Additionally, forward-looking statements are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results to differ materially from those expressed in the statements contained in this article. BHP cautions against reliance on any forward-looking statements. Except as required by applicable regulations or by law, BHP does not undertake to publicly update or review any forward-looking statements, whether as a result of new information or future events.

Footnotes:

1 All temperature references are to degrees Celsius.

2 The IEA was created in 1974 as a multilateral agency focused on oil security matters. It has since broadened its work to cover all aspects of the energy system, with 30 member countries and eight association countries. See https://www.iea.org/about For the purposes of this report, we refer to the detail within the IEA’s Net Zero Emissions Report released in May 2021. See Net Zero by 2050 – Analysis - IEA

3 In the first iteration of IEA NZE, in 2050, developed countries faced real carbon prices of US$250/t, major emerging markets like China and Brazil faced US$200/t, while the remainder of the developing world face US$55/t. In the latest publication, that latter assumption has increased to US$180/t. This presumably also changes how the energy system will transition in the developing world, but there has been no update to the regional breakdowns as of the time of writing.

4 Sources: BHP analysis based on publicly available scenarios and subscription services as well as internal data and inferred compositional outcomes. Scenarios are defined by organisation name and then a secondary title and vintage year if applicable. For the purposes of comparison, we have grouped the 96 IPCC 1.5 degree (“low overshoot”) scenarios we examined into quartiles. Sample set averages listed above treat the average of each quartile as an individual scenario.

5 Some of this improvement in efficiency may be due to developments outside the energy system, where one-quarter of GHG emissions occur. NZE is light on details here, given their focus on the narrow energy system. However, the IEA states that in order to remain within a 1.5 degree carbon budget in NZE, activity outside the energy system would be required. We estimate that it would need to see at least 250 mHa of afforestation, plus a two-third decline in deforestation, to offset the remaining GHG emissions from agriculture, forestry, and other land use (AFOLU). Also note that the changes in the energy system in NZE would be expected to have some positive spill-over effects on land use from short rotation advanced bio-energy crop production on marginal and pasture lands.

6 See pp. 31-36 of https://www.imf.org/en/Publications/WEO/Issues/2022/04/19/world-economic-outlook-april-2022

7 GCP_CarbonBudget_2022.pdf (globalcarbonproject.org)

8 To calculate the remaining budget after energy emissions, we subtract cumulative emissions from 2020-50 from the remaining IPCC carbon budget of ~500 Gt.

10 W. Steffen et al., Science 347, 1259855 (2015). DOI: 10.1126/science.1259855. There is also a Netflix documentary narrated by Sir David Attenborough entitled “Breaking Boundaries” that showcases this framework. https://www.netflix.com/sg/title/81336476

11 Excluding greenfield exploration licenses (or equivalent tenements), which are outside the area of influence of our existing mining operations.

12 In doing so, we focus on areas of highest ecosystem value both within and outside our own operational footprint, in partnership with Indigenous Peoples and local communities.

13 Steelmakers from China, Europe, Japan, South Korea and Australia have now included the ESF technology option into their steel decarbonisation plans.

14 We published some estimates of the impact of deep decarbonisation and physical climate change on steel demand at the WAIO investor briefing in 2021, which can also be accessed on this site.